Apr 23•5 min read

Covid Side-Effect: Data-Blindness

The pandemic has left us blinded to current economic circumstances, with unprecedented data-volatility acting as a smothering blanket under which any number of possible realities and outcomes can be imagined.

This unregistered ignorance by itself means financial markets are already functioning in a world of more risk than its participants realize.

We can expect no significant improvement in the ability to judge what is really happening until July/August at the earliest, and for some very large economies, not even then. And that's without factoring in any scenarios involving a possible 'second wave' of global infection.

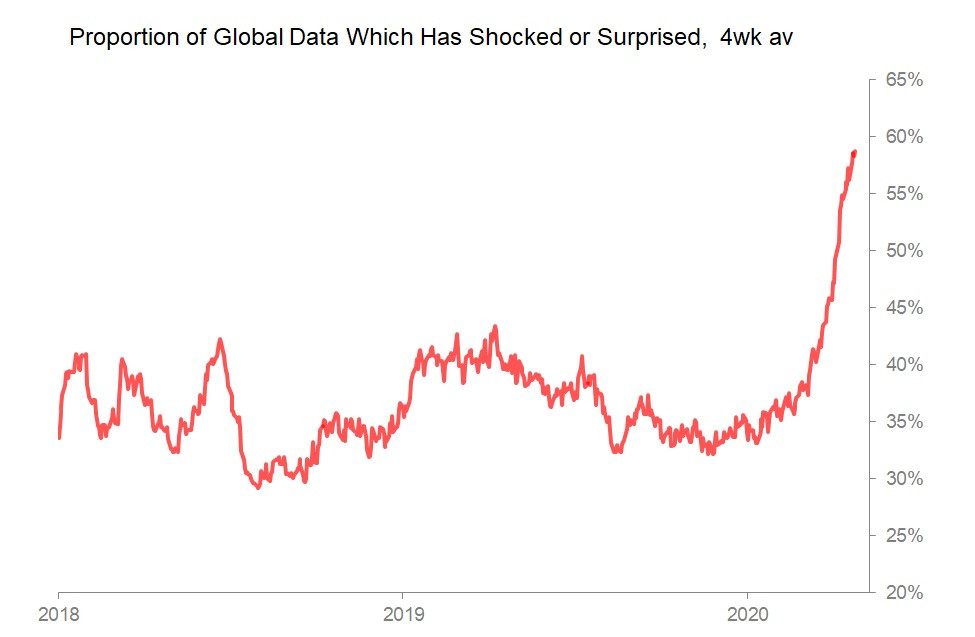

This sudden data-blindess shows up in the work I do tracking about 500 different data-points each month, recording those which land more than a standard deviation away from where consensus or trend thinks they 'should'. During the last month, the proportion of that data which has defied even short-term forecasting efforts has risen to just under 60%. There is no precedent for this lack of short-term visibility. The financial/economic world genuinely doesn't know what is going on right now, and doesn't guess right. How much less can we forecast the future?

Do not expect things to improve significantly any time soon - data-blindness is a side-effect of the pandemic we have to get used to.

Consider just Asia. There are many things making it extremely difficult to judge from Asia's experience how we can expect the world's economic data to play out. But the first problem is also the most radical: Covid-19 began and ended its surges at different times in different economies. Some economies thought they had dodged it, only to undergo the surge later (Singapore, Japan), when conventional wisdom (and currently available economic data) had mistakenly given them also the equivalent of a free pass.

Perhaps the most important thing to realize right at the start is that although Covid-19 first burst out in China and seems to have been most successfully suppressed there, throughout most of the rest of Asia, this pandemic really only got going in mid-March, and for some major Asian economies is currently still only in its early stages. In other words, except for China, Asia was not particularly early into this pandemic, and whilst for most the peak came only in early April, some are just now stuck in the phase where cases and deaths are surging. It will be months yet before we can imagine Asia's economic data beginning to return to 'normal'.

For China we may, just may, be getting some idea by mid-to -late May. For most of the others, we will have to wait until July/August before we can really begin to judge the 'post-bounce' damage or recovery.

And here's the bad news: the Asian economies still facing the surge phase, with no sign yet in a peak of new cases, or current infected tallies are: Japan, Indonesia, India, Singapore and, possibly, Thailand. At this stage, all I can say is that we may be recovering some data visibility by 3Q20.

Here's how Asia's experience of Covid-19 develops, using data from : https://epidemic-stats.com/coronavirus

China: Start of surge in cases 24th Jan acknowledged; obviously slowing sharply by mid-Feb. Peak number infected - 17th Feb, negligible by end-March. Data 'bounce' in March earliest; data back to normal April earliest; data released May earliest.

S Korea: start of surge in cases - 23rd Feb. Slowdown obvious by mid-March, and peak current infected: 12th March. Data 'bounce' April earliest; data back to normal May earliest; data released June earliest.

Malaysia: start of surge 15th March: Slowdown gradually emerging from around 17th April, with peak infected 5th April

Australia: Surge started 17th March, slowdown emerging 8th April, with peak infected 4th April. Data 'bounce' May earliest; data back to normal June earliest; data released August earliest.

Taiwan: Start of surge 17th-March, with slowdown obvious by 8th April, and with peak infected 6th April. Data 'bounce' May earliest; data back to normal June earliest; data released July earliest.

Hong Kong: Start of surge 19th March, with slowdown obvious by 10th April, and peak infected 7th April. Data 'bounce' May earliest; data back to normal June earliest; data released August earliest.

Indonesia: Start of surge 19th March, with no slowdown yet, and no peak infected yet. No data 'bounce' or normalization dateable.

Thailand: Start of surge 21st March, with slowdown emerging gradually and not definitively in 2nd week April. Peak infected, 9th April. Data 'bounce' May earliest; data back to normal June earliest; data released August earliest.

Japan: Start of surge 29th March. No slowdown yet, and no peak infected yet. No data 'bounce' or normalization dateable.

India: Start of surge 1st April. No slowdown yet, and no peak infected yet.No data 'bounce' or normalization dateable.

Singapore: Start of surge 9th April. No slowdown or peak yet. No data 'bounce' or normalization dateable.