Apr 06•6 min read

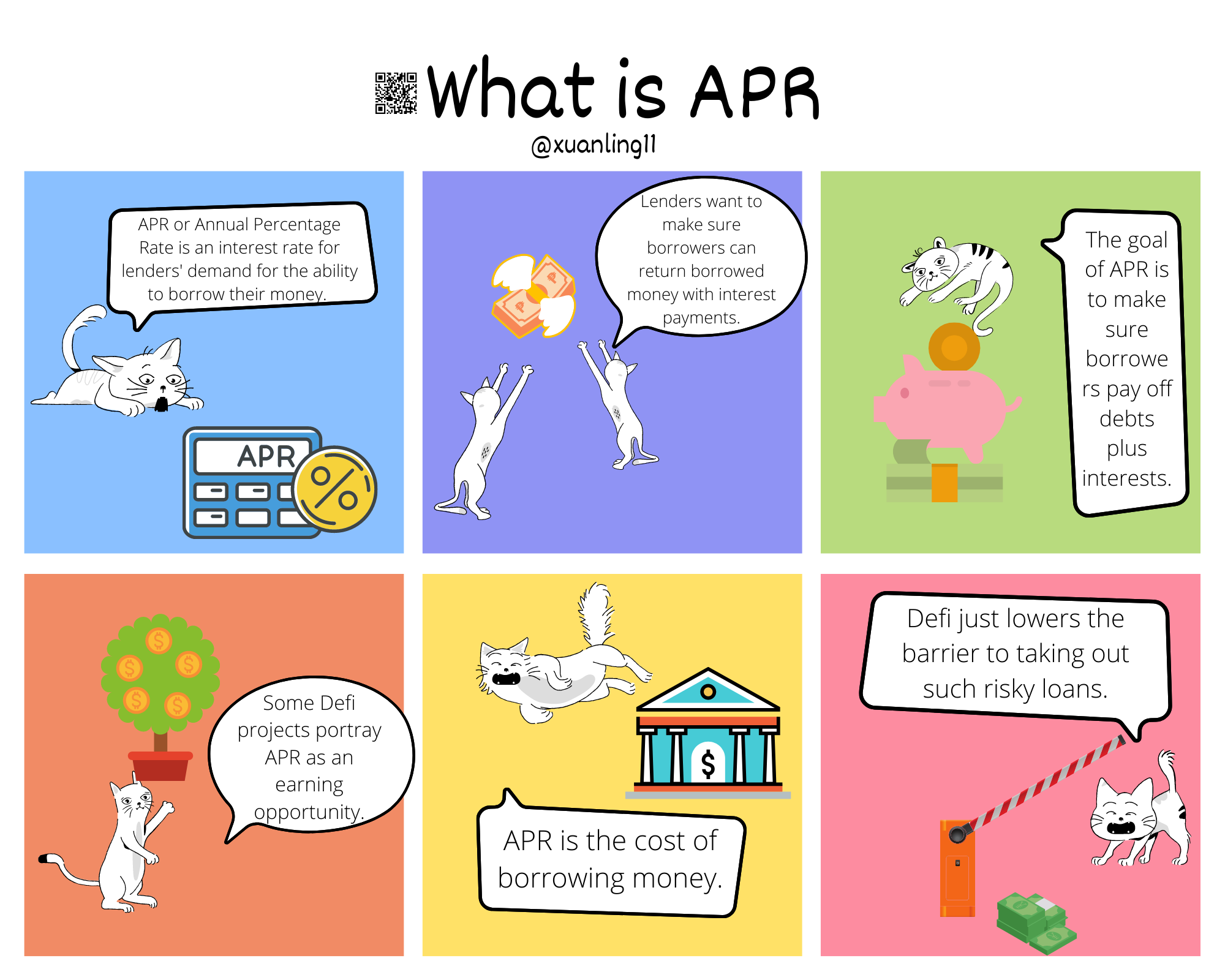

Crypto Comics - What is APR

I shared my thoughts about APR and some confusing financial terms.

Table of Content

Some Takeaway

What is APR

Different Types of APR

What is APY

APR vs. APY

What is the Point of Defi

What is Junk Bond

Tesla

Defi Improvement

In Conclusion

Some Takeaways

Defi or Decentralized Finance is a dreamland. It promised financial freedom to everyone without a financial background. It runs on autopilot until it hits the wall. Worst, they adopted the ever confusing financial jargon to trick you into believing money generators and make you feel happy about earning from nothing. Of course, there are several legit Defi projects that truly can disrupt the financial industry. However, there are more projects that brand themselves as a future but it does not reflect what they promised. Let’s take a look at the terms that actually meant.

