Mar 05•2 min read

Reviewing Stacking Rewards (Cycle #53)

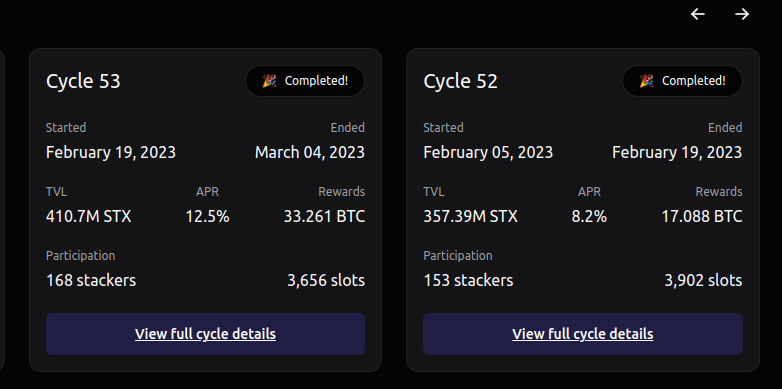

The stacking rewards distributed by Friedger Pool for cycle #53 were less than in cycle #52 while the total amount of received BTC rewards were higher and while for example stacking.club shows a higher APR:

It is not clear why stacking.club shows these APR values, but the total amount of stacked STX has changed and the price of btc/stx changed.

In cycle #53, the minimum amount for one slot was 110k STX; in cycle #52, it was 90k STX. This results in different number of slots. In cycle #53, Friedger Pool had 165 slots; in cycle #52, the pool had 224 slots. The pool locked around 19 millions STX for both cycles. With the same competition between miners, a higher return for cycle #52 would be expected. However, the competition between miners is driven by the btc/stx price.

At the end of cycle #53, the exchange rate for xbtc/stx on alexgo was 3594 sats/stx; in cycle #52, it was 1451 sats/stx. This would result in less STX in cycle #53, if the rewards amounts are the same. For whatever reasons, the total BTC rewards for the pool were higher in cycle #53 (~1.6 BTC) than in cycle #52 (~0.9 BTC). With the given exchange rates, the total rewards in STX are lower: in cycle #53 around 44k STX, in cycle #52 around 62k STX.

The example of cycle #53 and cycle #52 shows that stacking rewards depends on many factors and can’t be predicted seriously.