Aug 19•4 min read

The Valuation Project - Part 3, Japan

In the first instalment of this project, I proposed that a valuation of stockmarket indexes might be possible. The idea stemmed from the principle that a fair price for a financial asset would be one in which we could expect its earnings to allow it to retain its place in the economy. This suggested that a fair value PER might be related to the long-term nominal growth rate of the economy, with the standard deviation of that growth rate being added as a risk premium. In addition, I took the profits element of the valuation to be the Kalecki estimate of profits for the entire economy, rather than the distorted and inevitably selected aggregation of listed company earnings reports. .

The two tests which I hoped this method would satisfy were:

i) that it ought to represent a fair valuation from first principles

ii) that, in fact, the available financial history suggest it actually did represent actual valuation experience.

Testing for the US and the S&P 500 since 1991 suggested it did, in fact, give a useful guide as to the valuation of the index as a whole.

In part 2 I applied the same method to the FTSE100 and the UK economy. The initial results were disappointing, with the FTSE 100 persistently being sharply undervalued, and, what is more, showing no particularly strong directional correlation with the first principles valuation. However, the results with the wider FTSE 250 were better, particularly over the last 10 years. This suggested that the global characteristics of the FTSE 100 companies were at least partly responsible for the divorce between actual valuation and the valuation suggested by UK domestic economic experience and conditions. But if the FTSE 100 was considered as a global index, with both profits re-stated in dollars and the valuation parameters imported from the US, the valuation from first principles model in fact cohered well with the actual valuation experience.

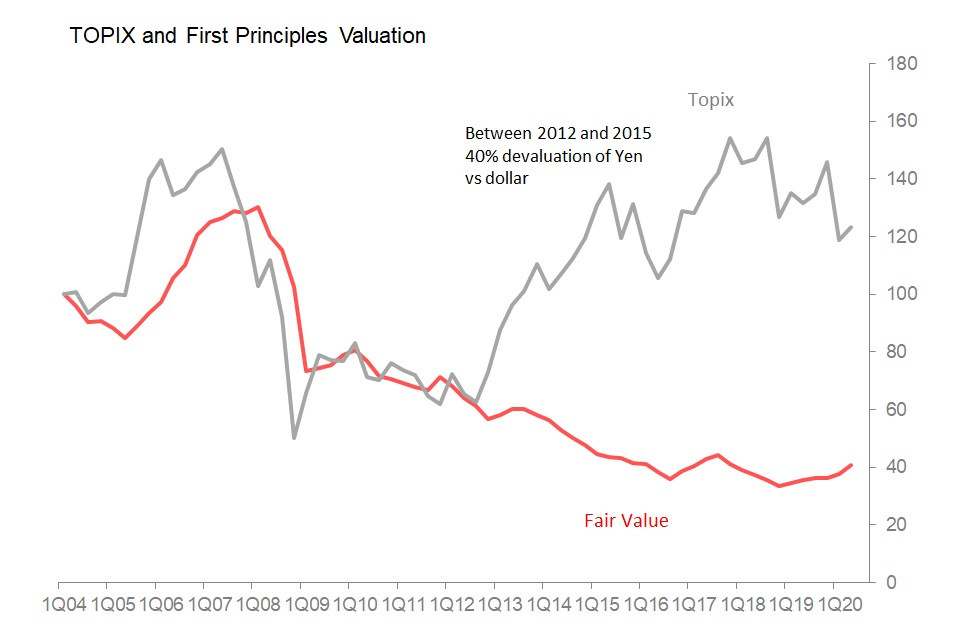

In this part, I consider whether the first principles valuation technique can be used in Japan. At first glance, the situation looks even less promising than with the FTSE 100. Using Japanese Kalecki profits, and a PER generated from the average 10yr nominal GDP growth rate plus a premium generated by the standard deviation of that growth rate, it seems that the TOPIX index is massively overvalued, and has been since around mid-2012. In fact, currently, this method would suggest that the TOPIX is overvalued approximately three times.

