Mar 08•7 min read

Have Money In The Bank? That's Risky.

Summary: The 16th largest bank in the US failed over the weekend, potentially spurring a run on banks across the country. Is it safe to keep your hard-earned money in a bank? It might be time to revisit this idea.

Are Banks Safe?

Are we at the beginning of a new financial crisis? If you look at the surface, things are difficult but seem stable, for lack of a better word. The jobs report that just came out shows that hiring is still robust, and wages are increasing at even a slower clip than before.

According to the US Labor Department, the US economy added 311,000 jobs in February, with the unemployment rate increasing from 3.4 percent to 3.6 percent. Most jobs were gained in leisure, hospitality, education, and health services. While these jobs are critical to the economy's running, the people in these fields are not paid as much as they should be.

Despite strong hiring and modest wage growth, everything is not what it seems if you look beyond the surface. The financial system may be on the brink of a new financial crisis emanating from regional banks. Suppose you have been watching the news lately. In that case, you probably know that Silicon Valley Bank (SVB) was shut down by bank regulators from the California Department of Financial Protection and Innovation and placed into receivership with the Federal Deposit Insurance Corporation (FDIC).

SVB's failure is the biggest bank failure since the great financial crisis and probably won’t be the last, to be honest. Most likely, this is the tip of the iceberg. I won’t go into detail about what happened, but the bottom line is the aggressive rate hikes by the Federal Reserve are starting to have an impact on banks that hold bonds with ultra-low interest rates that were purchased when rates were close to zero percent.

In the case of SVB, the customer base they catered to, namely technology startups, are having a hard time raising capital from their traditional sources such as initial public offerings (IPO) and private funding raising. This led to their clients pulling funds out of SVB to cover ongoing operating costs. SVB needed a way to fund clients’ withdraws and turned to their portfolio of treasury bonds, yielding a measly 1.7 percent. They had to sell these on the open market at a loss of $1.8 billion.

