Apr 10•5 min read

The Dollar System Is Coming To An End

Bitcoin has finally broken $30K! Is Bitcoin winter finally over? All signs are pointing to yes! Despite dire economic news about the economy, Bitcoin continues its long march back to its all-time high and beyond.

Bitcoin may not have decoupled from the broader financial markets regarding the raw trading of Bitcoin, but it has undoubtedly decoupled psychologically for an increasing number of people. For the first time in this short history, average people are starting to see Bitcoin as a safe haven. If you are an OG Bitcoiner, you already know this was the case, but it’s good to see more and more people realize the value of Bitcoin and, more importantly, the importance of self-custody.

I recently had a breakthrough of my own in orange pilling a few of my family members. Funny how a year and a few bank runs made a massive difference in how they perceived Bitcoin. I got them on the self-custody boat right off the bat. If you have people in your life you are trying to teach the benefits of Bitcoin to, the best thing you can do is be a resource and keep restating the message until it clicks.

The System Is Dying

Everyone comes to Bitcoin in their own time and in their own way. I suspect as inflation continues to rage, the national debt grows, 401k’s drop in value, and a declining standard of living takes hold, more people will be looking to Bitcoin to save whatever wealth they have left. It sucks that it will have to take a lot of pain and suffering for the majority of people around the world to realize the fiat monetary system we currently have is an aberration. For most of human history, humans used gold for trade. Gold has been used as money since 550 B.C.!

Gold and gold-backed currencies are the norm; fiat money backed by government promises to pay is not. The fiat money system only came about after a cataclysmic world war where millions of people died and countries were utterly destroyed. The only country that survived intact was the United States. The U.S. used the strength of its economy to become the world’s superpower, and most of the world didn’t mind, but times are changing.

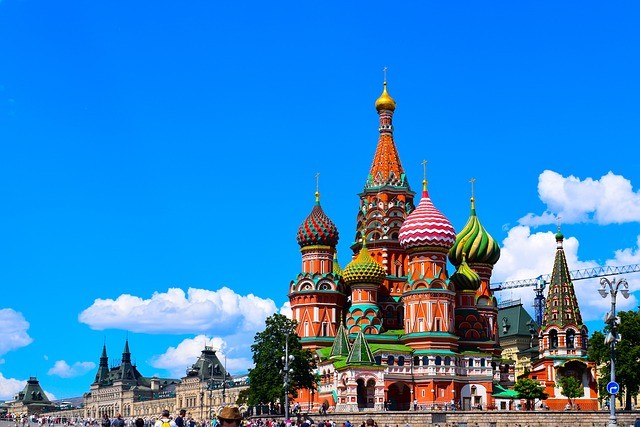

Today, China and Russia are chaffing at the international order led by the United States and Western Europe. They are taking active steps to undermine the dollar-centric global economic system. They are working together to de-dollarizing their economies and the economies of the “Global South”. They seem to be having some success in making that happen. Take a look at these headlines over the last few years:

China hoards gold in an effort to wean itself off the U.S. dollar

China thought to be stockpiling gold to cut greenback dependence

Russia and China teaming up to reduce reliance on dollar

Russia, China may be preparing new gold-backed currency

Brics Nations signing up for de-dollarization

Protect Your Wealth With Bitcoin!

This is just the tip of the iceberg, to be honest. Nigeria, Argentina, Afghanistan, Algeria, Mexico, and the United Arab Emirates are just a few countries that are actively seeking to join the rest of the BRICS nations in using their local currency for trade instead of relying on the dollar.

While these countries individually alone don’t have that much economic power but when you start to get a significant amount of countries opting into the BRICS financial framework, they won’t need dollars or will have a significantly reduced need to need to acquire them as they can use their currencies for trade.

What this means for the U.S. is less demand for treasury securities, the lifeblood of the U.S. economy. The government issues treasuries to finance deficit spending. If no one buys these treasuries, the government can’t fund its deficit spending without increasing taxes to generate income.

The federal reserve will have to step in and buy these treasuries with dollars they print out of thin air. This, of course, leads to more inflation and economic pain for the average American.

The dollar system is coming to an end. It may not be abrupt or a Weimar Germany hyperinflation situation, but it might be. Take a look at the signs around you; the world as we know it is coming to an end. Inflation is here to stay for the short to medium term until the government learns how to live within its means.

Suppose the U.S. government wants the dollar to maintain its position as the world’s reserve currency, its going to have to reform entitlements and cut spending. Currently, there is no political will to tackle these issues. It would be best to assume the current trajectory is here to stay. Plan accordingly. Buy hard assets. I urge anyone reading this to study Bitcoin and understand why it’s the best form of money ever created. Get on the Bitcoin lifeboat before it’s too late.

Thanks for reading!

Support My Blog!

Thanks for reading my blog! If you liked this content, please share it on social media! Truly appreciated!

Follow me on Sigle and Bitcoin Twitter

If you would like to support my blog, I gladly accept Bitcoin and Stacks (STX)

Bitcoin: bc1q2sy7thucye5qphpr4upz34l99yl5m33ggrtjdl

Stacks (STX): SP3BCZN307DECNR5PRMV6HY4P37AJ9N48JP0VE547