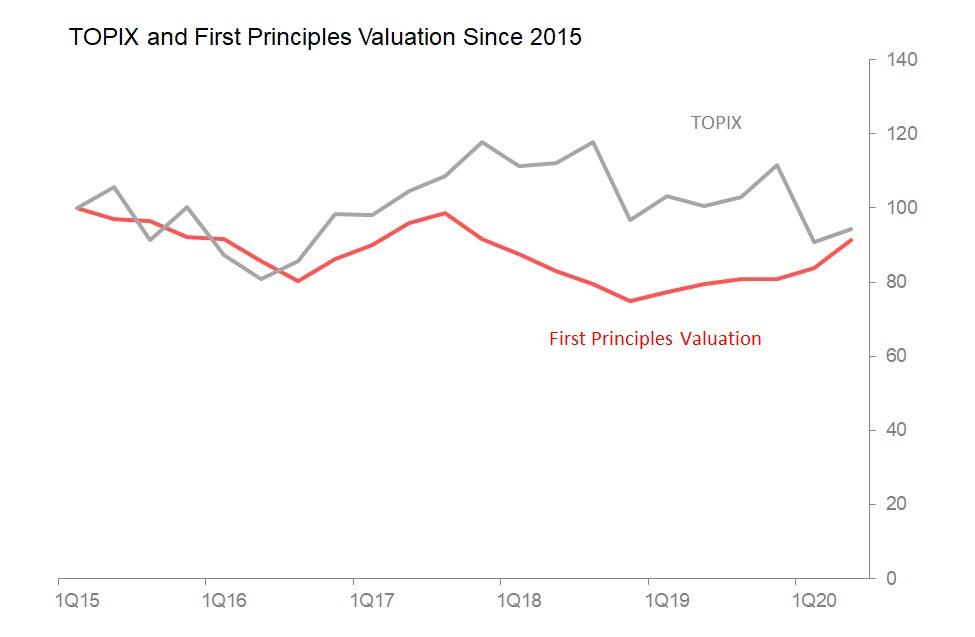

The second thing which is strange is that whilst this overvaluation is dramatic, in the years between 2004-2012 and subsequently, the first principles valuation had done a reasonably good job in assessing fair valuation. It is also the case that since around 2015 to the present day, the fluctuations in TOPIX have also cohered reasonably well with fluctuations in the first principles valuation.

