Feb 17•5 min read

Coldwater Slow Model Update - Japan 4Q 2020

Japan's 4Q national accounts are out, allowing us to update our valuation of TOPIX by calculating both the change in Kalecki profits and the appropriate multiple upon which those profits should be valued.

Conclusions Spoiler: The rise in the TOPIX is understandable - justified even - by the rise in Kalecki profits which trumped a small fall in fair valuation multiples. But though understandable, the valuation is the product of massive governmental financial support, both in terms of the overall fiscal deficit, and in terms of the accelerated ETF buying by Bank of Japan. Both are responses to the economic impact of the pandemic in 2020. If either, or both, are wound down or withdrawn, there will be challenges to profits, to multiples, and to the long-standing overvaluation of TOPIX.

Kalecki Profits : Unstable

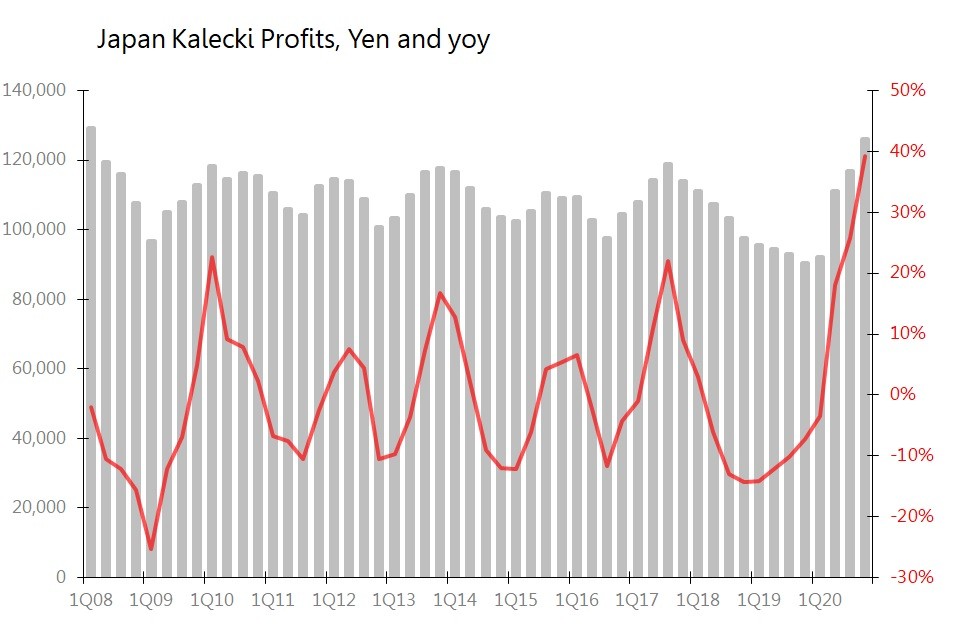

As with the US, the government's massively expanded fiscal deficit in 2020 generated a major surge in Kalecki profits, at the cost of radically altering the economic source of those profits and potentially destabilizing them over the coming year or two. I calculate that Kalecki profits in the 12m to December rose 39.3% yoy to an amount equivalent to 23.4% of GDP, the highest proportion since early 2010, and 1.6SDs above the 10yr average proportion.

At the heart of this was a government deficit which bulged to Yn 73.6tr in 2020, equivalent to 13.6% of GDP, up from Yn 17 tr in 2019, or 3% of GDP. That Yn 56.6tr rise in government dissaving by itself generated the Yn 35.5tr rise in Kalecki profits, and more. The other two big contributors to profits fell, with net investment spending down Yn 7.7tr to Yn47.3tr, and household dissaving (the difference between private consumption and compensation) down Yn12.5tr to just Yn 6.25tr. Meanwhile, net exports' contribution to profits was little changed at a mere Yn1.06tr.

The result is a dramatically distorted generation of profits, with the government deficit accounting for a record 58.4%. Meanwhile, net investment spending ceded its traditional-for-Japan leading roll, accounting for only 37.5% of net profits, the lowest proportion since 2013. Both the household sector and net exports have retreated to only marginal significance as far as profits are concerned, accounting for 5% and minus 0.8% of profits respectively.

As should be obvious from these charts, the surge in 2020 profits is profoundly unstable, and anomalous. The legacy is that this year, profits will only be maintained if the government makes no attempt to stabilize or improve its fiscal position. Or if it does, this fiscal tightening will be offset by resurgent investment spending and a rapid loosening of Mrs Watanabe's purse-strings.

We also know that the challenge will first be seen in 2Q21.

