Jun 27•3 min read

Liquidium Update - Demo Day

Dear Investor,

Today is the Bitcoin Frontier Fund's demo day, and we will be the first ones to pitch. You can join for free by clicking here.

We're happy to welcome six new investors to our pre-seed round. Thank you for your continuous support and feedback. Today's demo day is the final step of our accelerator program and marks the closing of our round. We have increased the amount we're raising by $200k to bring in investors from today's demo day and finally close the round for good. That being said, we’re open again for bringing investors in to our round and we’re happy to talk to you. You can find a link to my Calendly here.

Here's a summary of what happened at Liquidium last week. We welcomed new investors, including Bitcoin Magazine Fund and Pim Roozen from Skynet Trading. We added stats to our UI to help borrowers set reasonable terms and talked with various Ordinal Marketplaces and Platforms about collaboration. We optimized internal OKRs and milestones and prepared for our demo day. Additionally, we continued internal tests for upcoming closed beta.

Accomplishments:

Welcome our new investors:

Bitcoin Magazine Fund

Pim Roozen (from Skynet Trading)

Petros Naziroglu (from Skynet Trading)

Kal Chan (from Celsius)

BitGod

Added stats to our UI to make it easier for Borrowers to set reasonable terms.

Talked with various Ordinal Marketplaces and Platforms about collaboration.

Optimized internal OKRs and milestones.

Prepared for our demo day on Tuesday, June 27th.

Continuing internal tests for upcoming closed beta .

Market Overview

Highlights

OKX enabled trading for BRC-20 Tokens

New Ordinal Maxi Biz Mint coming up

High On-Chain Monkey Dimensions trading volume

Opportunity

NFT lending has seen increased activity with new companies entering the space. Blur released BLEND, a peer-to-peer NFT lending protocol on Ethereum, and Binance launched their own NFT lending platform.

