Nov 21•2 min read

Singapore's One-Trick Services Economy

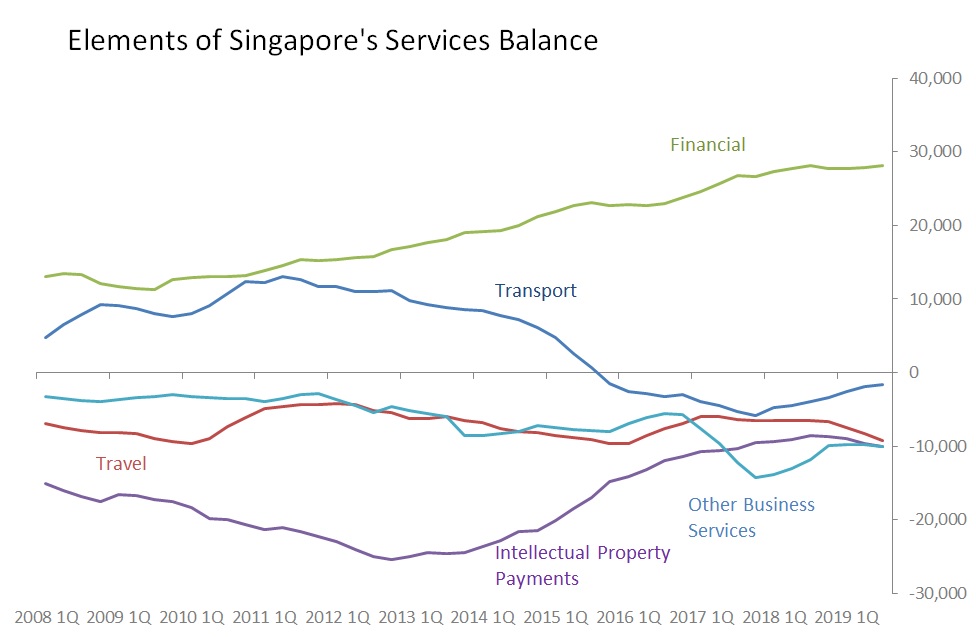

Singapore's 3Q current account surplus looks huge - S$22bn, equivalent to 17.8% of 3Q GDP - but its composition emphasises how, as an international services centre, it has become lop-sidedly dependent on financial services. In the year to Sept 2019, Singapore's financial services trade generated an international trade surplus of S$28.1bn. However, financial services is now the only substantial international services surplus Singapore now enjoys. For example:

Travel services, which include both tourism and air services, showed a deficit of S$9.2bn;

Transport services, which include Singapore's role as Asean's transhipment centre, showed a deficit of S$1.6bn;

Intellectual property payments showed a deficit of S$10.1bn;

Telecoms, Computer and Info Services showed a deficit of S$3.4bn;

'Other Business Services' showed a deficit of $10bn.

And as a result, Singapore generated a deficit in international services of S$3.3bn. This is quite extraordinary for a major regional and global financial services centre.

Whilst there's no doubting the success of Singapore's positioning as a financial centre, its inability to generate similar success in the wider global services economy is genuinely surprising. Consider, for example, Hong Kong. Although we do not have a detailed quarterly breakdown for Hong Kong's services balance, we do know that in the 12m to June 2019 services generated a surplus of HK$266bn (probably a record).

But unlike in Singapore, that surplus is almost certainly generated by a wide range of activities: in 2017, for example, when Hong Kong generated a net HK$207bn of services surplus, it included HK$101bn in transport services, HK$62bn in travel services, HK$116bn in financial services, and HK$19.5bn in 'other business services'. The main drag was, of course, manufacturing services, which generated a deficit of HK$91bn.