Dec 21•5 min read

2021 Fiscal Fortunes

2020 was dominated by the damage done by the pandemic and the fiscal rescues done to contain it. 2021 will be dominated by the continuation, moderation or reversal of those fiscal measures. Both economic growth and corporate profits are hostage to how and when countries decide to edge back to fiscal normality.

Kalecki profits calculations illustrate how much is at stake. As you know, the Kalecki analysis sees profits as corporate net savings which, as a mathematical identity must be equal to net investment and the savings/dissavings of other sectors (government, household and net exports).

In the 12m to 3Q20, the fiscal deficit accounted for:

55.6% of Japan Kalecki profits;

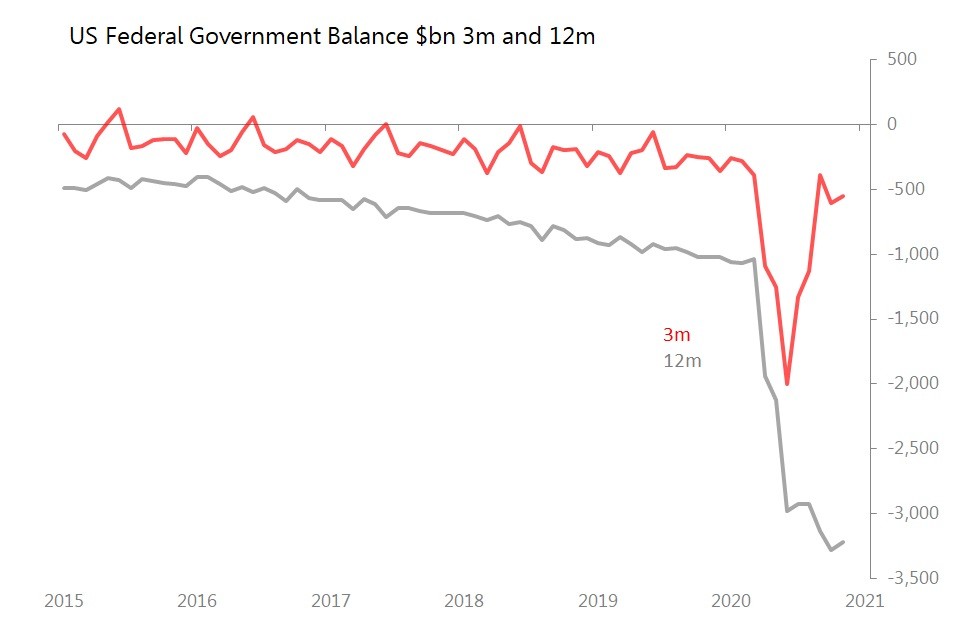

44% of US Kalecki profits;

