Dec 11•3 min read

Japan: Deteriorating Duponts Meet the Business Downturn

The sharp deterioration in Japan's 4Q Business Outlook Survey shouldn't really have come as a shock, even though historically this survey has generally been steady in the fourth quarter. This year, however, the assessment of large manufacturing companies fell 7.6pts to minus 7.8, and for large companies generally fell 7.3pts to minus 6.2, which was the worst since 2Q16. For good measure, there was no yoy sales growth reported (manufacturers down 0.7% yoy, non-manufacturers up 0.3%), and profits were reported down 6.3% yoy (manufacturers down 10.1% non-manufacturers down 4.7%).

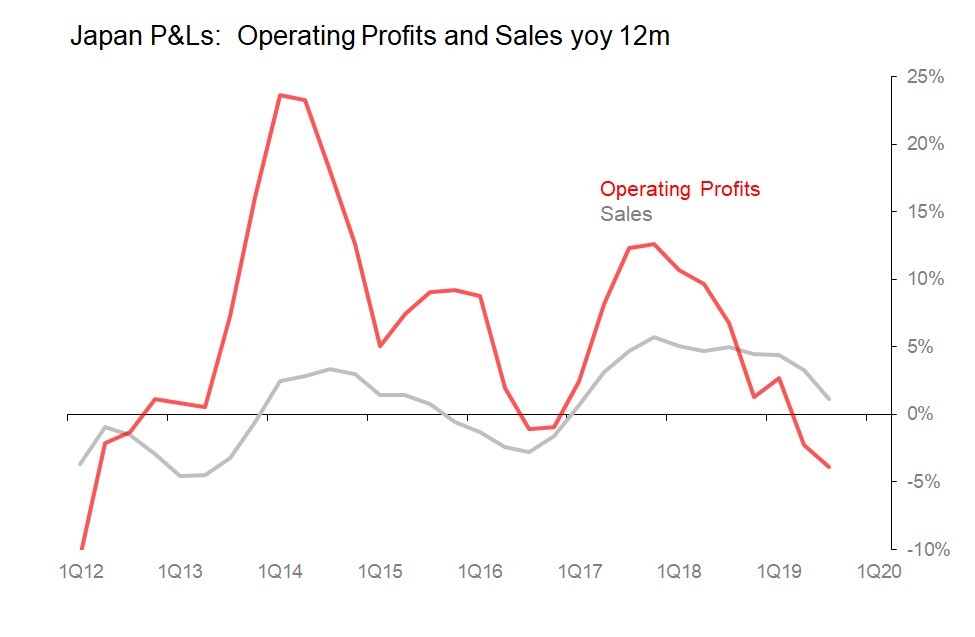

The reason this dour result should have been anticipated is that it echoes quite closely the results of the MOF's epic quarterly survey of private sector balance sheets and p&ls, which was released on 2nd December. That showed sales down 2.6% yoy in 3Q, with profits down 5.3%; and on a 12m basis, sales growth slowing to 1.1% and profits falling 3.9%.

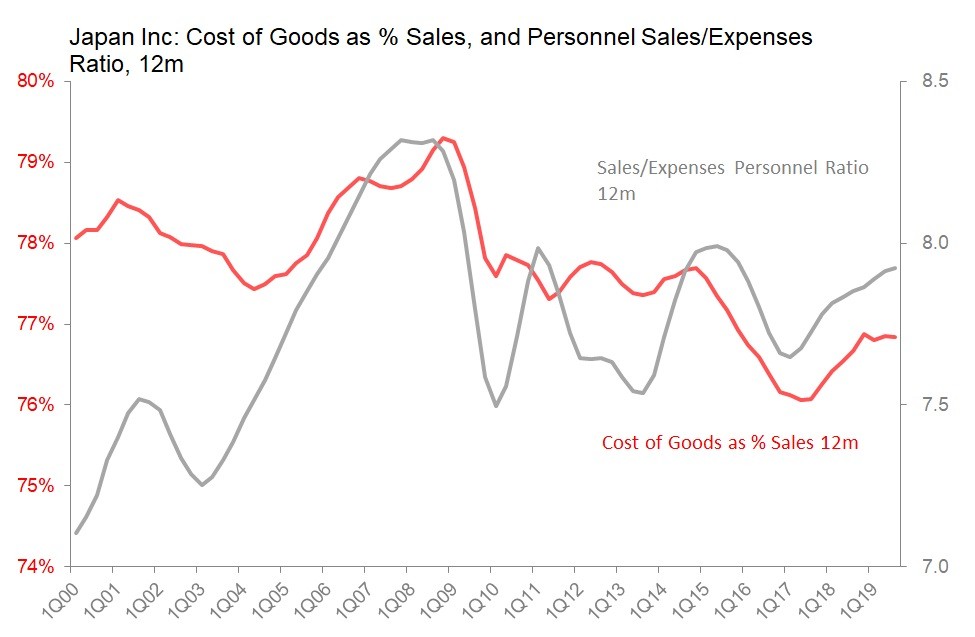

Go a little deeper and all the potential contributors to Japanese corporate ROE are in decline. In 3Q operating margins slipped 69bps qoq to 4.10%, which was the lowest since 3Q16, and this cut 12m OPM to 4.65%. The reason is that cost of goods sold as % of sales rose 75bps qoq to 77%, for which a 6bps fall in SG&A/sales to 18.9% could not compensate. And it's worth pointing out that this difficulty in cutting SG&A to recompense for a rise in cost of goods sold is now a structural issue which, alas, is being stressed further by cyclical pressures. Personnel expenses are 69% of SG&A costs, and over the last three years corporate Japan has managed to raise the sales/expenses ratio of personnel from 7.61x in 2H16 to a peak of 7.95x in 2Q19. But except in absolutely peak top-of-the-cycle circumstances, that 7.95x is about as high as it has got, and in 3Q it went into mild retreat, falling to 7.93x.

In other words, if the cost of goods sold ratio doesn't come down, either margins will continue to be crushed, or, alternatively, labour conditions will become tougher in Japan.

Margins are not the only contributor to ROE, but there's little comfort to be had from trends in either asset turns (sales/assets) or financial leverage (total assets/shareholders' equity). With sales rising only 1.1% in the 12m to 3Q whilst total assets rose 2.4%, asset turns have fallen to 0.852, extending a decline which has been relentless since 2012. As for financial leverage, with shareholders' equity still rising 3.5% whilst assets rose 2.4%, the leverage ratio slipped further to 2.37x, which is the lowest since my records start (in 1980).

With changes in margins, asset turns and financial leverage all acting in concert against it, ROE fell 31bps to 2.03% in 3Q, annualizing to 8.2%. This was the lowest since 3Q12, and is a full standard deviation below the average of 10.7% achieved since 2000.

The point, I think, is that since all its Dupont ratios are in decline, and with little obvious scope for improvement in any of them, corporate Japan is already suffering the consequences of a slowdown, and is in poor shape to rescue its deteriorating corporate performance. Which is why the bad news from the MOF's business survey this morning should not have been unexpected.