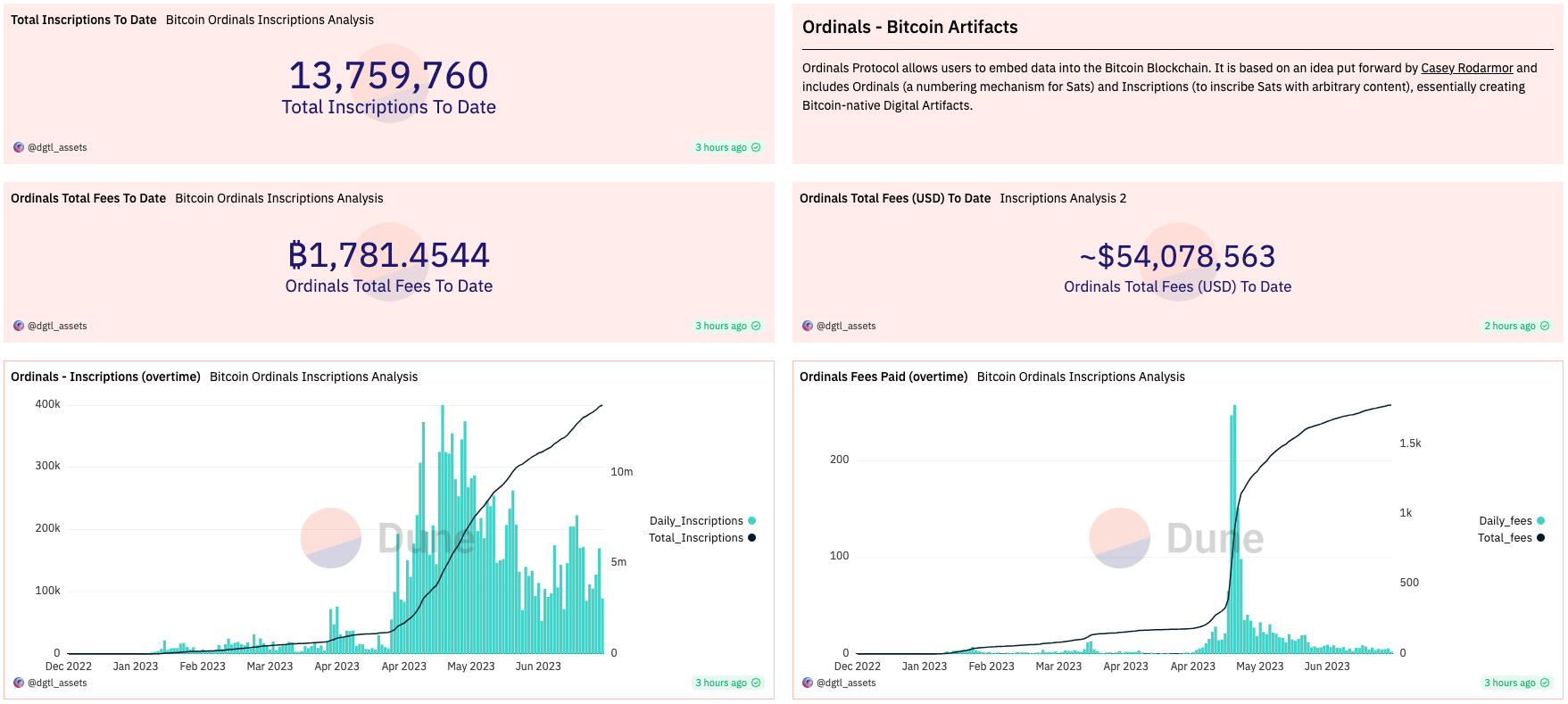

Dune Analytics reports that the NFT lending market on Ethereum has almost reached $2 billion in borrowing volume. In addition, Ordinals have been experiencing substantial weekly growth.

Liquidium is applying a similar concept to Ordinals, which will have a significant impact on the current market. It will be the first DeFi solution for Ordinals, allowing users to borrow and lend BTC using Ordinals as collateral.

Using metrics gathered from our competitors on Ethereum and comparing the Ethereum NFT market to the current Ordinals market, we estimate a daily borrow volume of $1.3 million on Liquidium. This translates to a revenue of approximately $25k per day during the current market. These numbers are expected to increase significantly during the next bull market.

https://docs.google.com/spreadsheets/d/1ehxX4vItM3nnwveoxo8iu3d3ApLPEOoYzujYDkP8ezM/edit?usp=sharing

https://dune.com/impossiblefinance/nft-lending-aggregated-dash

https://dune.com/dgtl_assets/bitcoin-ordinals-analysis

Bitcoin Ordinals Metrics:

Total Ordinal Inscriptions: 13,759,760

Total Ordinals Fees Paid: $54,078,563

Ordinal Marketplace Volume: $115,546,396

https://dune.com/dgtl_assets/bitcoin-ordinals-analysis

https://ordinalhub.com/price-tracking?dateRange=All&page=1

Analytics

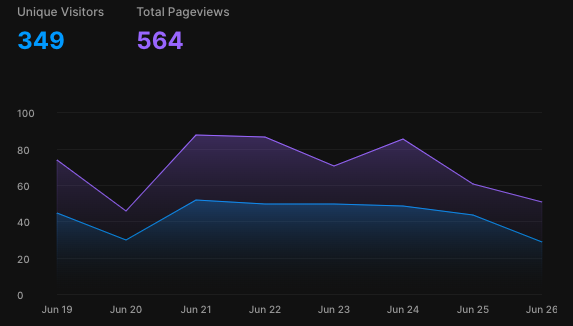

Landing Page

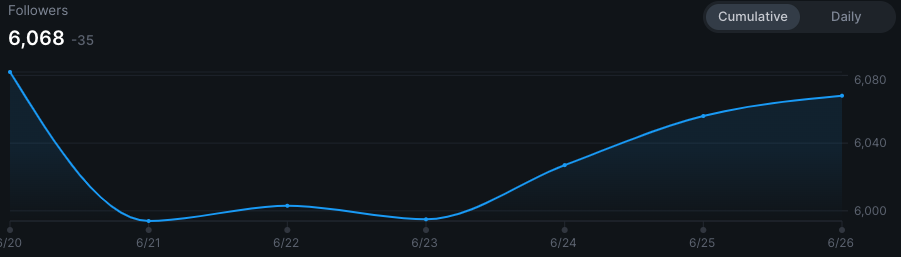

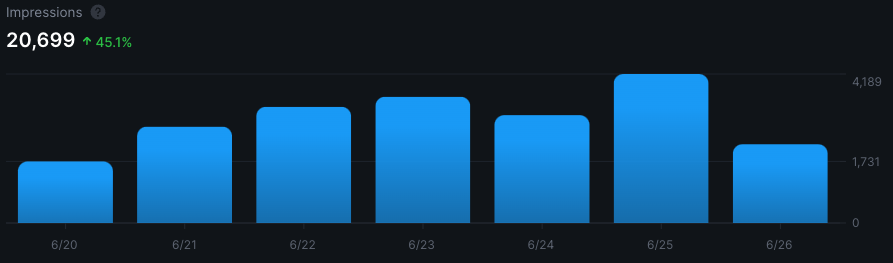

Twitter Stats

https://typefully.com/LiquidiumFi/stats?d=7d

Engagement Highlight

Find relevant resources here (incl. Whitepaper, Docs, Deck). Find a time to talk with me here.

All best, Robin & Team