Valuation Multiples: Slight Moderation

On the principle that profits multiple for fair valuation ought to allow the profit-producing asset to maintain its place in the economy, the multiple will change in reaction to dramatic shifts in nominal GDP. (Eg, a lower nominal GDP will grant a higher multiple to a particular profits-flow, but greater volatility will reduce the fair-value multiple.)

In 2020, lower nominal GDP growth (0.7% in the 10yrs to calendar 2020, down from 1.3% in calendar 2019) raised the multiple, but this was offset by a sharply higher 10yr volatility in nominal GDP (2.5% in 2020 vs 1.6% in 2019). The net result was that the fair-value multiple slid to 32x from the 34.6x seen at end-2019.

TOPIX Valuation: Short Term Rational, Long Term Gross Overvaluation

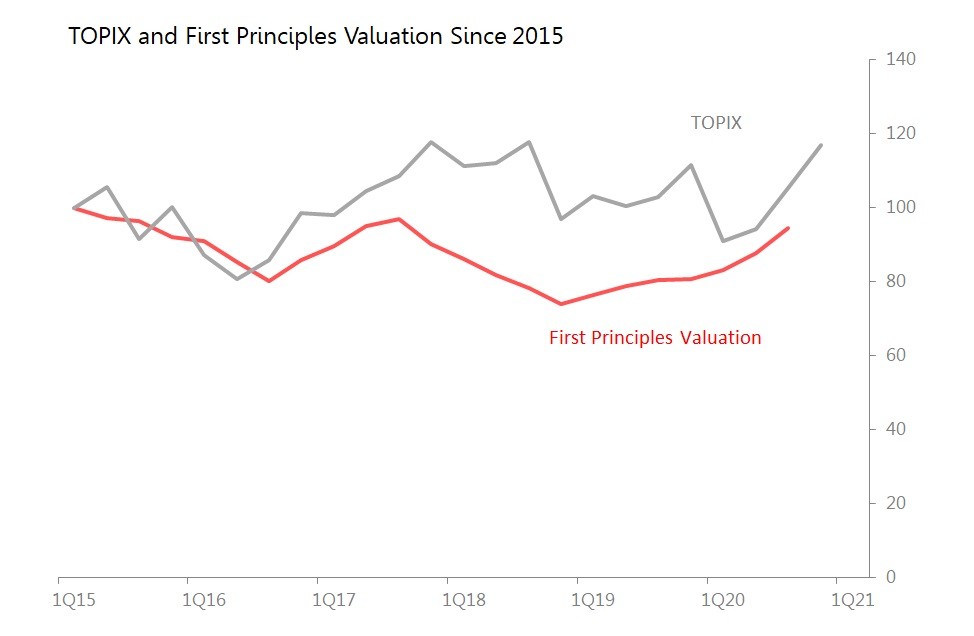

With Kalecki profits surging but fair-value multiples retreating, the net result would be for a rise of 9.9% qoq in TOPIX valuations. In fact, during 4Q, TOPIX rose 11% qoq to 1804.68, which is surprisingly closely in line with the change in the Slow Model metrics.

The problem remains, however, that although in the short term, TOPIX does seem to be moving roughly in line with Slow Model valuations, since around 2012-13 TOPIX has been very sharply over-valued on this fundamental basis.

Can the Overvaluation Survive 2021?

On a long-term basis, TOPIX looks approximately 250% overvalued. That overvaluation widened dramatically from 2012 onwards, and has been maintained around the 200%-300% levels since around 2015. It's current overvaluation sits comfortably within that 2015 range, so within its own exceptional universe, it is unexceptional.

I believe that the fundamental overvaluation of TOPIX is underwritten by Bank of Japan monetary policy indirectly, and directly by the size and the pace of BOJ's buying of Japanese ETFs. As the chart shows, the extent of overvaluation has fluctuated rather closely with the 12m change in BOJ's EFT holdings (book value). At end-January, BOJ's accounts show holdings of Yn 35.6tr of ETF holdings, which, marked to market, are probably worth around Yn 45tr, and represent around 7% of total market capitalization.

Throughout 2020's pandemic, BOJ significantly accelerated its ETF buying, adding Yn7.0tr in 2020, up from Yn 4.70 tr in 2019, and an annual record.

Conclusion: The rise in the TOPIX is understandable - justified even - by the rise in Kalecki profits which trumped a small fall in fair valuation multiples. But though understandable, the valuation is the product of massive governmental financial support, both in terms of the overall fiscal deficit, and in terms of the accelerated ETF buying by Bank of Japan. Both are responses to the economic impact of the pandemic in 2020. If either, or both, are wound down or withdrawn, there will be challenges to profits, to multiples, and to the long-standing overvaluation of TOPIX.