Feb 12•3 min read

Coldwater Slow Model Update - UK 4Q20

Valuation from the Coldwater Slow Model's first principles suggests that:

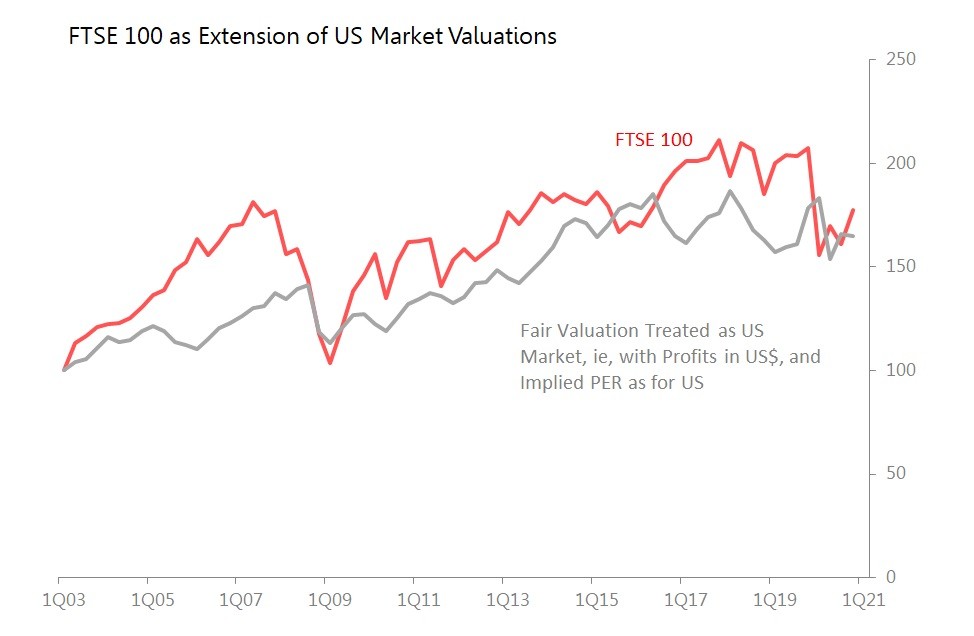

The FTSE 100 continues to be approximately fairly valued when considered as an extension of US market valuations.

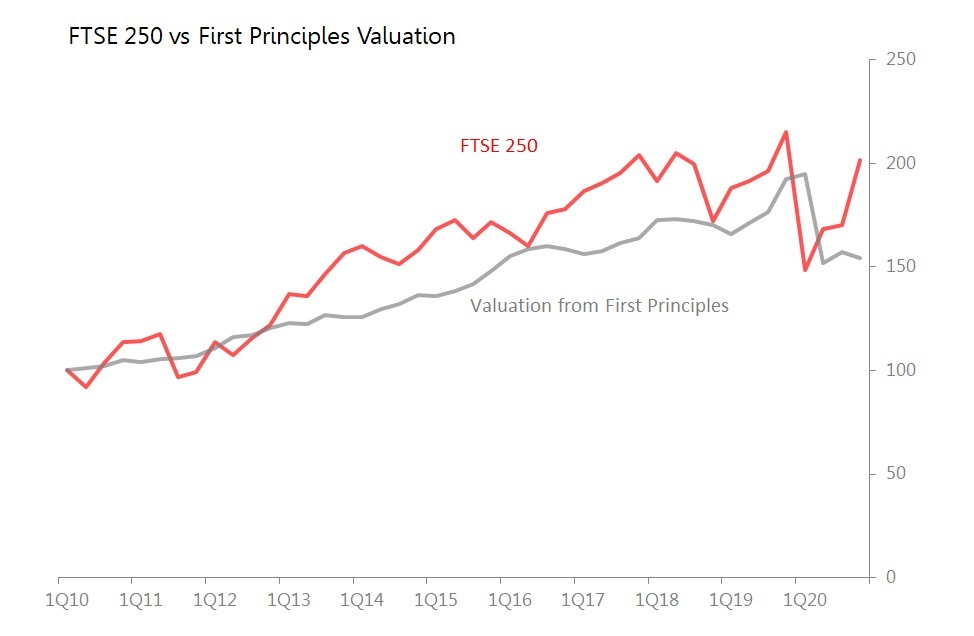

The FTSE 250 is now the most over-valued against fair value as it has been for at least the last decade.

