May 04•10 min read

Inflation-Hedging, or a Bolt Hole for the End of the Financial Supercycle?

Twice today I have been asked the same question by two very different types of investor - one a quant-driven strategist, the other an entrepreneurial financial company business-builder.

Given that TIPS yields have been negative since the onset of the pandemic in early 2020, is there available any other decent kind of inflation hedge? Well, is there? It looks difficult. Particularly if you think, as I do, that Kalecki profits and consequently equity valuations are peaking right now. Particularly if you think, as I do, that in a world in which both taxes and interest rates are more likely to rise than fall in the medium term, that property prices are unlikely to continue rising relative to disposable incomes. Particularly if you think, as I do, that pandemic-related expansion of central bank balance sheets must eventually be slowed or reversed. Particularly if you think, as I do, that the frantic expansion of fiscal deficits during 2020 will, at the very least, face a sharp downturn in its delta during 2021 and beyond.

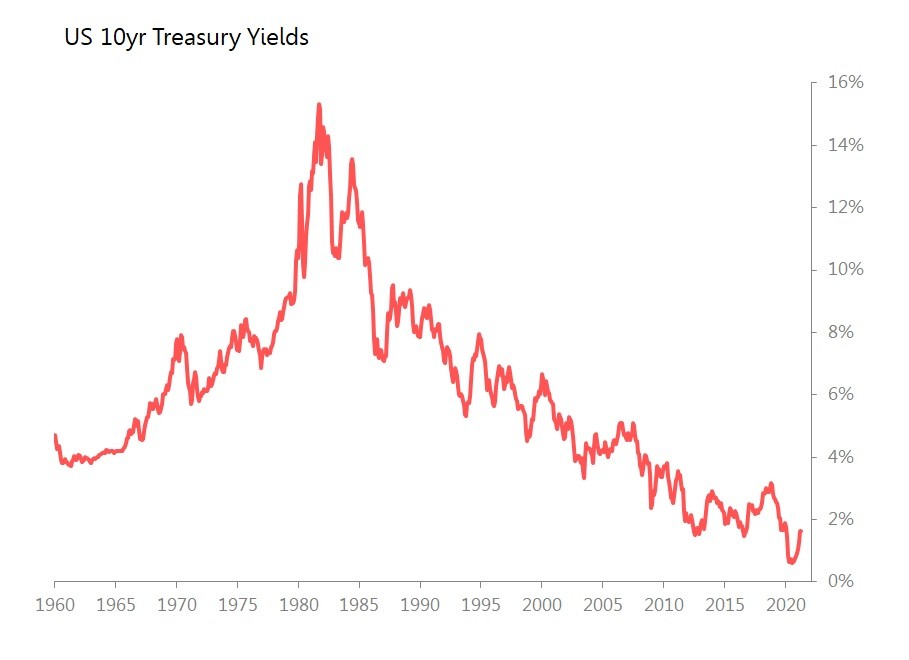

All of these are merely a way of saying that, finally, more than 10yrs after the logical (but not actual) end of the 30 year bond bull market, almost all of what the financial services industry has to sell looks unattractive. Are we looking for an 'inflation hedge' or a bolt-hole for the end of the financial industry super-cycle?

Strangely, I suggest that a useful way to edge towards a solution is to acknowledge that there are some very serious unacknowledged problems about the word 'inflation'. The problem is that we think, wrongly, that we know what it means because we a measurement which bears its name, and an industry which takes it seriously.

I think the broad sense in which we use the term 'inflation' is to talk about change in the value of money. How much will a certain amount of money held now be able to buy at some time in the future, relative to now. When we seek an 'inflation hedge' the desire is to preserve in time the value of the money we hold.

This is no easy concept. However, rather than grappling with the fundamental difficulties, we avoid it by focussing on a quite different concept, that of 'Consumer Price Inflation' measured by the Consumer Price Index (CPI). It is against changes in the CPI that the financial industry seeks to protect itself.

Why? There are two massive problems with CPI - the profound one is ontological, the contingent one is methodological.

Inflation - The Ontological Problem

The ontological problem is that changes in the value of money are no more captured by changes in the Consumer Price Index that the function of money is exhausted by its 'medium of exchange' aspect. CPI gives a uniquely privileged position to consumers, which is itself an unacknowledged artefact expressing the priorities of societies at a particular moment of demographic and financial development. Put simply, rises in Consumer Price Inflation will matter more to a demographically young and relatively poor society than to an aging savings-rich society. The economics profession is moulded and shaped precisely by the priorities of the former (think pre-and-post War problems), whilst the societies it seeks to understand have shifted to the latter. To an older, savings-rich society largely unconcerned with the problems of securing the means to preserve existence, anything but dramatic CPI inflation is unlikely to matter as much as, for example, inflation in housing prices, asset prices or - think about it - rising death duties.

(And, incidentally, the assumption that 'asset price inflation' is a benign thing is itself remarkably squint-eyed. If I want to buy an iPhone, low Consumer Price Inflation might be a good thing. If I want to buy part of Apple, asset price inflation erodes my ability to do so. If I want to buy a sofa, low Consumer Price Inflation might help; if I want to buy a house to put it in, asset inflation is a nightmare).

The CPI is not, therefore, a measure of inflation. All claims about 'real yields' are therefore mistaken at an absolutely fundamental level. This needs to be remembered when we come to think about what an 'inflation hedge' might be.

