Jul 10•3 min read

Liquidium Update - Closed Beta & Demo Day

Dear Investor,

Here's a summary of what happened at Liquidium last two weeks:

We launched our closed beta, with over 80 loan requests and the first loan accepted and repaid in the first two days.

We presented Liquidium at Bitcoin Frontier Fund’s Demo Day and closed two new investors shortly after that. Now we’re at a total of around $450k committed to this round.

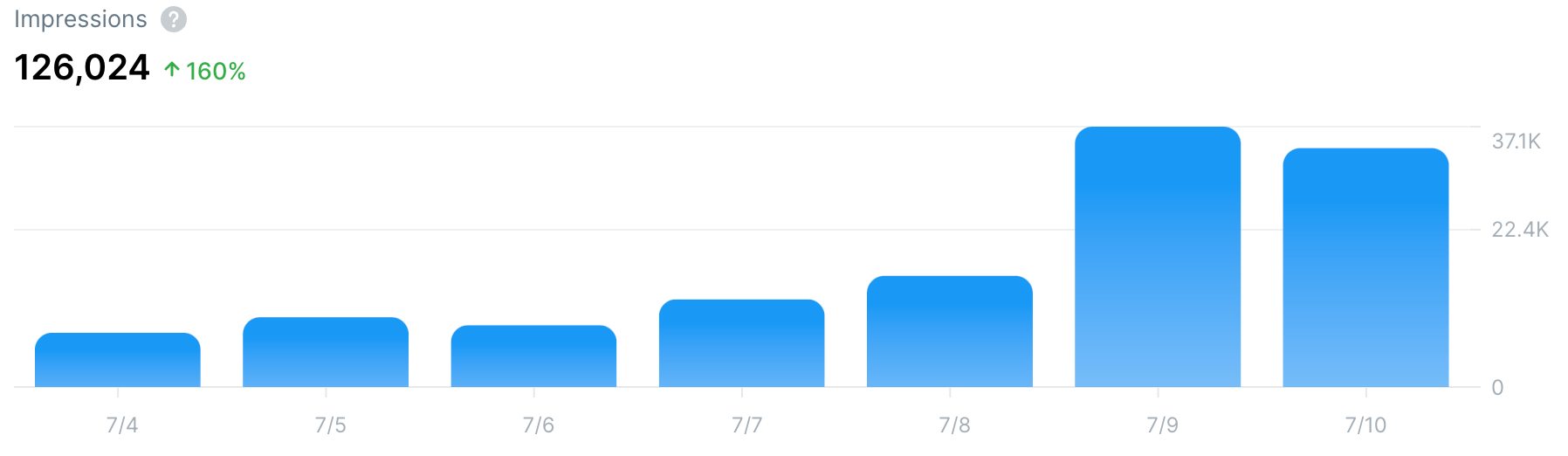

Our team also optimized OKRs and milestones, finalized UI/UX improvements, and updated our chatbot knowledge base. Additionally, our CMO attended BlockDown in Portugal as a panelist speaker and we made progress on recruiting new developers. Finally, we installed analytics tags for tracking user behavior and grew impressions of our Twitter account by 160%.

We are excited to continue working on our Bitcoin Ordinal lending protocol and look forward to sharing more updates with you soon.

Accomplishments:

Closed beta launch with ~1500 early-access users, over 80 loan requests, and the first loan accepted and repaid

