Jan 14•2 min read

Bleak Expectations

Since 2013, the NY Fed has conducted a fairly comprehensive monthly survey of householders' economic attitudes and expectations. January's results, out today, make rather sobering reading. In short, the household sector think inflation's going up, taxes are going way-up, getting credit remains extremely difficult by historic standards, chances of finding a job quickly are near record lows, and although house prices are rising, the chances of moving any time soon are at record lows.

These are not the attitudes which generate a robust recovery.

First, whilst the likelihood of losing your job has come down to 14.99% from April's pandemic high of 20.93%, it is once again on the rise. Worse, if you're fired, the chances of finding a new job within three months fell to 42.64% - that's the lowest since 2013.

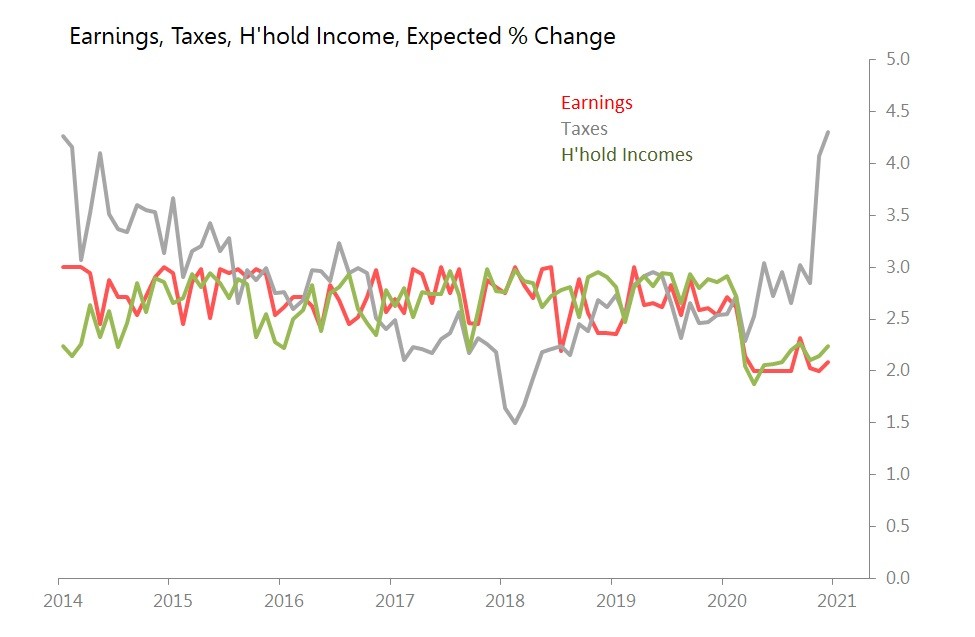

Second, whilst expected earnings growth of 2.09% and h'hold income growth of 2.24% are both below long-term average (of 2.66% and 2.60% respectively), the expected change in taxes is up 4.3% (vs l/t average of 2.9%).

Third, a composite index on the difficulty of getting credit is stuck at its most discouraging level since 2013, with no rebound at all from the worst of the pandemic.

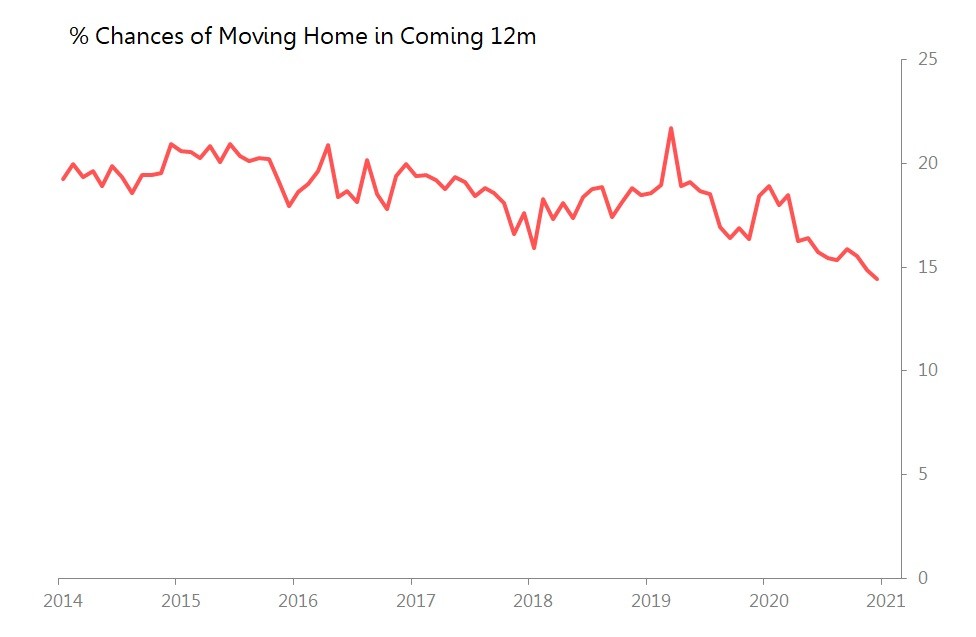

Fourth, the housing market prospects don't look too hot, since although home prices are expected to rise 3.6% (vs l/t average of 3.2%), the likelihood of actually moving has sunk to 14.4%, which is a record low for this survey, and compares to a l/t average of 18.7%.

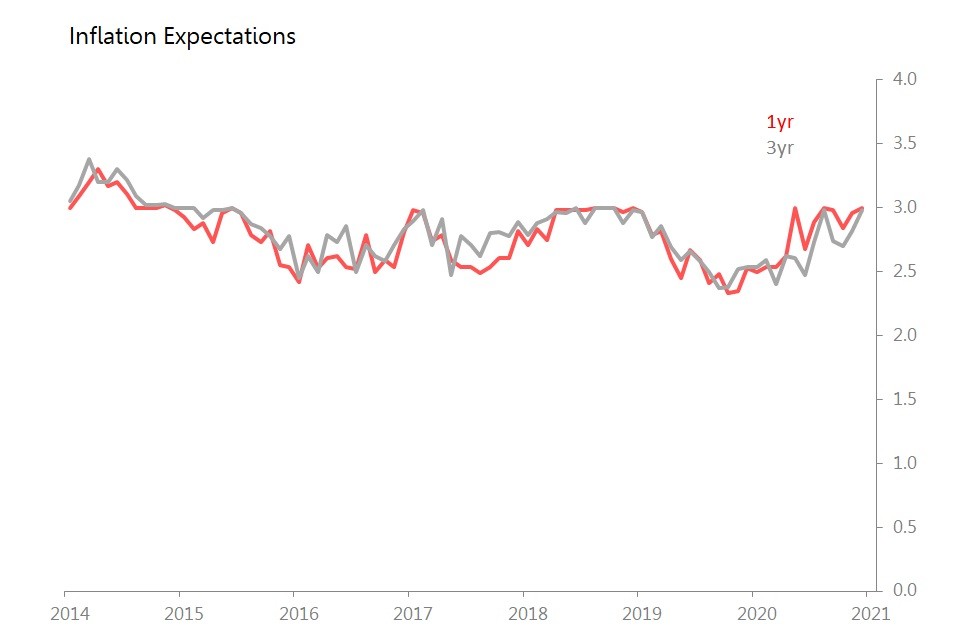

Fifth, oh yes, inflation expectations have jumped, to 3% for 12m and 2.98% for 3yr - both right at the very top end of this survey's history.

To summarize (and repeat): these are not the attitudes which generate a robust recovery.