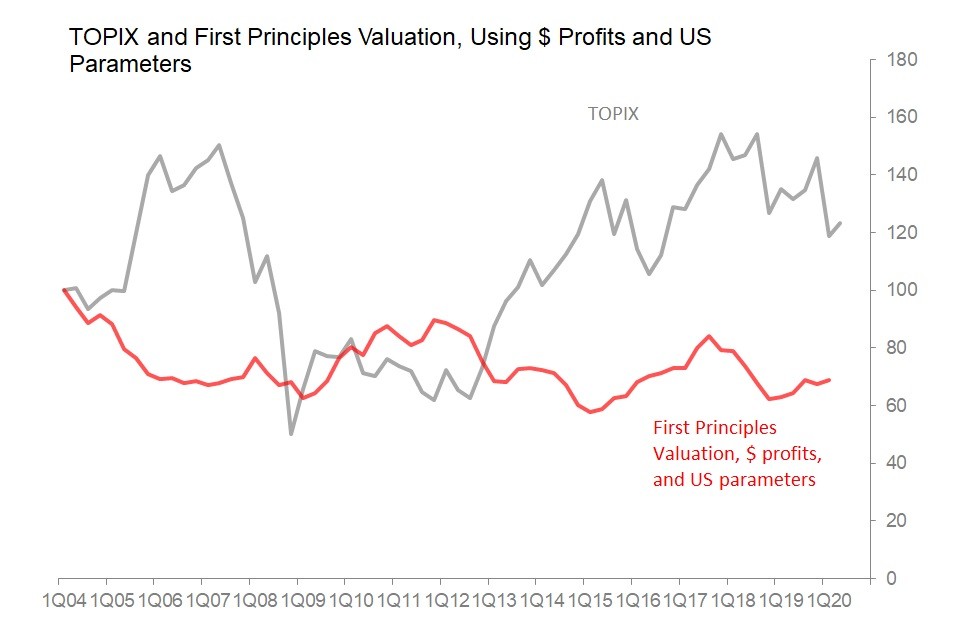

Whilst it seemed intuitively acceptable to view the FTSE 100 index as more of a global index, rather than purely local index, one can't say the same for TOPIX. The expectation that I could apply US-derived parameters to this market, and restate earnings in dollars, seems somewhat arbitrary. If so, it would seem to break the first of my rules for this project - that the method 'ought to make sense'. When tried, it also breaks my second rule - it absolutely does not work, and at first glance does a worse job than the original attempt, offering no insight into the volatile dynamics of 2004 - 2012, no significant improvement on the 2015-2020 results, and no rebuttal of the enduring and dramatic overvaluation since then. In short, it fails.

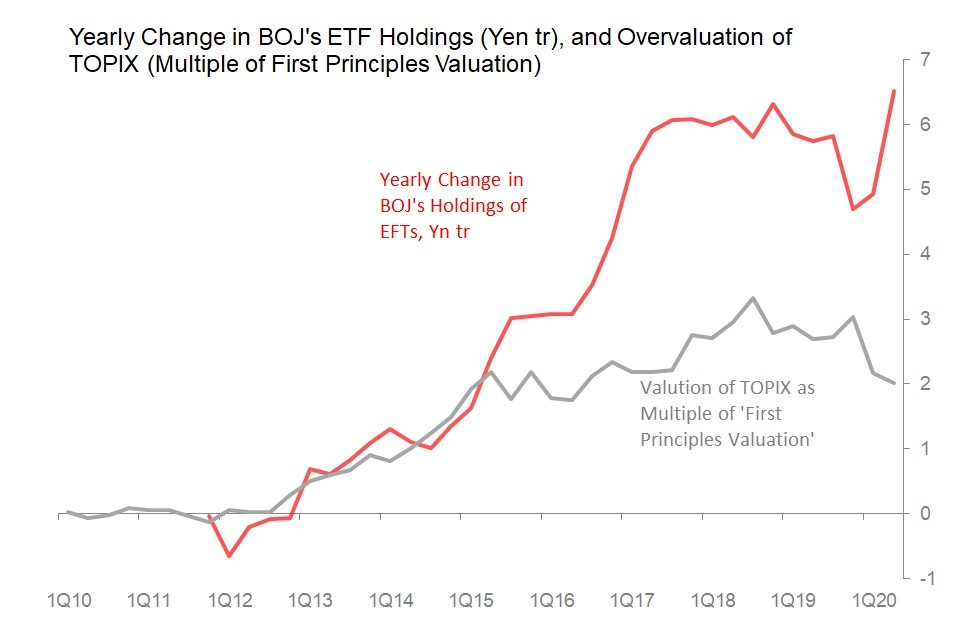

There remains a rather simple explanation: the model suggests the market is severely overvalued, and maybe the model has it right. After all, since late 2010 Bank of Japan has explicitly been in the business of supporting Japanese market indexes by through its purchases of ETFs. BOJ's holdings are now very substantial, with its latest balance sheet showing a holding of Yn33.62tr, with holdings rising by approximately Yn6tr a year since 2016.

Certainly, the period of dramatic and sustained overvaluation of TOPIX has coincided with Bank of Japan's buying - buying specifically aimed at supporting the market and encouraging private sector investors.

I dislike charts deploying more than a single axis, because they are too easy to use for nefarious purposes. Here then, is an alternative, showing the year-on-year nominal change in BOJ's ETF holdings, and the relative overvaluation of TOPIX.