Mar 08•8 min readInscription #464295

Introducing the Bitcoin Frontier Fund

These are the moments Bitcoin was built for.

As I write this, we’re living through the second and third biggest bank failures in US history, with Silicon Valley Bank and Signature Bank. Over the weekend, we watched the fiat-backed stablecoin USDC depeg from $1 to $0.82 due to the contagion. Finally, we’re learning about Operation Choke Point 2.0, a US Government effort to restrict crypto on and off-ramps by discouraging traditional finance institutions from servicing the crypto industry.

This serves as a painful reminder that there are one of two paths in front of us:

A future where all roads in crypto lead back to fiat and end with government control.

A future where all roads lead to Bitcoin and end with Bitcoin.

We believe in the second future.

Today, we’re excited to announce that Stacks Ventures has officially rebranded to the Bitcoin Frontier Fund. While our fund has operated as an independent and strategic for-profit fund in the Stacks ecosystem, we’ve invested in many Bitcoin L1 builders (our fund does not require teams to build on Stacks). Now, the momentum of Ordinals has made it clear the opportunity lies in doubling down on Bitcoin L1.

The Road to a Billion Bitcoin Users

Bitcoin requires no intermediaries to send any amount of money worldwide in minutes. It’s the immunity to the risks of fractional reserve banking that we so desperately need. It cannot be censored; the founder is gone, and no organization is steering it. Proof-of-Work (PoW) is resistant to state attacks and does not reward incumbent network participants. Anyone can run a node, contribute hash power, and participate in open source. There’s no better candidate for a global reserve currency or settlement layer. For all intents and purposes, Bitcoin is the closest thing we have to the economic definition of a public good.

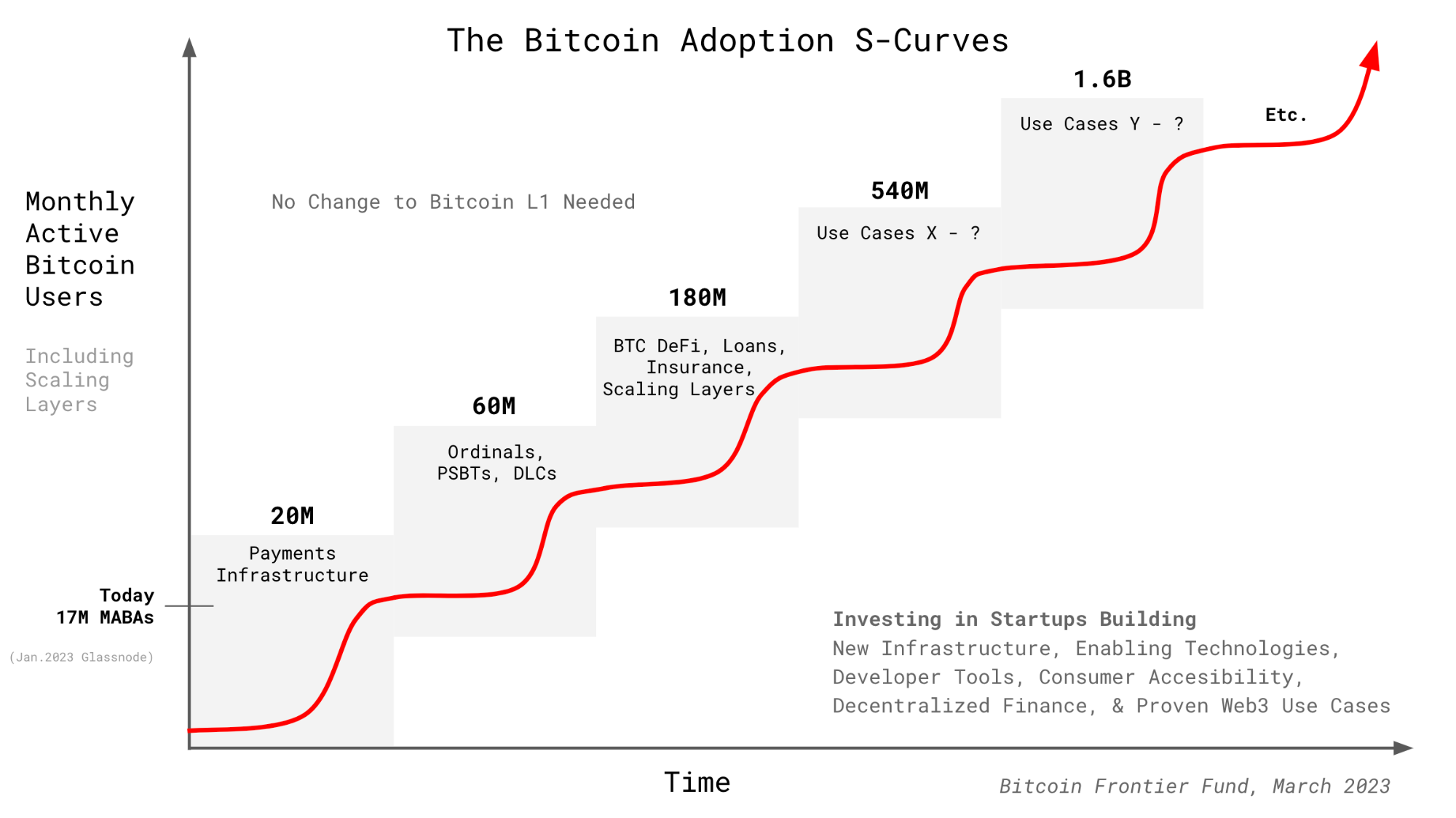

However, as of today, Bitcoin has yet to achieve Product/Market Fit with the mass market. Attempts to simply integrate Bitcoin into point-of-sale as a medium of exchange have not gained widespread adoption. The tools are too difficult, the user experience (UX) is too clunky, and the use cases are too few to pass the toothbrush test, a heuristic coined by the founder of Google stating products used at least twice per day are far more likely to reach mass adoption. On-chain data illustrates this fact: Bitcoin launched in 2009 and had 17 million monthly active addresses as of January 2023, according to Glassnode. To put this in perspective, Twitter started in 2006 and has 450 million monthly active users today.