What is Interest Rate

The interest rate sounds so innocent. It is the amount a lender charges a borrower for a percentage of the amount loaned. The higher the interest rate, the higher the cost of the loan will be. However, many so-called interest rates are case-by-case-based and a simple interest rate definition is irrelevant whatsoever.

What is APR

APR or Annual Percentage Rate is for lenders' demand for the ability to borrow their money. It is a rate without a compounding effect. The higher the APR, the more cost you pay off. However, the higher the APR, does not reflect the interest rate itself. Let me explain why here.

For example, if you have a 17% APR on your credit card, you don't just pay off 17% of the total borrowed amount of say $2,000 or $340 but with a specific billing cycle of the 25-day result of uneven monthly fees depends on how much you owed and how fast you pay off your debts, you likely to pay more than $340.

So the interest rate of 17% is smaller than 17% APR if you pay off slowly or you can pay off faster to get close to a 17% interest rate!

APR is associated with cost. The less cost, the less painful it is. It encourages spending more money if possible. I saw many articles that described high APR on Defi here and here. Articles are probably mixed up with APY and APR. The fact of high ARP is more costly and risky!

The high APR is actually not a good thing in lending because it discourages the borrowers from taking out more loans!

Different Types of APR

There are many different types of APR case by case. They all work against borrowers and benefit lenders. Because you do not have money to do and try to borrow from others, people who got money have a right to play a game with you (Am I Right?).

APR can be a standard, variable, penalty, cash advance, promotional, and probably many more.

Here are how it plays out:

Standard: it is used under normal circumstances if lenders no worry about how fast they receive money with interest payments

Variable: it is used under interest rate fluctuation circumstances, particularly during or after the recession. Lenders want borrowers to bear the risks of paying uncertain interest rates rather than cost their own expenses.

Penalty: it is used under circumstances where lenders need their money on time or penalizes borrowers with extra interest payments

Cash advance: it is used under circumstances, particularly for lenders who have a handful of cash while borrowers need cash urgently. Of course, APR is high to get full cash.

Promotional: it is used under circumstances where lenders want more pool of borrowers and are offered limited promotional rates.

You can see the pattern is more punishment than offering rewards here.

That is also why banks offer low APR in saving accounts and charged high mortgage APR which does not make any sense when they punish you to lend their money, in the same manner, to punish you to borrow their money. What a business idea!

What is APY

APY or Annual Percentage Yield. When you see yield, you automatically think about investment returns. It is not what you think in the literal sense. Even though APY included a compound interest effect, it does not guarantee such yield!

It is a projectional interest rate that offers you an earning opportunity but it does not guarantee to have such a return.

As you may be aware, many Defi projects offer crazy 100% APY until you get into their pool, and APY suddenly drops to 15% or less. Their argument will be “oh well, the market is bad and yield has been impacted”. The reality is that the Defi pool needs money to run on so that they can offer more opportunities to lend with higher APR to borrowers. However, APR will never be able to catch up with APY in the long term. This makes Defi a very short-sighted project from the financial aspect and turns Defi into a Ponzi Scheme.

