Apr 11•6 min read

Modern Economic Nonsense - Inflation and Incentives

The economy is when things happened and needed an explanation but never could fully describe the subject until a new theory over-ruled the old one.

There are 3 types of economic theory.

The one that created a model that never would work. The one that forecasts like weather reports and the one that hasn't been approved until proven to be wrong.

Thanks for wasting your time reading my own theory and hopefully you may learn something.

Here, I shared my research about inflation, incentives, and some theories that I created.

Table of Content

Some Takeaway

Quantity Theory of Money

Bitcoin’s Hard Cap

Incentive vs. Inflation

Speculation vs. Investment

Categories of Assets

Fiat Currency - Inflation Investment

Stocks - Inflation Speculation

DeFi - Inflation Gambling

Gold - Incentive Investment

Cryptocurrency - Incentive Speculation

NFT - Incentive Gambling

Real Estates

In Conclusion

Some Takeaways

https://twitter.com/Ryan57322689/status/1513176439558131715

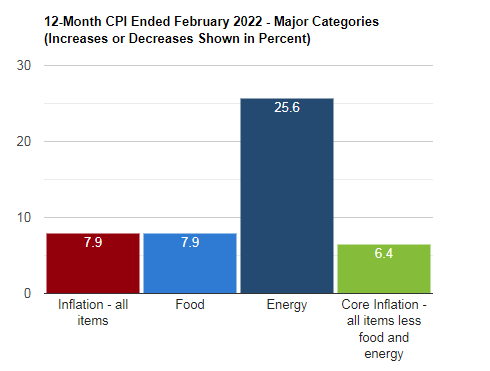

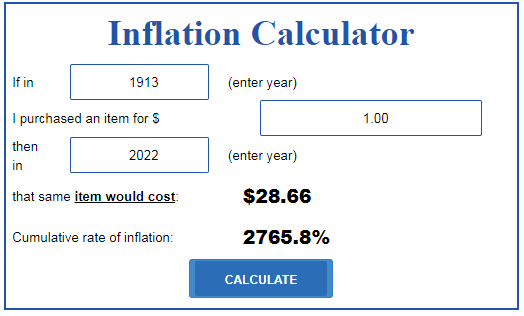

Inflation was a public enemy No.1 in the United States when President Gerald Ford declared it in 1974. Inflation measures how much more expensive a set of goods and services has become over a certain period of time, said a year. The higher the inflation rate, the higher the cost of goods and services. It will reduce your purchasing power over time and make your net worth less than in previous years. Negative inflation or deflation is not good either. Consumers will delay purchases and wait for a cheaper price to buy while earnings will reduce due to deflation.

Image credit: https://www.usinflationcalculator.com/

Therefore, a practicable, stable low inflation rate environment is preferable. At least, that works theory. It is difficult to control in reality which financial bubbles continue creating.

Quantity Theory of Money

The relationship between the money supply and the size of the economy is called the quantity theory of money. When gold was a standard, the recession was created by nations due to over-issuing national gold bank notes which exceeded what nations possessed. Similarly, too many banknotes in the nation which exceed what the national economy would be also created a recession in the modern time.

Bitcoin’s Hard Cap

Everyone who is familiar with Bitcoin would know that the supply of Bitcoin was capped at 21 million. It is solely to prevent even from the quantity theory of money that one or group of few changes the supply to create an inflation or deflation environment. Despite skepticism about Bitcoin at some point removing such a hard cap, Bitcoin creates an alternative economy that is opposite to what the mainstream used to believe.

Incentive vs. Inflation

The incentive is human nature that eventually drives the economy. Inflation is the aftermath of incentive adjustments. The higher the price of goods and services, the lower the incentive people will buy them. And vice versa.

Speculation vs. Investment

Speculation is a name given to a failed investment and investment is the name given to a successful speculation. The distinction between those two is so thin that many people confuse one other. Speculation is an unsuccessful effort to turn a little money into a lot while investment is an effort that successfully prevents a lot of money from becoming a little. While gambling is effortless to successfully turn a little money into a lot.

Statistically speaking:

