Dec 10•2 min read

The Collapse in Japan's Machine Tool Orders

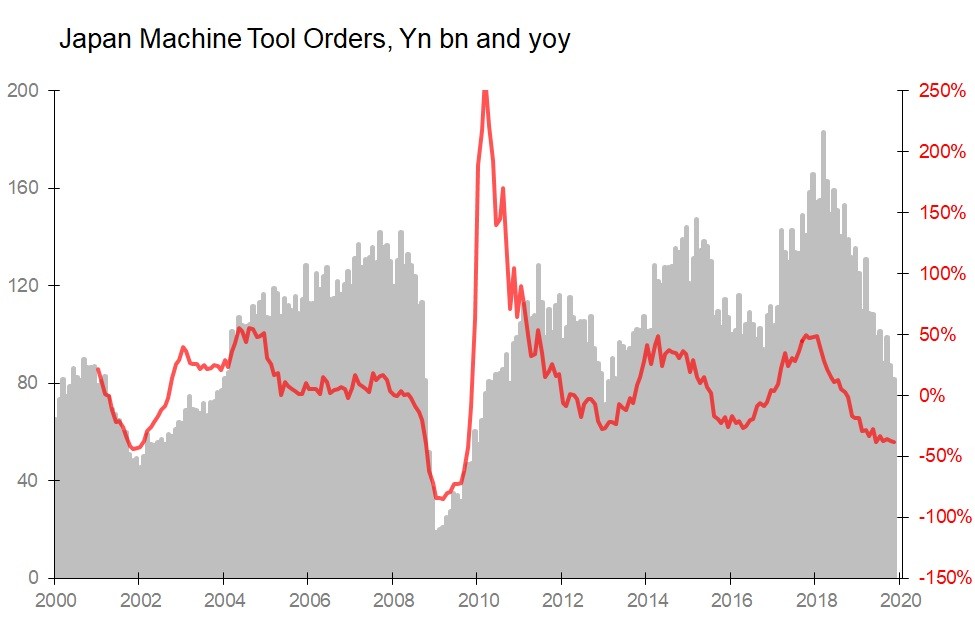

We get used to things: when we learn that orders for Japan's machine tools fell 38% yoy in November, the initial reaction is simply 'so what's new'? After all, these orders have been falling by 30%+ yoy since April, so today's lousy news is nothing new. But it is. November was the month when the base of comparison turns sharply positive for this series: in November 2018, the result was 2SDs below historic seasonal trends, so, factoring that in, it was touch-and-go whether this fall should have moderated into the 20%. Instead, November 2019 produced a result which was 2.1SDs below historic seasonal trends.

Even that doesn't really express how bad this result was. In yen terms, November's Yn 81.7bn orders was the lowest since January 2013, which was itself a bit of a freak result. Rather, orders in the lost Yn 80 are last seen back in 2010. It get's worse: foreign orders fell 32.1% to Yn 50.31bn, which was the lowest since February -2010. But then the yen was trading at 90.2 to the dollar, whilst today it is at 108.8. In dollar terms, export orders are right back at 2009 levels.

Machine tools are literally the cutting edge of the manufacturing investment cycle. Such a collapse in orders tells us either that Japan has lost its position in this market, or that the manufacturing cycle has entered a quite severe recession. The weakness of the yen, coupled with the collapse in Japan's own orders (down 45.5% yoy in November), tells us the latter is more likely than the former.

These are grim tidings. The only nutmeg of consolation I can offer is the possibility that this collapse may be very sector-specific (the auto industry?). After all, my Shocks & Surprises index for the capital goods sector globally, though negative, is now only mildly so, indicating nothing like the pain Japan's machine tool industry is experiencing.