Aug 04•5 min read

Stockmarket Index Valuation from First Principles - Part 1

Stockmarket valuations: there are two related questions:

How should a stockmarket be valued?

How is a stockmarket valued?

It is natural to expect that these two questions resolve down to the same question: how do you value stockmarkets? In fact, however, the 'traditional' Capital Asset Pricing Model* only pretends to have solved the first question because, it is said, it can solve the second. If so, the method can only be contingently useful.

Worse, if it cannot or does not actually explain current valuations, then its claim to be the way a stockmarket should be valued is nullified by default. Analysts have spent decades trying to make the market fit the theory in real time. Wasted effort.

Worse yet: currently the world's major central banks have overtly targetted those 10yr bond yields usually seen as the 'risk free rate' and have expanded their holdings in them so greatly that no-one can plausibly claim that the yields are set by the market. Rather, the prices are the result of central bank policy buying masquerading as a natural demand resulting from savings/investment decisions. Consequently, there is no reason to believe that these represent a 'risk free rate' in the first place.

Our traditional methods and assumptions about stockmarket valuations lie in tatters. It is time to develop a new approach.

The following is an attempt to construct a valuation methodology from first principles.

1. Underlying principle: an investment keeps its value if it maintains its place in the economy in which it is domiciled. If it is unable to maintain its value relative to the economy, we should see it as currently over-valued. If it is going to raise its value relative to the economy, we should see it as currently undervalued. Fair valuation, then, is the value at which it simply maintains its place in the economy.

2. As a first-step, then, we should start by discounting profits at a rate which is related to the long term nominal growth of the economy. We should not necessarily expect that rate to be unchanged over time, since the long-term nominal growth rate itself will fluctuate. Valuations should fluctuate accordingly.

3. In addition, we have to expect to be compensated for the risk to valuation at any one time raised by the volatility of the economy, which will have an impact on the value of the asset relative to that economy. This can be seen as equivalent to the 'risk premium' requirement of the usual valuation models. In this case, however, that risk premium is related directly to the volatility of nominal economic growth, in other words, to the standard deviation of the long term growth rate.

4. Taking 10 years as the 'long term', we can therefore suggest that the first-principles discount rate will be the 10yr moving average nominal GDP growth rate + the 10yr moving standard deviation of that rate. By extension, the appropriate Price/Earnings Ratio will be the inverse of that rate.

5. To what should the PER be applied? Again, from first principles, we should apply it to the profits of the entire economy, not the aggregated announced profits of the companies listed. Why? Essentially because stockmarket announced profits are subject to endless accounting manipulation, often done precisely to disguise or 'smooth' the current situation. And secondly, because the indexes themselves are quintessentially examples of selection bias. At any one time, then, the profits of the listed companies will necessarily be unrepresentative of the broader economy. As an alternative, I use the Kalecki profits calculations generated via quarterly national accounts, which express corporate profits as net investment plus the result of changes in savings/dissavings from rest of the economy (ie, from households, from governments, and from the rest of the world's spending/saving transactions with the economy).

This seems to me a reasonable approach from first-principles - a stockmarket index will be properly constituted and trading at fair value if it mirrors the profits of the economy discounted at a rate which at which the underlying assets maintain their position within the host economy.

This seems to me to provide a plausible answer the first question: 'How should a stockmarket be valued.'

(Nevertheless, it will likely be rejected by two types of economic fundamentalists. Those embracing a neo-classical doctrine will reject the Kaleckian approach to profits, since Solow-type production functions pretend that profits/GDP and compensation/GDP ratios are basically unchanging. Those embracing a neo-Keynesian and/or Sraffan doctrine will, conversely see no virtue (or point) in the entire discounting methodology in the first place.)

What about the second: is this actually how stockmarkets are valued?

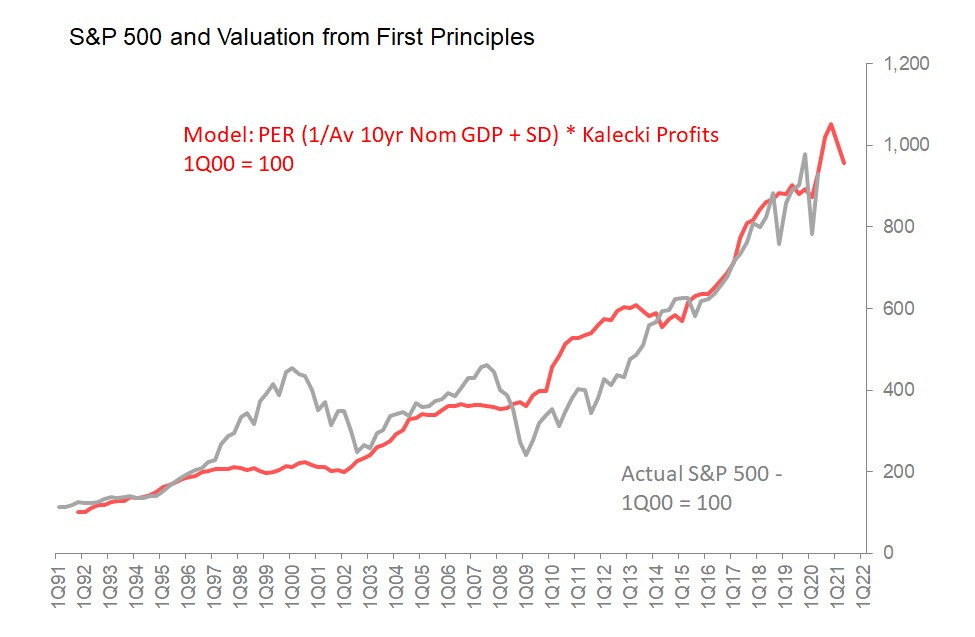

For the US S&P 500, which is arguably the most important and central stockmarket in the world, and the one which often sets the climate for other global stockmarkets, the answer is, surprisingly, 'yes'. The following compares the quarterly changes in the 12m Kalecki profits for the US on a PER set by the average 10yr nominal GDP growth rate + standard deviation of that rate, and what actually happened to the S&P, over the last 29 years (since 1991). There are periods of considerable overvaluation and also stretches of undervaluation, but overall, the levels of the S&P change much as the changes in this first-principles valuation method would expect. In this chart, the valuation model is also advanced four quarters, suggesting its role as a leading rather than lagging indicator.

Even though the periods of over/undervaluation are extended so much that it does not generate short or medium term trading strategies, I think this is nevertheless a profoundly encouraging start. Strategically, if will surely help to know if the market you are invested in is fundamentaly overvalued, undervalued, or trading around fair value.

Part 2 will run this valuation method on other major stockmarkets and discuss the results.

* Capital Asset Pricing Model (CAPM) involves pricing an asset, or a market, through discounting to expected future profits at a discount rate based on a 'risk free rate' and 'an equity risk premium'