Apr 12•4 min read

A sh*t coin, what a tragedy, it traded like a pump-and-dump, and municipalities engaging in financial fraud, what a shit show!

This is not investment advice. I am not your financial advisor. Do your own due diligence. This is for educational purposes only.

It's always the same chorus with the wave of hysteria and finger pointing when there's blood in the waters for early stage projects.

A sh*t coin, what a tragedy, it traded like a pump-and-dump, and municipalities engaging in financial fraud, what a shit show!

Of course this kind of attitude is partisan and only shows one side of reality.

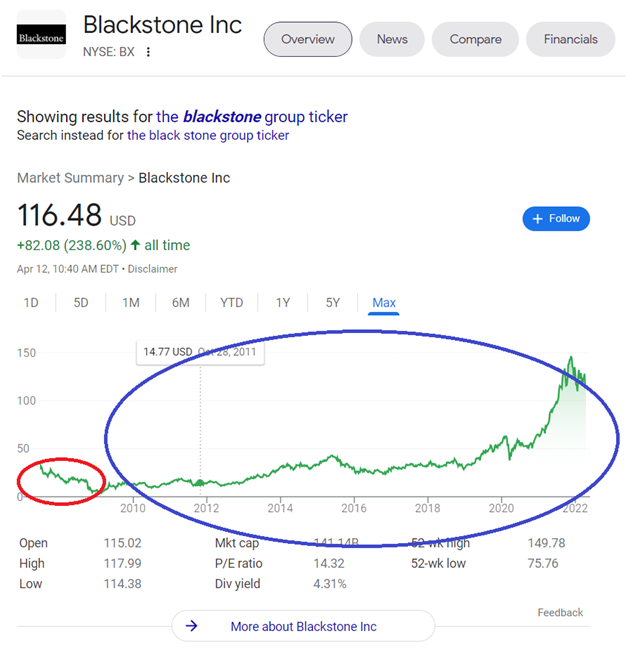

How many IPOs have failed early on upon listing to then recover in tremendous ways? Facebook was one of the biggest flops in History. Pets dot com and the blackstone group are no exception, and the list goes on.

These were early stage companies but utility was already built at orders of magnitude higher than Web 3 projects such as CityCoin, Arkadiko and others.

Comparatively, the latter are literally in infancy and for at least some of these early stage Web 3 protocols, I wouldn't be surprised to see a similar dynamic to play out, especially as developers build utility and stakeholders adopt the paradigm shift that Web 3 represents.

But no, it's easier to look at what doesn’t work and trash talk without having done an once of due diligence.

Although a sophisticated investor, one nay sayer clamors for example that Miami would have been better off by buying Bitcoin. At this point, it would have been better to not take any risk and to NOT innovate, just to avoid the bad press and trolls?

However, Miami not only did not spend a single dollar in Miami coin, but they recently drew $5 million from the city protocol to benefit affordable housing.

What's more, Miami has yielded half a million dollar in Bitcoin and has announced that Miamians who vote will be airdropped a Bitcoin dividend, all of which proceeded from the Miami coin protocol! What better way to educate Miamians about Bitcoin but to airdrop Bitcoin to Miamians who vote?

Well that's the kind of reward that Miami harvests today for risking & for innovating yesterday, and frankly your nay saying attitude is simply ignorant.

Also if you are a Bitcoiner how come you don't understand this:

What better way to onboard people to Bitcoin than to onboard an entire city of people to Bitcoin? I'm paraphrasing Patrick W Stanley in his recent presentation of City coin 2.0 that you can find in the link above.

I would go even further and offer the following thought. Although this is NOT an investment advice, low prices represent an opportunity if invested the right way.

Take for example Arkadiko, the first ever Defi protocol built using smart contract for Bitcoin (Stacks). Well the lower the Total value locked, the higher your returns as you will be capturing a higher share of the pie of $Diko governance rewards when you provide liquidity.

Combine this with the fact that rewards are higher early on in the life cycle of the protocol, and you would probably reconsider your risk reward profile when prices and TVLs are low (Returns = Reward / Total Value Locked).

Again, this is not investment advice, and it's for educational purposes only, but if you're fine with this and want to learn more about Arkadiko, then have a look at my previous article, $Diko catches my eye.

Bottom line, do not listen to the nay sayers who love cherry picking information because finger pointing doesn't accomplish much other than comforting their rather big egos. Most of the times, there is room for due diligence to understand fundamental dynamics at play.

Do your own due diligence, keep your research sharp, have a strategy and execute wisely! And remember that "bear markets make people a lot of money, they just don't know it at the time".