Presented at Bitcoin Frontier Fund's Demo Day

Closed two new investors

Optimized OKRs and milestones

Renewed terms of service and master user agreement

Finalized UI/UX improvements

Started building a community on Instagram Threads

Updated chatbot knowledge base

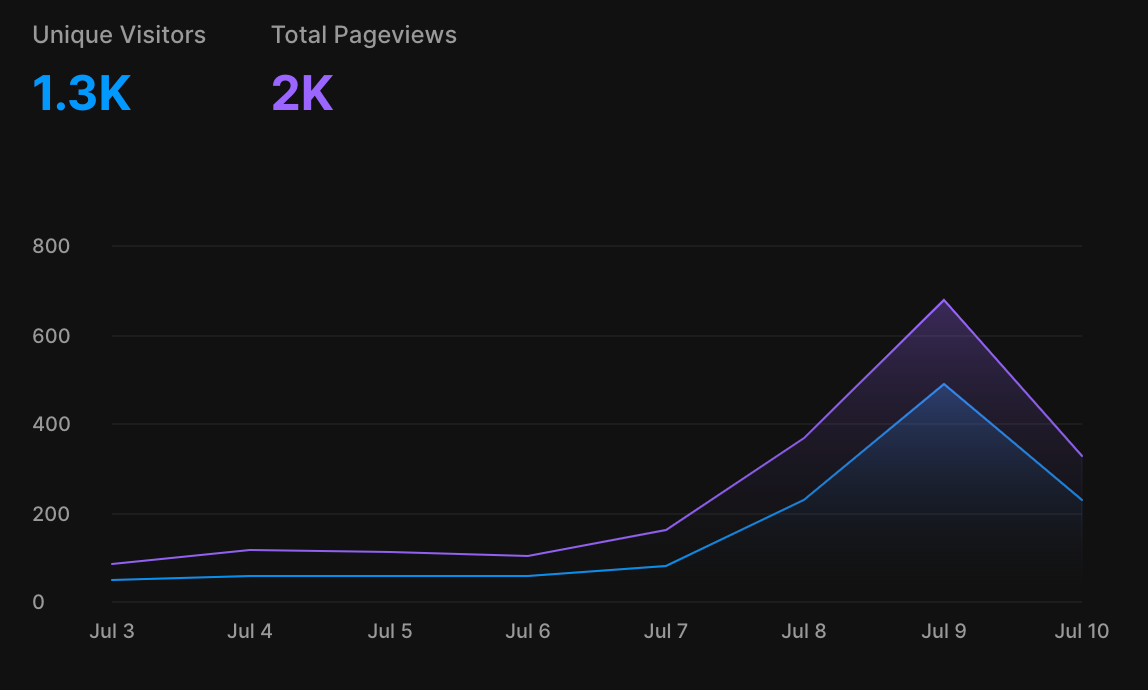

Installed analytics tags for tracking user behavior

Our CMO is attending BlockDown in Portugal right now and a panelist speaker

In contact with two Business Development candidates

Progress on recruiting new developers

Grew impressions of Robin's personal Twitter by over 350% in the past 14 days

Grew Twitter impressions by 160%

Market Overview

Highlights

OMB minted out and the floor price increased by 3x

Liquidium launched closed beta

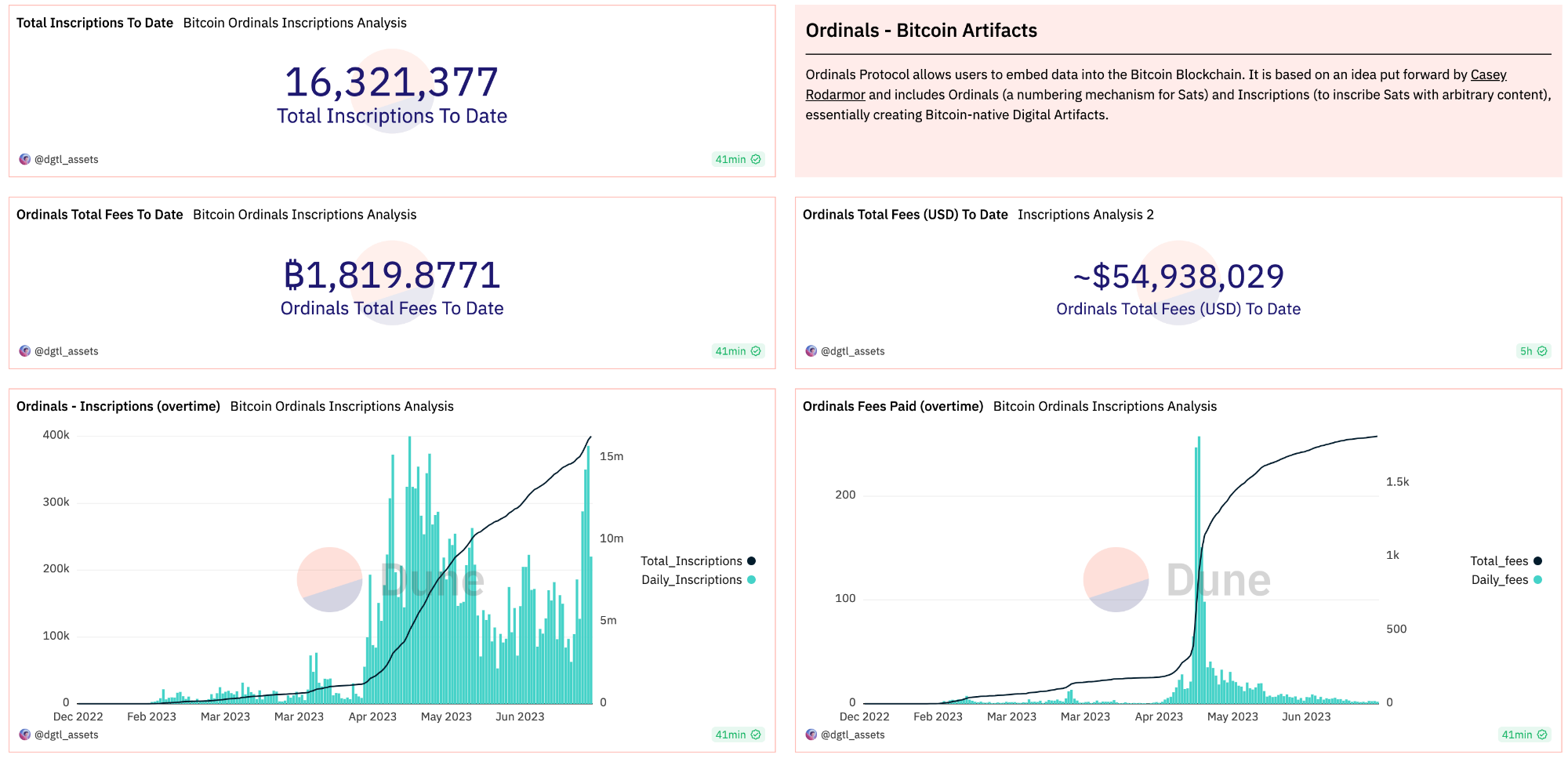

Crossed 16M inscriptions now

Ordinals trading volume is starting to overtake Ethereum NFT trading volume from time to time

Opportunity

NFT lending has seen increased activity with new companies entering the space. Blur released BLEND, a peer-to-peer NFT lending protocol on Ethereum, and Binance launched its own NFT lending platform.

Dune Analytics reports that the NFT lending market on Ethereum has almost reached $2 billion in borrowing volume. In addition, Ordinals have been experiencing substantial weekly growth.