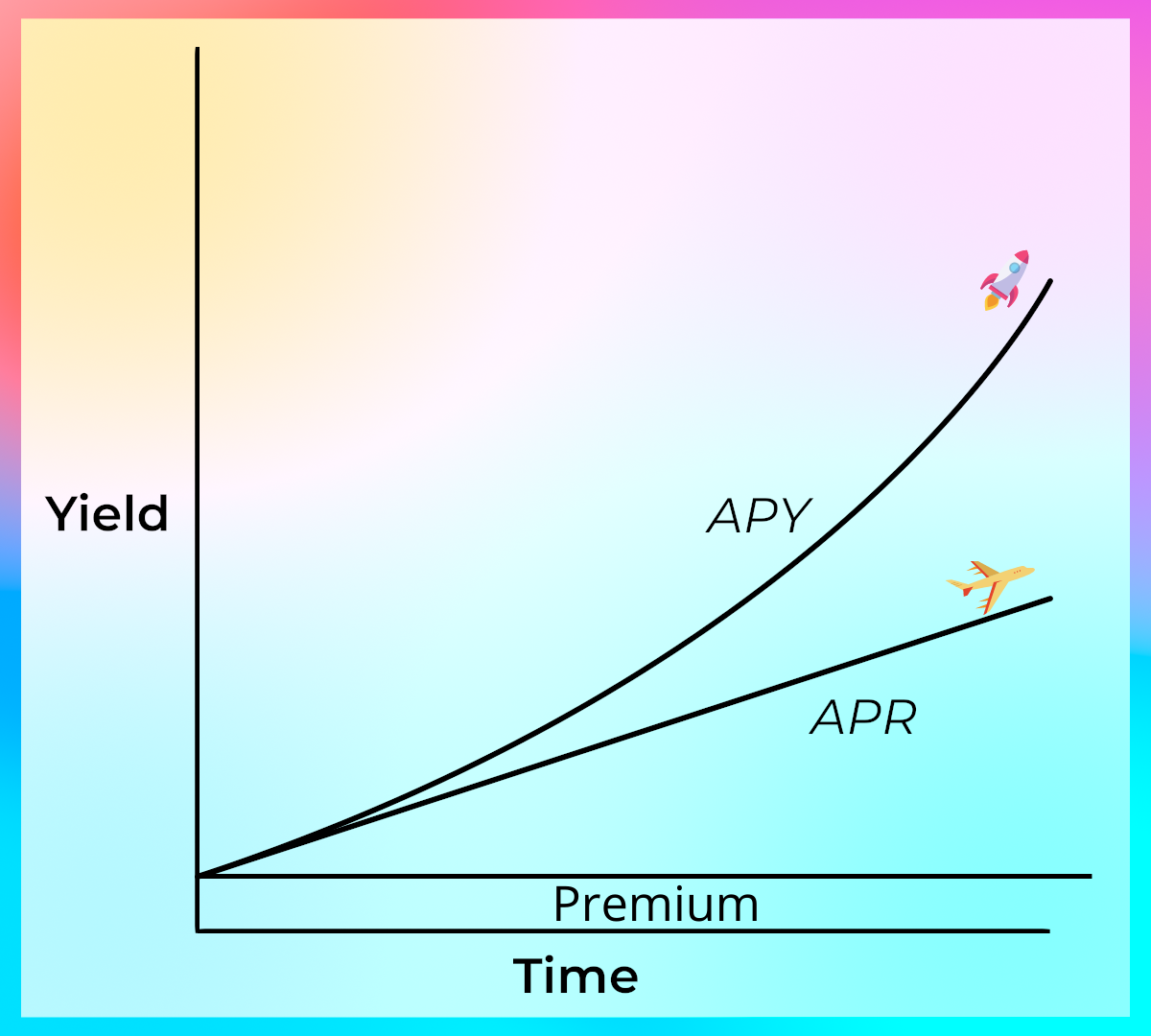

APR vs. APY

Image credit modified from: https://medium.com/kogecoin/apr-apy-in-depth-guide-for-defi-5a3bc8cb51c2

You know how those two terms actually work in Defi. APR is a cost associated with borrowing money with a slower rate of return. APY is to the moon a promise to lure you into a financial scheme that may never pay off such a promise in the long term.

What is the Point of Defi

For retail investors, there are not much more benefits in the long term to offer. You will likely lose money in the long term with Defi products. Probably, in my opinion, staking is the best to offer to retail investors. But what do I know?

For institutional investors, it is a great tool to trade junk bonds!

What is Junk Bond

Junk bonds are those loans or debts that are highly likely, not able to pay off, and rated by credit-rating agencies. In financial terms, those bonds are highly likely to default. They are highly speculative financial instruments that are offered by companies with higher yields to attract more investors and wish to raise more funds to improve their operations.

Tesla

Did you know that Tesla used to raise their money through junk bonds on earlier dates until the company took off so crazy that those people who invested in Tesla junk bonds suddenly made profits crazy which made the stock more speculative than ever? Well, now you know that.

Defi Improvement

One proposal to improve Defi is to tie it into projects or a way to fund projects. It can become a way to raise funds for crypto projects or companies to grow and offer returns to their investors. Olympus DAO is the closed concept of this sort. However, they will not tell you they sell your junk and raise their projects, do they?!

In Conclusion

Ever confusing financial terms trick so many people into something they don't know but promise too well. We should rethink Defi terms to make it more transparent!

Photo by Sam Dan Truong on Unsplash

Resource

https://www.investopedia.com/terms/i/interestrate.asp

https://www.valuepenguin.com/how-credit-card-interest-apr-calculated

https://every.to/almanack/defi-yields

https://newsletter.thedefiant.io/p/-defi-alpha-217-apr-on-eth-usdc-using?s=r

https://www.investopedia.com/terms/a/apy.asp

https://medium.com/kogecoin/apr-apy-in-depth-guide-for-defi-5a3bc8cb51c2

https://yourcryptolibrary.com/defi/what-is-apy-apr-in-defi/

https://www.investopedia.com/terms/j/junkbond.asp

https://www.olympusdao.finance/