Apr 29•7 min read

Coldwater Slow Model Valuation - US 1Q21

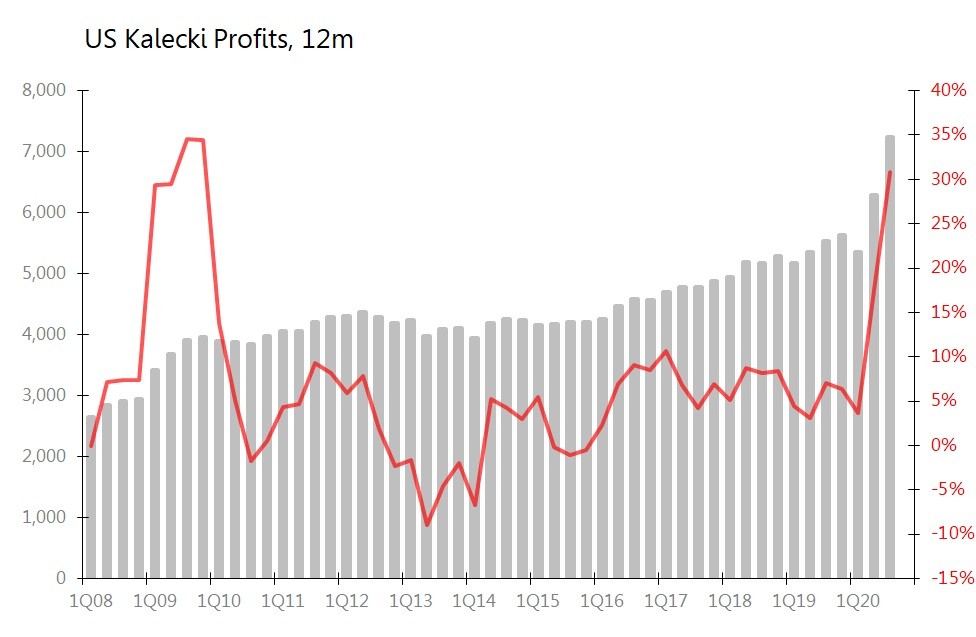

1. The surge in the S&P 500 during 2020 and 1Q21 has been largely supported by a phantom jump in profits revealed in the Kalecki calculations. The surge was neither irrational and has not resulted in an 'irrational' over-pricing.

2. But as far as Kalecki profits are concerned, the 12m to March are as good as its going to get. An erosion in profits will emerge as the year goes on, starting this quarter.

3. Even at current index levels, S&P valuation will become increasingly stretched as the year goes on.

Background and Valuation Technique

The first estimate of 1Q's GDP growth was largely in line with expectations, at an annualized 6.4% in real terms, a result that leaves real GDP 0.4% larger than in 1Q20. In nominal terms, GDP grew by an annualized 10.7%, leaving nominal GDP 2.3% larger than in 1Q20. The breakdown allows us to have a sighting shot at Kalecki profits, and from that, to understand the fundamental valuation situation of the S&P500.

There are two principles guiding the Coldwater Slow model's valuations:

First, the stockmarket valuation should be based on a estimate of the economy's profits, rather than the profits narratives presented by listed companies - since these are not only open to inter-temporal manipulation and/or accounting uncertainties, but are also an exercise in selection bias. Consequently, we use the Kalecki profits calculations as the first basis of valuation.

Second, fair valuation of an asset would, precisely, be one which ensured that the asset maintained its position within the economy as a whole. Consequently, the appropriate profits multiples are a function of the long-term nominal growth of the economy, coupled with a premium to reflect the actual volatility of that long-term growth average. Practically this has the advantage of severing the direct link between asset valuations and 'risk-free' bond yields at a time when manipulating those yields through massive direct intervention has become a major goal for central banks.

Kalecki Profits in the 12m to March 2021

Perversely, the massive expansion of the government deficit in response to the pandemic has been so huge as to offset all other losses to corporate profits during the pandemic in 2020. This strange and lopsided assemblage of profits almost certainly hit its peak in the 12m to March. I calculate that Kalecki profits jumped 59.1% yoy in the 12m to March, rising to 38.6% of GDP - easily a record since 1980. In nominal terms, Kalecki profits rose $3.166tr yoy to $8.521tr.