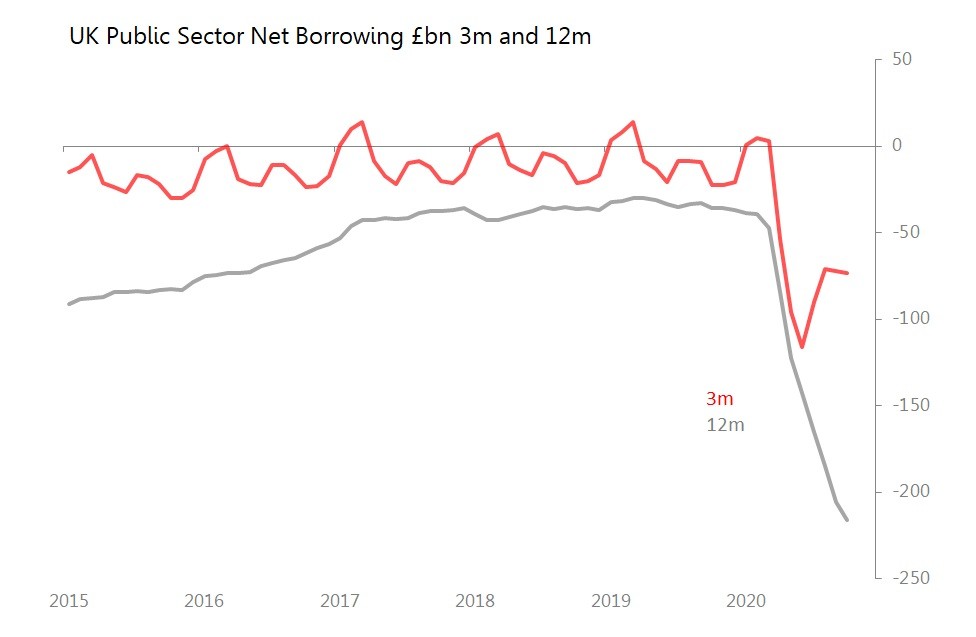

40.3% of UK Kalecki profits;

17.7% of German Kalecki profits.

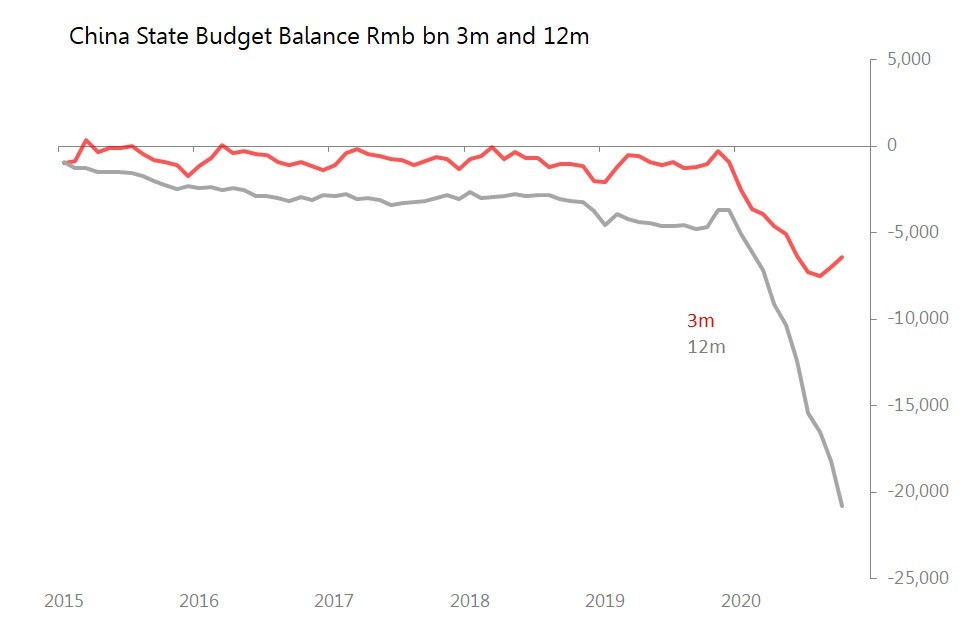

It is not possible to calculate China's Kalecki profits, but we do know that by October, China's 12m fiscal deficit had more than quintupled yoy to Rmb20.8tr (c 5.5% of GDP). As we shall see, the extent of 2020's fiscal blowout in China, relative to its recent history, is among the most extreme of this survey.

So a sighting-shot at which markets are most obviously hostage to fiscal fortune would identify Japan and China as the most vulnerable; the US and UK as only slightly less vulnerable; and Germany as substantially insulated from this risk.

However, we have to set against this the perceived urgency with which governments seek to restore fiscal normality, and that involves a judgement about just how far from recent fiscal experience 2020 has been for each country. This we can illustrate for all these economies, looking at the 12m fiscal deficit for context, and the latest 3m deficit for current trends. As we shall see, whilst the US and UK are both showing early signs of fiscal recovery (bad for Kalecki profits), there are no such signs in China or Japan.

Starting with the US, the 12m deficit stood at $3.218tr in the 12m to November, which was 3.1x the deficit in the same period last year. However, the chart shows that there is already a substantial movement back towards normality, with the 3m deficit now only up only 2.1x, and there are signs that the 12m deficit is stabilizing. The possibility that medium term stabilization towards previous normality may, of course, be dashed by the incoming administration.