Speculation: 49% win vs. 51% loss

Investment: 51% win vs. 49% loss

Gambling: 50% win vs. 50% loss

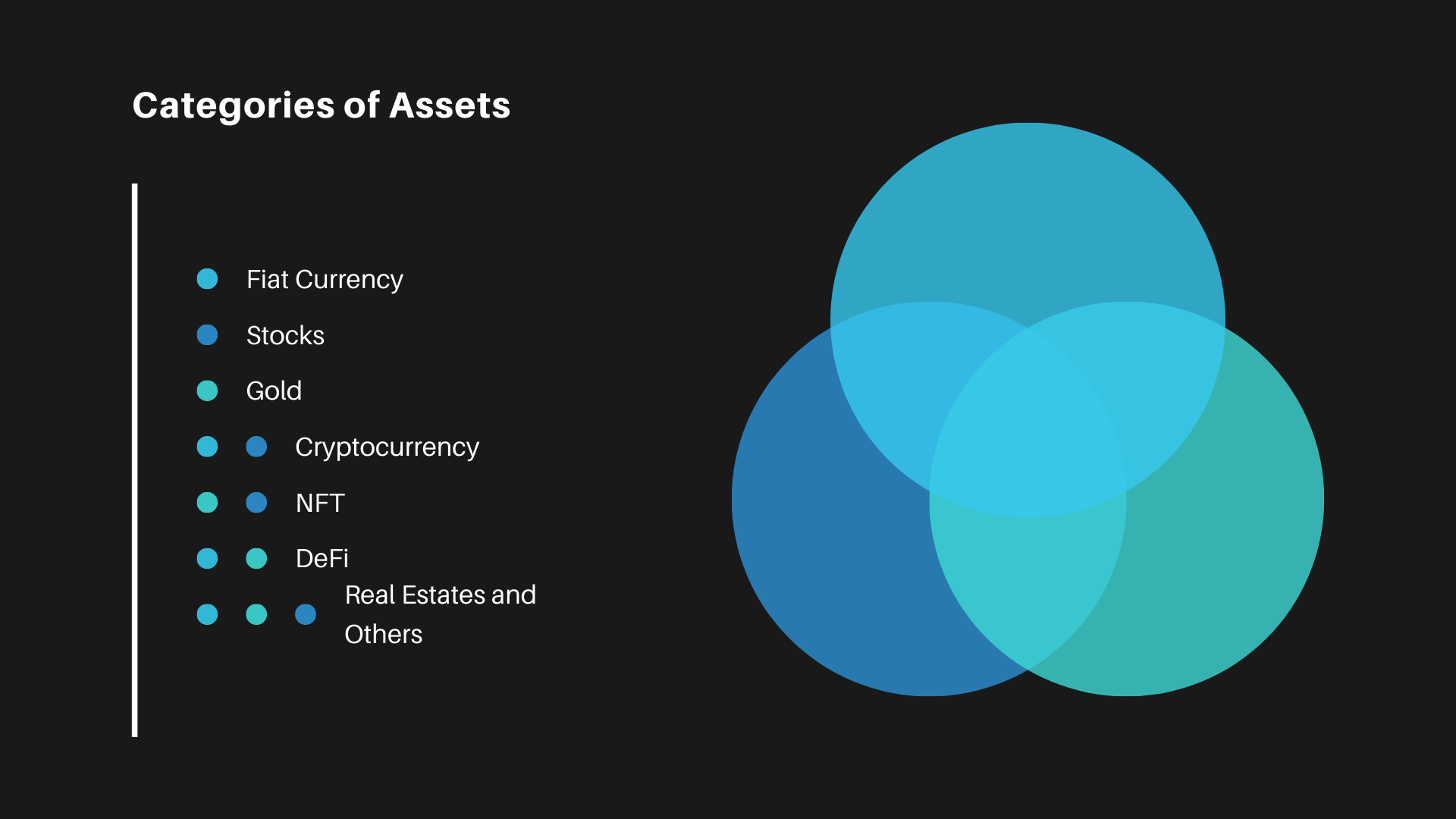

Categories of Assets

We now can separate assets into different categories.

Fiat Currency - Inflation Investment

Look at fiat currency, they are the losers of history with a 2,765.8% cumulative rate of inflation since 1913. But they are the winners of the short-term high inflation rate environment because if you have cash on hand, the interest rate has nothing to do with your ability to purchase at full price.

Stocks - Inflation Speculation

Stocks are speculative investments. Companies that issue stocks gain the most. It is a good way to speculate on the economy through the stock market but they are detached from the economy far far away into their own fairytale. Inflation may impact their valuation until they create another bubble to push away the fear of inflation.

DeFi - Inflation Gambling

Defi or Decentralized Finance is designed purposely to manipulate the supply of financial products called liquidity. It is a gamble to beat inflation in the short term but eaten by the inflation in the long term

Gold - Incentive Investment

Gold is a speculative asset that inflation is embedded in itself. There is limited gold that exists on the earth yet there are so many investments to claim they owned gold. However, it is an investment to bet if the nation will fail its economy in the future and gold will come back as the trading currency at some point which is never the case. Until the failure of the nation occurred. But such gold trading is likely happening at the national level rather than the individual level as an individual carries a risk of losing gold during wartime due to physical safety threats.

Cryptocurrency - Incentive Speculation

The currency's economical environment may indirectly affect the crypto market until they become its own ecosystem. Inflation does not apply to cryptocurrencies in the long term and they are speculation assets that have no previous track records. But it does not make them neglectable to the future economy. Some may question them as gambling. It does portray in the short term because no evidence suggests in the past that cryptocurrencies will prevail. Again, cryptocurrencies did not exist in the past. However, their price drive-by incentives. The higher they go, the more likely people will accumulate more when the price cools down.

NFT - Incentive Gambling

NFT is a gamble to win incentive. It doesn’t matter about their own features and art value itself. It is a speculative asset out of the speculative currency. It does provide incentives through cryptocurrency but it also creates its own narrative which makes gambling like an economic environment. There is no mechanism like cryptocurrencies to present one or few people to dominate the market and manipulate the supply. It falls under the quantity theory of the money trap.

Real Estates and Others

Housing can be any one of the categories depending on how you see it. I avoid discussing it as similar to the oil that makes monopoly games out of such assets. Of course, I will touch on these subjects later in my articles.

In Conclusion

Inflation is good and bad. However, to be distinguished between investment, speculation, and gambling can help you to navigate the future.

Photo by Faye Cornish on Unsplash

Resource

https://www.imf.org/external/pubs/ft/fandd/basics/30-inflation.htm

https://river.com/learn/can-bitcoins-hard-cap-of-21-million-be-changed/