Admittedly, Bitcoin’s technology is far more disruptive than Twitter's. It’s taken longer for the infrastructure to mature; for developers and investors to wrap their heads around the unique advantages of a technology that on its face is more inefficient and costly than centralized alternatives. It’s also taken time for the concept of programmable smart contracts to show end-user value. The DeFi, NFT, and Web3 experiments that took place from 2020 to 2022 proved the merit of the technology. At the same time, the respective fallout from Terra to FTX showed the limitations and risks of this new paradigm. Now, Bitcoin can learn from the experiments on other chains and incorporate the best parts into Bitcoin and Bitcoin Layers.

Look no further than the Ordinals protocol for proof of innovation from other chains making their way to Bitcoin. Launched on mainnet on January 20th, 2023, it took only 6 weeks for multiple wallets, marketplaces, and tools to launch; and for the ecosystem to exceed $6M in on-chain trading volume, a milestone that took OpenSea 14 months to achieve. While Ordinals is an extremely simple protocol, it nailed the 80/20 of the NFT use case made popular on Ethereum while being a 10x improvement for storing metadata on chain. Today, we’re seeing that innovation trickle over into more use cases: namespaces for decentralized identity, fungible tokens, and even zero-knowledge (zk) rollups. Developers are flocking to Bitcoin to be a part of this new design space.

We’re only scratching the surface of what’s possible on Bitcoin. In addition to Ordinals and Inscriptions, tools like Discreet Log Contracts (DLCs), Partially Signed Bitcoin Transactions (PSBTs), and others represent additional white space for developers to solve problems for end users. Bitcoin represents a blue ocean for builders with near unlimited potential, with Ordinals merely the opening credits to a new era. The road to a billion Bitcoin users will be paved by new infrastructure, enabling technologies, and developer tools that solve everyday problems for end users. This is how Bitcoin ultimately passes the toothbrush test.

The Bitcoin Frontier Fund

Today, we’re rebranding and refocusing because we believe it is in our fund’s best interest, not only from a financial perspective, but also from a strategic one on behalf of our current Limited Partners in the Stacks ecosystem. The greater the usage and developer base of Bitcoin L1, the stronger the need for scalability and expressivity layers like Stacks, Lightning, and even zk-rollups. We make this decision with the support of our existing investors and the aligned intention to broaden our tent, build bridges, and welcome developers and investors in other ecosystems to join us in the mission of accelerating Bitcoin’s adoption through new use cases.

Ultimately, the most successful Bitcoin startups today will build bottoms-up, approaching the base layer with a beginner's mindset and solving problems in new and unorthodox ways. These startups will unlock the largest base of liquidity in the industry and design the most decentralized new protocols, finally deciding the best future scalability paradigms in collaboration with the various ecosystems. Stacks, Lightning, and other layers are not at odds with each other. On the contrary, we are all on the same team fighting to grow Bitcoin adoption against both apathy and the legacy fiat system. Different layers will present different tradeoffs, and different tools will be ideal for different use cases. We intend to invest in the best teams independent of the tools they choose to build with.

As founders and operators ourselves with decades of experience combining Web2 and Web3, our fund specializes in go-to-market and early-stage startup acceleration. We make many small investments in teams as small as two co-founders and as early as a product in beta. We’re often the first check, taking teams through the gauntlet to prepare for and kick off their first funding round. We were among the first investors in companies like DLC Link, GoSats, Xverse, Pay With Moon, Gamma, ALEX, Arkadiko, NeoSwap, Sigle, the Sustainable Bitcoin Protocol, and others. Collectively, we invested in over 50 startups over the past 48 months (the most of any fund in the Bitcoin ecosystem), with the average company raising over $1M within six months of our investment.

As a small investor with a large portfolio, our community and network of 100+ founders and 200+ investors/mentors is one of our biggest value propositions. We go hands on with new portfolio companies for the first few months, but we don’t take boards seats or try to control very much at all. It’s your company and we’re here to support and work through your biggest challenges following your lead. An important point is that we also invest in companies that compete with each other. Inevitably, most early stage startups pivot; friends become frenemies and vice vice versa. An important part of our philosophy is not picking winners or favorites, but simply supporting all great teams who want to work with us. We give the same terms to all companies based on their stage and our partners won’t individually do discretionary investing in our startups (I’ve been on the record making blind follow-on investments based on capital raised). Our partners also won’t agree to be an advisor to one of our startups until 6 months after our Demo Days. This is to prevent negative signaling and keep a level playing field for all portfolio companies to get to the next round.

The mission of our fund is to build the best community for founders and investors building on Bitcoin. With this name change, we broaden our tent and double down on this mission. The road to a billion Bitcoin users will not be paved by us but by the thousands of developers, founders, and investors who believe in growing the Bitcoin ecosystem. We expect to play a small but meaningful role in this, and we couldn’t be more excited to participate in this new era of Bitcoin innovation.