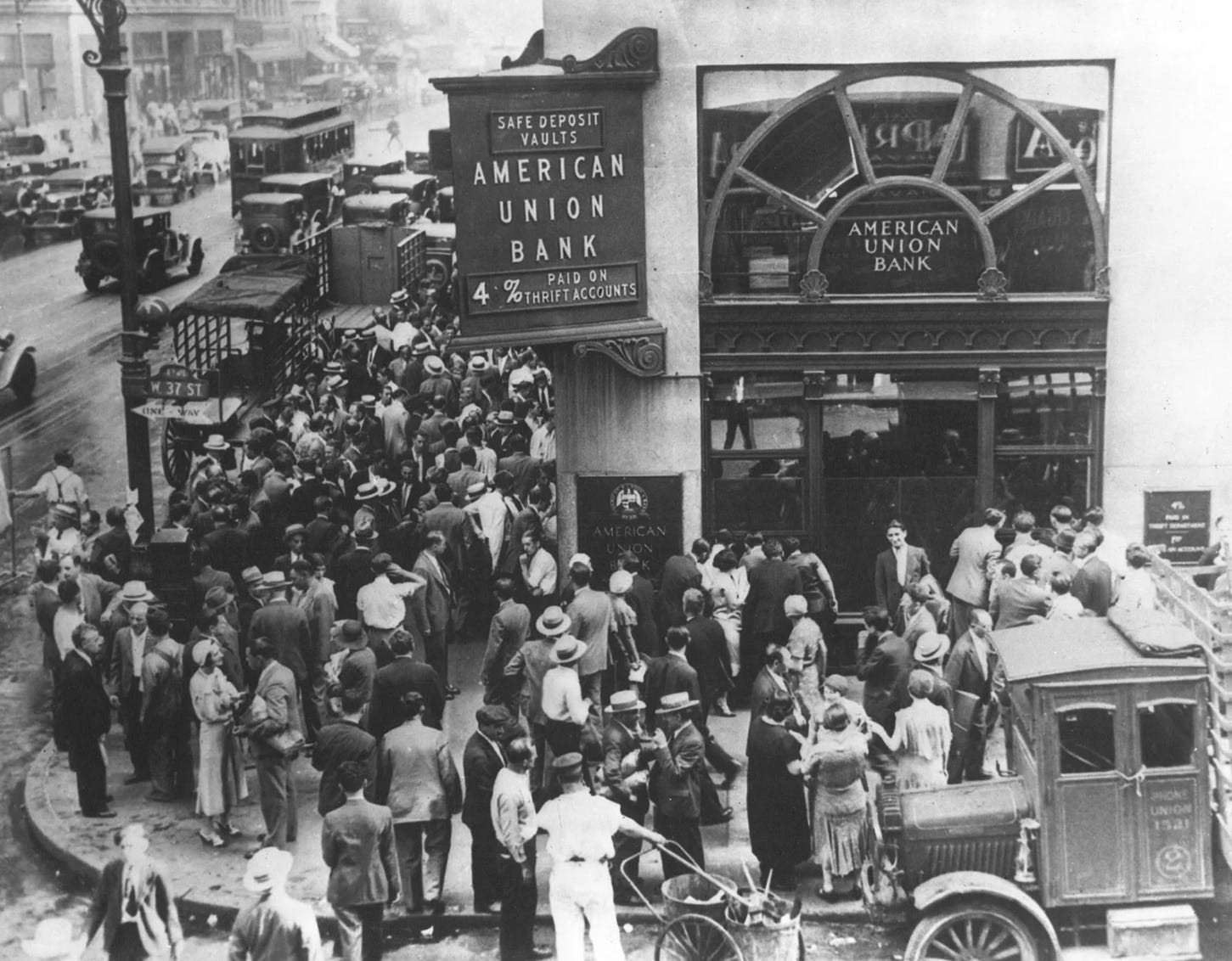

They announced a stock sale of $2.25 billion to fill this whole left from selling bonds. The announcement of the deal spooked the market and depositors at the bank. In the end, what happened was a quintessential bank run. SVB depositors lost faith in the ability of the bank to keep their money safe and tried to get their money out of the bank before they couldn’t get any out. Now that it’s in receivership with the FDIC, who knows when or if depositors will get their money back?

Yes, deposits up to $250,000 are federally protected, and customers will receive that portion of their account. Still, anything above that is considered uninsured, and there is no guarantee that this money will be returned to depositors. My question to you is, if this can happen to the 16th largest bank in America, what’s stopping this from happening to YOUR bank? In reality, nothing, just blind faith in the business operation of your bank. You give them way more trust than they deserve.

Do you think this is just a problem for the big banks? Think your local, regional bank is immune to this situation? Think again. This same scenario could unfold across the country as higher interest rates make it hard for businesses to borrow money to keep their businesses afloat, thus increasing the demand to withdraw money from the bank.

You would think higher interest rates would force banks to raise interest rates paid on deposits to entice consumers to put money in the bank, but they haven’t raised rates enough to make it attractive. Most banks are offering 3-4 percent interest.

You can get 5 percent essentially risk-free from the federal government. Which one sounds like the better deal? Four percent interest with counterparty risk or five percent with no counterparty risk?

Seems like an obvious choice to me. So if you have the Fed making economic conditions more difficult, consumers withdrawing funds, and using treasury bonds as a saving vehicle, what hope do regional banks have to stay in business over the long term during the “higher for longer” interest rates imposed by the Fed?

The stated goal of the federal reserve is to crush inflation and return it to 2 percent. They are trying to achieve this by increasing the number of people out of a job. They won’t tell you this and will hide this fact with fluffy-sounding language, but the end goal is to strangle the economy just enough to increase the unemployment rate north of 5 percent. People without jobs don’t spend money on goods and services. Do you know what else they don’t do? Pay their mortgages, credit cards, and car loans—the bread and butter of regional banks’ business model.

If you bank with a community bank or credit union, you might want to consider pulling some of your money out of the bank and putting it into something you can trust.

Trust The ONLY Money That Can’t be Debased: Bitcoin

The best way to protect your money in this type of economic environment is to save your money in something that the federal reserve can’t manipulate. Bitcoin is the solution to this madness and is needed now more than ever.

Third parties don’t control Bitcoin, and more coins can’t be printed out of thin air. There will only be 21 million coins ever created. EVER. This is hardcoded into the minds of every Bitcoiner and Bitcoin developer. This number will never change and can be relied upon to stay constant. You can’t say this about the dollar or any fiat currency.

In addition to the supply being set in stone and the lack of control by third parties, you can self-custody your own Bitcoin. Whether you buy $10 worth of Bitcoin or $10 million worth of Bitcoin, if you have the private keys to your Bitcoin, it’s yours, unlike the money sitting in the bank. No one can take it from you. No government will swoop and takes control of your deposits over $250,000.

When you self custody your Bitcoin, you are the insurance policy for your money. It’s up to you to keep it safe and sound. It is a heavy responsibility, but who do you trust more, you or your bank down the street? Plenty of user-friendly tools make the self-custody of your Bitcoin simple, easy, and effective. Here are a few companies you may want to look at to secure your Bitcoin holdings.

Support My Blog :)

Store your wealth in the most secure monetary system ever created. It’s time to upgrade our monetary system. Make the switch today!

If you would like to contribute to the success of this blog, you can donate BTC or Stacks (STX)! Don’t feel like you have to, but if you do, it is greatly appreciated! Take care!

BTC: bc1q2sy7thucye5qphpr4upz34l99yl5m33ggrtjdl

STX: SP3BCZN307DECNR5PRMV6HY4P37AJ9N48JP0VE547