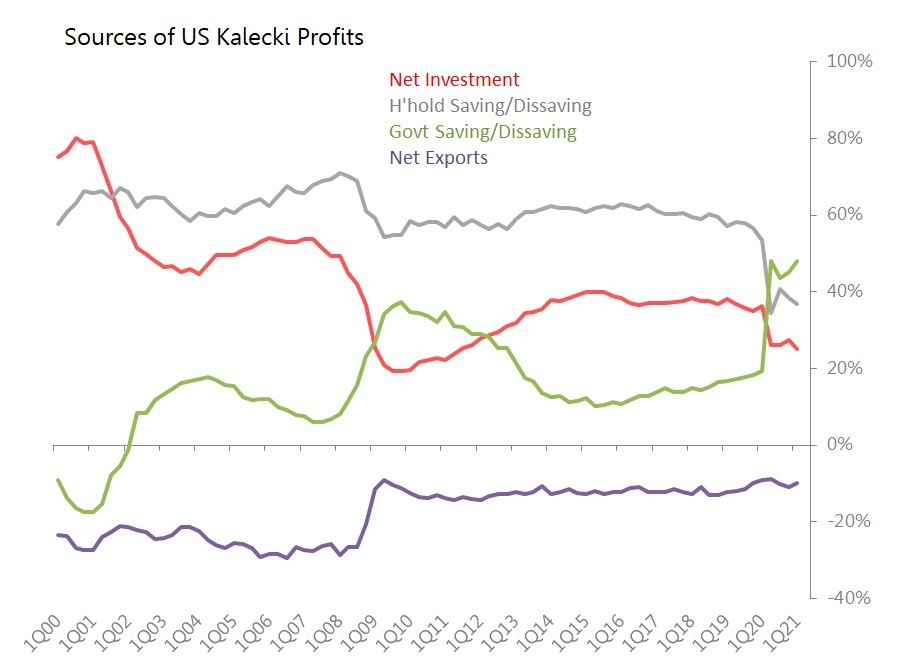

Kalecki's insight is that corporate profits can be seen as corporate savings, which are by definition the sum of net corporate investment, plus changes in savings/dissavings in the household sector (ie, compensation minus consumption), the government sector (ie, taxes minus spending) and net exports (ie exports minus imports).

For the 12m to March, the key contributor to profits was the widening of the fiscal deficit by $3.558tr yoy to $4.095tr.

Net investment, meanwhile, rose only $188.7bn yoy to $2.13tr (a small positive yoy contributor to profits ); net h'hold dissaving widened $272bn to $3.143tr (a slightly larger positive yoy contributor to profits); and the trade deficit widened $353bn yoy to $847bn (a drag on yoy profits largely offsetting the other two positive contributions).

The result is a massive, unprecedented and continuing distortion of profits-sources, which continued to widen throughout 1Q21. Put simply the contribution of the fiscal deficit to corporate profits has never been greater in peacetime, whilst the contribution from net investment and household sector dissaving has rarely been so inconsequential.

The things to bear in mind about this are:

1. Contrary to common sense and media belief, the pandemic has been a bonanza for many businesses. This is seen also by the way S&P earnings are running ahead of expectations.

2. The source of those profits is entirely unfamiliar, and little understood.

3. The sheer strangeness of the construction of profits warns that there are major hazards to profits as 'normalization' begins to take place. Put baldly, it's too good to last.

Multiples and Valuation

Meanwhile, the fair-value multiple to be applied to these profits has also been disturbed by the volatility of GDP generated by the pandemic. The 10yr average nominal GDP growth has slowed to 3.4% from 4% immediately prior to the pandemic. This slowdown suggests an expansion of a fair-value multiple. However, the sharp rise in volatility of that growth rate (to 2.4pps from 0.9pps prior to the pandemic) more than offsets that rise in fair-value multiple. Taken together, the fair-value multiple has fallen to 17.2x from a pre-pandemic peak of 20.4x. As the recovery continues this year, we will see that multiple rise again, slowly.

Applying these valuation techniques since 1990, and comparing their qoq change with qoq changes in the S&P 500, it seems likely that not only should this be a technique which discovers fair pricing value, but has also, in fact, seemed to achieve that on a fairly consistent and regular basis.

Conclusions

This leaves us in a position to draw some conclusions.

First, the S&P's strength during 2020 and 2021 so far has been very largely supported by the strange and largely unwatched jump in Kalecki profits. It is not the pricing of assets which has been speculative and irrational, but rather the belief that the extraordinary expansion of fiscal policy can and will be maintained and extended.

Second, from a profits growth point of view, this is as good as it is going to get. This is because the fiscal deficit, which accounted for a record 48.1% of Kalecki profits in the 12m to March, is very unlikely to continue to expand at anything like the sequential rate recorded in 2020. The fiscal deficit may well continue to expand, but hardly by the $3.166tr seen yoy in the 12m to March. Indeed, 2Q21 is the time when the sharp slowdown in the 'delta' of the fiscal deficit turns sharply negative - in the 12m to June 2021, it seems unlikely the increase in the deficit will be much above $2tr - a cut of 50% in the positive contribution to profits.

This slowdown in the main contributor to profits will be offset to some extent by a recovery in net investment spending and a rise in household sector dissaving. But the largest ever yoy gain in net investment comes in at $300bn (in 1Q12), and the largest-ever yoy expansion of h'hold dissaving weighed in at $367bn (in 4Q90). Both would have to break their previous bests by approximately 50% simply to offset the likely fall in the yoy contribution from the fiscal deficit.

But if they managed this, it would produce a dramatic expansion in domestic demand at a time when much of the world remains mired in pandemic. The result would be an expansion of the trade deficit, and that, of course would be the (negative) balancing item in the Kalecki profits equation.

Forecasts are there to be disproved, so I rarely make them. This one, however, I am prepared to make: during the rest of 2021 Kalecki profits will retreat from the high point achieved in the 12m to March. Which leads on to a third conclusion:

Third, whilst the S&P index levels have been largely supported in the year to March, even at current levels valuations will become increasingly stretched as the year goes on.