Mar 08•4 min read

Conservative Corporate Japan Knows How to Crisis

Japan's MOF's huge quarterly survey of private sector balance sheets and p&ls found corporate Japan in 4Q exiting the extraordinary circumstances of 2020 in surprisingly good shape. The combination of historically conservative balance sheet management, operational discipline and some helpful terms-of-trade tailwinds allowed corporate Japan to exit with ROE and ROA levels almost at 2019 levels, despite carrying a massive build-up of cash on the balance sheet.

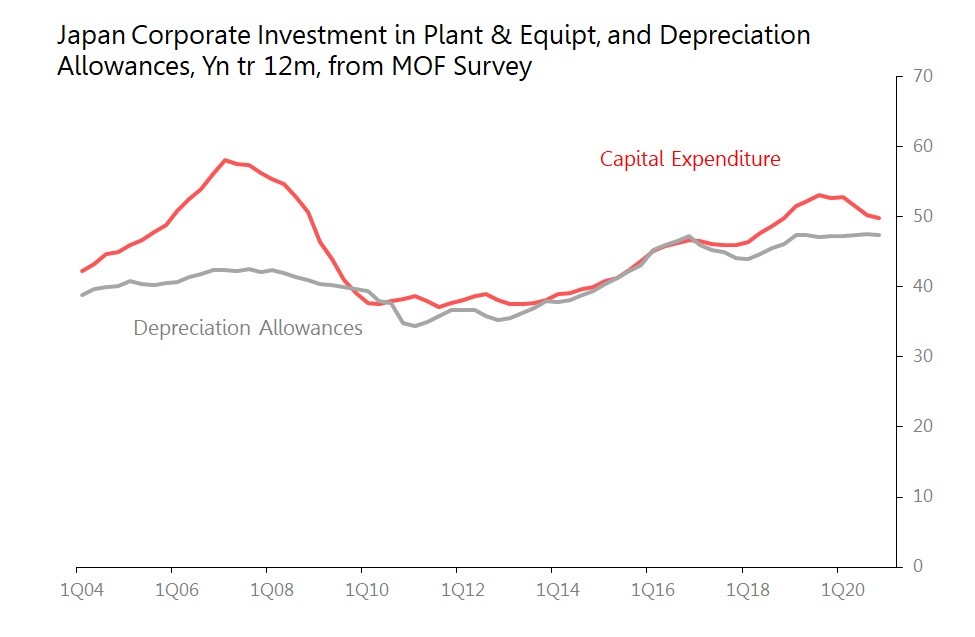

One result is seen in the continued willingness to keep investing at levels above the depreciation allowances, with the 4.3% yoy fall in 4Q capex disguising the fact that a 2.3% qoq rise was exactly in line with historic seasonal trends. Over 2020 as a whole, Japan's capex was equivalent to 170% of cashflow, and 105% of depreciation allowances.

It was, of course, a dreadfully challenging year. Sales fell 4.5% yoy in 4Q, which was the sixth successive quarterly yoy contraction, but operating profits fell only 2% yoy, although that was the seventh successive quarterly yoy fall. Although it is not correct to see Japan as purely an export-led economy, it is worth noting that Japan's export prices also fell 1.7% yoy in 4Q.

As the result suggests, there was some improvement in margins: in fact, operating margins rose to 4.38% in 4Q from 2.83% in 3Q and, perhaps more surprising 4.27% in 4Q19. The improvement in margins was almost equally shared by a 0.8pp qoq fall in cost of goods sold/sales and a 0.7pp qoq fall in Sales and General Admin(S&GA)/sales ratio.

The margin gain won in the fall in the cost of goods sold is a function of the improvement in the terms of trade Japan saw during the pandemic: although the big terms of trade gains were made in during the height of the pandemic in 2Q20, during 4Q they were still up 8.8% yoy, and this improvement continued to benefit the cost of goods sold ratio.

By contrast, the 0.7pps fall in the S&GA/sales fall was won through active management, with the burden being shared between:

personnel expenses (down 0.4pps qoq as a percentage of sales); and

ad min & directors' expenses (down 0.3pps qoq as a percentage of sales).

Total staff numbers fell 1.6% yoy in 4Q, but for the 12m to December, sales per employee fell 7.1% yoy whilst total expenses per employee fell only 1.4%. This has depressed the sales/expenses per employee ratio at 7.39x. This is the lowest since the nadir of 2009, and is 1.8SDs below the post-2008 average of 7.80x. We should certainly expect continued pressure on both employment and wages as firms attempt to resuscitate this ratio.

The improvement in margins was almost enough to rescue overall returns on equity and assets. Annualized return on assets improved 1.3pps to 3.4% in 4Q which was down only 0.1pp from 4Q19. Return on equity was similarly improved, rising 3.3pps qoq to an annualized 8.3%, which was only 0.1pp below what was achieved in 4Q19.

What makes this more remarkable was that this was achieved even as the unavoidable fall in sales depressed asset turns (sales/assets) to a record low of 0.74x for 2020 as a whole. However, even here, there was something of rescue shown in 4Q, when sales rose 7.4% qoq whilst total assets rose 3.5%.

The impact of the fall in asset turns was itself muted by a rise in financial leverage (assets/shareholders' equity). For the year, total assets rose 2.4% yoy whilst shareholders' equity fell 0.9%. In net debt/equity terms, leverage rose to 2.48x in 4Q, compared with 2.40x in 4Q19.

As for balance sheet management, the main feature is the dramatic build-up of cash on hand,. This rose no less than 15.3% yoy in 2020, continuing to rise through to the end of the year. Cash now accounts for a record 13.3% of the entire balance sheet - that's the highest since 1990 - and a record 2.21 months of sales. Holding so much cash on the balance sheet depressed Japan's ROE by 2.8pps for 2020 as a whole..

Still, this combination of an improved terms of trade, surprisingly responsive management and decent balance sheet management means corporate Japan exited 2020 in surprisingly good shape. And something of that can be seen in 4Q's capital spending, which rose 2.3% qoq, almost exactly in line with what historically we expect in 4Q, and cut the yoy fall to only 4.3% yoy. This was modest overall, and was equivalent to 170% of cashflow and 105% of depreciation allowances.