Slow Model Valuations

The Coldwater Slow Model valuation has as its starting point two axioms:

First, that at fair valuation of an asset, such as a stockmarket index, will ensure that it maintains its position relative to the rest of the economy. Hence, the multiple applied to profits will be determined by the long-term nominal growth rate of the economy, with a premium added to take account of the volatility of the economic growth.

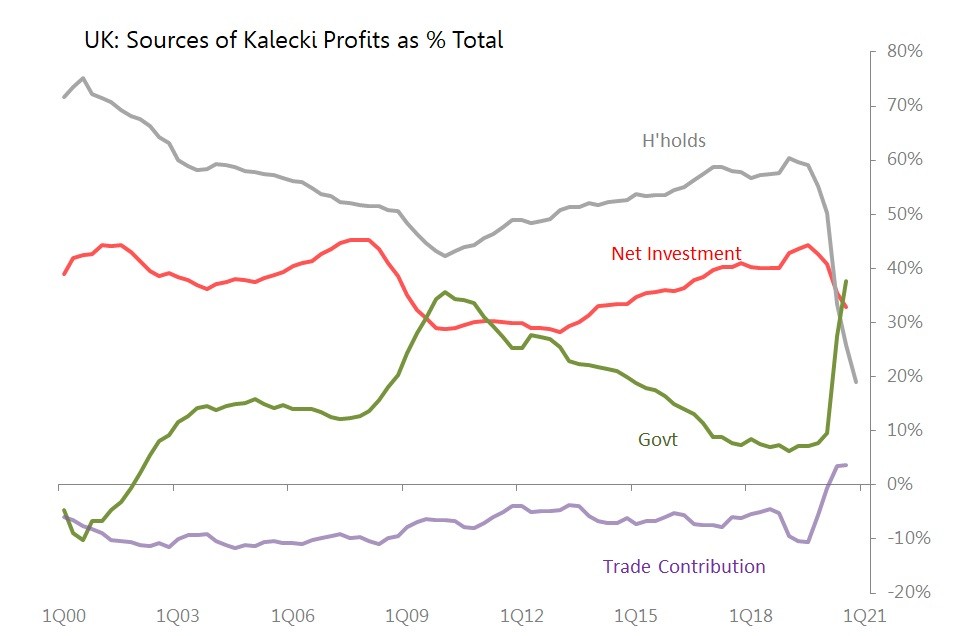

Second, that the profits which this multiple is applied to is the profits for the whole economy, rather than the (mutable) stock index constituents. Profits for the economy are calculated/estimated using the Kalecki profits equation, in which profits are 'net business savings' which, by definition must equal net investment plus the savings or dissavings of the other participants in the economy (ie, households, governments, and net exports).

4Q Developments: Multiple and Profits

Historically, and in reflection of the companies it represents, the FTSE 100 performs primarily as an international index, rather than one specifically reflecting British conditions. As a result, its historic valuation is explained best by expressing the UK's Kalecki profits in dollar terms, and applying the multiples of the US economy. Those US multiples inched up to 17.1x in 4Q (vs 17x in 3Q) as the rise in GDP volatility (which would demand a lower multiple) almost completely offset the slowdown in nominal growth (which would demand a higher multiple).

The FTSE 250 is a more authentically British-oriented index, and consequently its historic valuation more closely reflects changes in UK profits and UK implied multiples. As with the US, the fair value multiple inched up in 4Q, to 16.7x (vs 16.5x in 3Q), as the increase in economic volatility offset the overall lower nominal growth rate against which profits are assessed.

As far as Kalecki profits are concerned, 12m profits rose 7.8% yoy in the 12m to Dec 2020, but this was a slowdown of 3% qoq, with the yoy rate falling from 16.4% in 3Q. But the sources of profits remain wildly distorted by the government's response to 2020's pandemic. In fact, government dissaving accounted for no less than 49.7% of Kalecki profits, compared with 33.1% for net investment, 19% for h'hold dissaving and a negative contribution of 1.8% from net exports. Although the overall level of Kalecki profits to GDP remains with the normal range, this extraordinary distortion of sources leaves profits extremely vulnerable in any post-pandemic normalization.