Germany's federal government budget deficit, however, seems unlikely to stabilize or normalize any time soon, as the second wave of the pandemic appears to have reversed the limited progress made in 3Q. The Eu72bn deficit recorded in the 12m to October compares with a surplus of Eu6.18bn in the same period last year, and the Eu29.4bn deficit recorded in 3m to October compares with a Eu68mn deficit in the same period last year. The starting position was that Germany's Kalecki profits were substantially less hostage to the fiscal expansion experienced in 2020, and the current second-round of fiscal deterioration suggests that, if anything, a correction of the deficit is unlikely to be a medium-term source of stress for Germany's Kalecki profits.

The swerve in France's budget position during 2020 is less dramatic than Germany's with the Eu52.2bn deficit in the 12m to October only 2.5x that of the same period last year, In the 3m to October, the (highly seasonal) deficit of Eu8.8bn compared with a Eu2.2bn surplus last year. As with Germany, the latest data shows the deficit growing faster again, but only mildly so. Stabilization of the deficit during 2021 seems within reach.

The deterioration in the UK's net public sector borrowing in the 12m to October is the most extreme of the bunch, with the borrowing up 6.1x yoy. The political pressure to return public finances back to recently experienced realms of the responsible ought to be correspondingly intense. But perhaps a start has already been made: in the 3m to October, the borrowing requirement was 'only' 3.3x that of the same period last year.

China's economy is viewed as having made the fastest and most vigorous escape from the pandemic. One of the reasons, however, is that not only is its fiscal stimulus been relatively extreme, it has also been not only maintained, but intensified during the recovery. In the 12m to October, China's Rmb 20.8tr deficit was 4.5x that of the same period last year. More surprising, the 3m deficit of Rmb6.412tr is 5.1x bigger than the same period last year. In other words, the latest data shows not stabilization or reversal, but intensification of the fiscal stimulus.

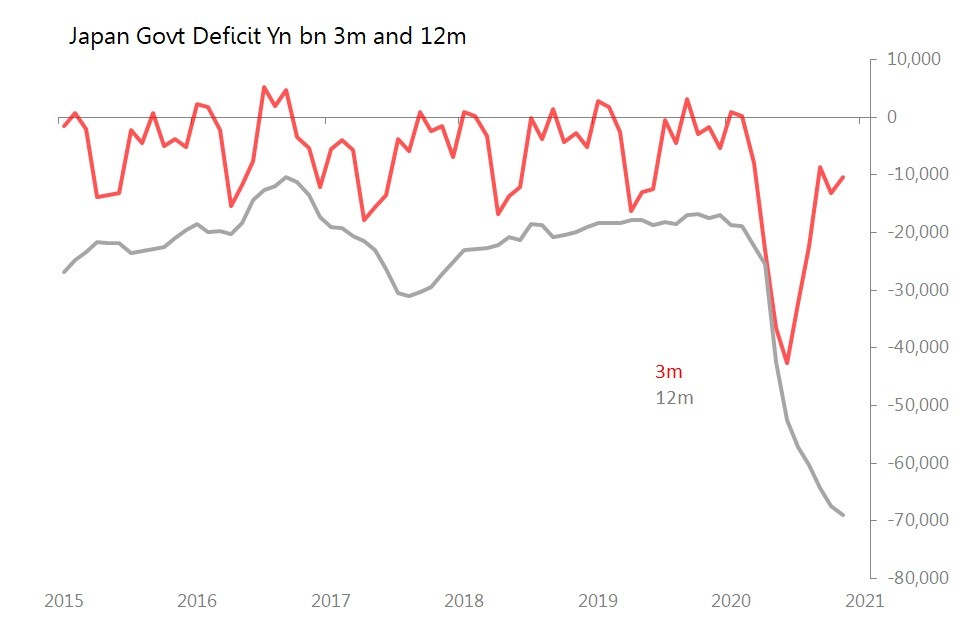

Finally to Japan, which has more experience of dramatic fiscal deficits than most. There the 12m government deficit of Yn68.96tr was 4x that of the same period last year. As with China, the latest data shows no significant move towards moderation, with the Yn 10.4tr deficit some 6.1x the same period last year. There is no evidence yet in either Japan or China that they view the time as right to start budget reconstruction. For both Japan and China, that is good news for profits, although bad news for government debt.