Liquidium is applying a similar concept to Ordinals, which will have a significant impact on the current market. It will be the first DeFi solution for Ordinals, allowing users to borrow and lend BTC using Ordinals as collateral.

Using metrics gathered from our competitors on Ethereum and comparing the Ethereum NFT market to the current Ordinals market, we estimate a daily borrow volume of $1.3 million on Liquidium. These numbers are expected to increase significantly during the next bull market.

https://docs.google.com/spreadsheets/d/1ehxX4vItM3nnwveoxo8iu3d3ApLPEOoYzujYDkP8ezM/edit?usp=sharing

https://dune.com/impossiblefinance/nft-lending-aggregated-dash

https://dune.com/dgtl_assets/bitcoin-ordinals-analysis

Bitcoin Ordinals Metrics:

Total Ordinal Inscriptions: 16,321,377

Total Ordinals Fees Paid: $54,938,029

Ordinal Marketplace Volume: $125,971,573

https://dune.com/dgtl_assets/bitcoin-ordinals-analysis

https://ordinalhub.com/price-tracking?dateRange=All&page=1

Analytics

Landing Page

Twitter Stats

https://typefully.com/LiquidiumFi/stats?d=7d

Engagement Highlight

https://typefully.com/LiquidiumFi/stats?d=7d

Find relevant resources here (incl. Whitepaper, Docs, and Deck). Find a time to talk with me here.

All best, Robin & Team