Inflation - The Methodological Problem

The methodological problems of Consumer Prices Indexes are more obvious, but although they are more acknowledged, CPI remains curiously accepted at face value. The main problem is the role 'hedonics' play in the calculations. 'Hedonics' declare that changing prices should acknowledge the increasing complexity of many goods, for only by doing so can we realistically measure changes in the price of like-for-like goods. Thus, hedonics will adjust (downwards) the price of a notebook or mobile phone as it becomes an increasingly complex and advanced product.

On the face of it, this seems a merely sensible effort to ensure stability of comparisons over time. But for goods with significantly changing technical characteristics, it discounts the way in which those very technical changes encourages or even enforces changes in the use of the product. The changing role of notebook computers or mobile phones makes the point - what you need in a mobile phone, what counts as a mobile phone, changes as the tech changes.

There are thus two competing ways to assess changes in the price of, say, a mobile phone. The hedonics way assesses what you are getting by looking at the increasing technical prowess is grants you - if you pay more for a 'better' mobile phone, then the change in actual price you pay for the phone needs to be adjusted downwards in the CPI basket because you are literally getting more technical bang for your buck. But the alternative way is simply to measure how much you pay for a mobile phone, accepting that the technical prowess of that phone may be irrelevant since those same technical advances have altered what you use a mobile phone for. The technical advance alters the definition of 'a mobile phone'.

Alibaba's Embarrassing Reveal

Some years ago China's Alibaba (Alibaba - China's Amazon) ran a fascinating piece of research in which it used the same mass of buying data to calculate

i) an inflation index using the generally-accepted hedonics-heavy CPI methodology, and

ii) an inflation index tracking how much people actually spent on units of (say) 'a mobile phone'. In the latter, it was the consumer behaviour itself which defined what 'a mobile phone' actually was.

The difference was absolutely astonishing: using the official CPI methodology the world was disinflationary; using product definitions actually discovered by looking at what people paid for products, inflation was running at or near double-digits.

.jpg)

Shortly after publishing these results, Alibaba's research department stopped releasing the data. Nonetheless, the implications are genuinely revolutionary.

They imply that we have not been living through a disinflationary age, but an unrecognized inflationary age. They imply that monetary policies throughout the world have been tolerating and feeding that inflation for decades, even if has been acknowledged only in asset prices.

More, if 'hedonic' definitions are fundamentally misconceived, then perhaps it is precisely the food & energy prices excluded in global 'core CPI' results which should form a major focus of price indexes.

So What Is Inflation?

At this point, the easy criticism needs to end, and I need to offer an idea of what inflation, thought of as the erosion in the value of money, might actually be. For me the starting point is to embrace the truth that it is ultimately bound up with time as we experience it. An interest rate is, after all, a rent demanded to compensate for deferring spending a sum of money now. Arguably, the only place that zero-interest rates make sense is on your death-bed.

And the only sorts of economies for which zero interest-rates really make sense are those so exceptionally surfeited with savings that they place no value on preserving them. Bill Gates, for example, spends his time not preserving his wealth, but ridding himself (and his family) of it.

If interest rates are the compensation made for time, then inflation is its opposite: a fall in the value of money is a fall in the value of your time.

So we discover a logic behind non-linear interest rate changes (and more broadly, the non-linearity of most financial markets). Interest rates should be zero on your deathbed, where there is no value to the future because you don't have one. Conversely, when your future is only plausibly threatened, you will demand a great deal to delay gratification to a future time you are no longer certain will be available to you. High interest rates are a function of uncertainty because your time isn't infinite but it has not run out yet. This is also perhaps the underlying reason why inflation is so damaging to societies, why it so often presages revolution: inflation compromises your future ability to exercise your time in the only context you can , the context of a society.

Philosophically interesting, perhaps, but does it get us any nearer thinking about an inflation hedge? Perhaps it does. because if we acknowledge that money, inflation and interest rates are all inextricably bound up with the one commodity which for us will always be in short supply - our time on this earth - then things get interesting. For example, it is striking that the great beneficiaries of the era of ultra-low interest rates - the FAANGs - are rewarded precisely for their ability to command that most valuable commodity of all - our time. Our attention and our time.

The FAANGs have, very precisely, learned how to recognize and harvest the value from the one commodity - our time - which is being officially declared of little or no value by policymakers via ultra-low interest rates. They are valuable precisely because their activity focusses directly on exposing and profiting from the untruth embodied in interest rate policies.

This, then, ought to provide us with clues beyond the realm of the FAANGs. The first possibility is that other competing companies and technologies might be able to wrest back some of the value in our time being commandeered by the FAANGs. There are numerous technologies trying to do just that, by restoring control over the data which is used to command your attention. The decentralization of databases and the associated rise in crypto-secured internet communications is often geared to just this subversion of the 'attention economy.' This piece, for example, is posted on a site which is part of the Blockstack environment. If the Blockstack environment succeeds in securing for its users control over their portion of the attention economy, its associated currency - Stacks - should discover in its price the value of the time its users devote to it. If so, it is reasonable to expect that that value will be maintained even at a time when zero-interest rates are claiming an erosion of that value. In that sense, Stacks could be an inflation-hedge. Other cryptos offering similar or analogous prices on attention and time would share the same virtue.

But this is probably too abstruse an argument (though I entertain it seriously). More simply, one would expect that activities which value and preserve your time, during period when interest rates assert your time is of almost no value, are likely to be popular. Companies offering to extend your time (from 'mindfulness' to 'healthcare'), or promise greater reward from your time (ie, travel and tourism) are likely share in the revaluation of your time, and consequently survive any erosion of the value of money (and time).