Oct 14•2 min read

Hong Kong - Still Crucial for China

One way of looking at China's suppression of dissent in Hong Kong is that, rather than being willing to kill the goose which lays the golden eggs, it is making the territory safe for Chinese finance. That, at any rate, is consistent with the accelerated boom in equity financing activity underway in Hong Kong, despite the grim trifecta of political unrest, a struggle against Covid-19, and the crackdown on civil liberties.

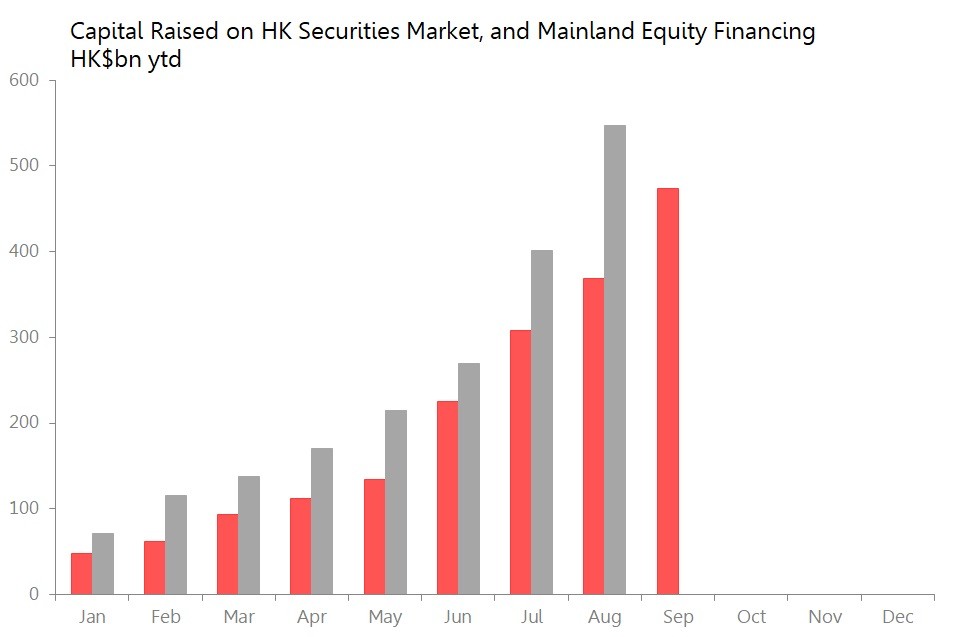

The first exhibit shows the extraordinary surge in financing activity during the first nine months. In Jan-Sept, Hong Kong's securities markets raised HK$211.4bn in IPOs, which was up 65.5% yoy. The total amount of capital raised came to HK$473.8bn, which was more than double the amount raised during the same period last year. In fact, it was also 5% more than the entire amount of capital raised in 2019. This is no sign that Hong Kong is losing its role as a capital-raising centre for China.

Moreover, that HK$473.8bn remains very material even in the context of China's giant economy. For China's monthly aggregate financing data tells us that the amount of new equity capital raised on the mainland's own securities markets came to Rmb493bn in Jan-August, or HK$547.1bn. In other words, the amount raised in HK alone during Jan-August was more than two-thirds of the total raised on mainland bourses.

Hong Kong is perennially concerned that it will one day be overtaken as a financing centre by either Shanghai or Shenzhen. That may happen, but it isn't happening yet. Last year, more capital was raised in HK's securities markets than the equity raised in the mainland. It is too early to know that this will not happen again. Bear in mind that Rmb250bn of the Rmb493bn in equity-finance raised so far this year on the mainland came during two consecutive record months of July and August. Unless that pace is maintained, it is quite possible that Hong Kong's capital-raising efforts will once again top those of its mainland competitors.