Apr 02•7 min read

Crypto Comics - What is FOMO

I shared my thoughts about FOMO and some interesting facts.

TL;DR

Some Takeaway

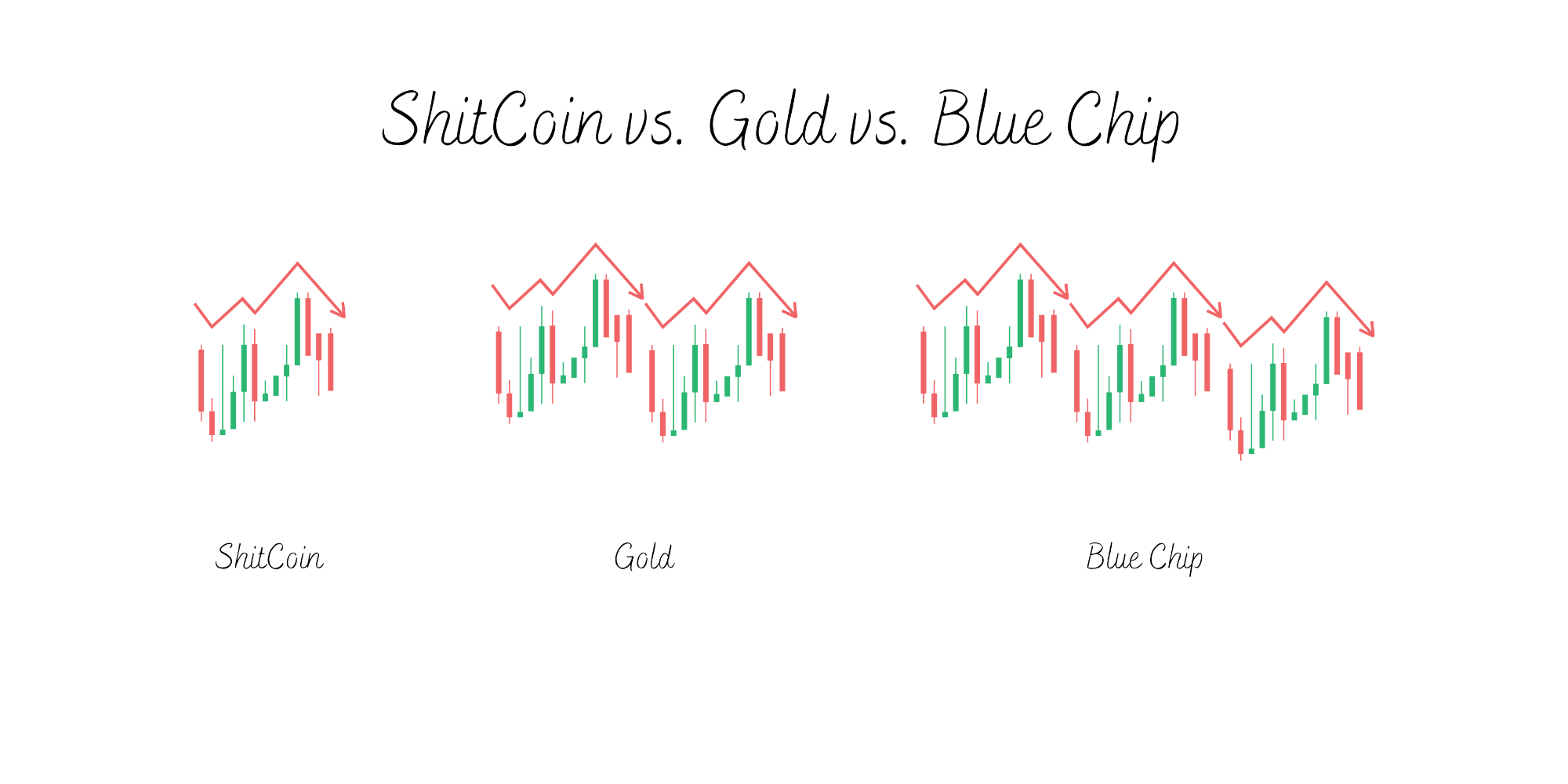

Shitcoin vs Gold vs Blue Chip

History of Bubble

History of FOMO

Pandemic of FOMO

How to Cure FOMO in Crypto

Crypto Castle

Some Takeaway

FOMO or Fear of Missing Out is a type of social anxiety. It probably first got introduced in the year 2000. Patrick McGinnis invented FOMO back in 2003. Contrary to FOBO or Fear of Better Options which drives us to do nothing, FOMO wants to do everything as much as possible.

Shitcoin vs Gold vs Blue Chip

FOMO can be good. Look at the asset price movement. Shitcoin is a shitcoin because it only went up once. Gold went up twice during the 100 years. Blue Chip went up multiple times. So, the opportunity is key for FOMO to join as many as possible.

History of Bubble

An economic bubble refers to overheating asset prices that are unreal in terms of the actual economical worth of the nation. The idea is that “perhaps I can sell to someone with a higher value later”.

17th century - The birth of the bubble: Tulipmania (1634–1637)

The story went with the rare supply of tulips in the Netherlands causing a growing demand ultimately leading to the high market price and then crashing overnight with the national economy going down with it. The story turned out to be fake with less scale than it was described.

18th century - The first financial crisis: The South Sea Bubble (1720)

The stock market was founded in 1711 and the South Sea Company offered an incredible 6% interest to those who bought their stocks. The company hoped to profit from trade with Spain but it turned out to be false. Worst, the company purchased national debt and assumed people would continue purchasing the stock so the company could pay off debt interests. A Ponzi scheme led by King George eventually caused the crash of the bubble and many lost their money.

18th century - The first barrrr crash: The Mississippi Bubble (1720)

John Law was a smart guy, though what if his company took out the power of French taxes and the minting of money power, he could generate wealth forever! Again, people demanded more of his company stocks, and he could exchange that money for purchasing public debts. So he printed cash infinity and the market crashed along with the nation.

19th century - The first fake land scheme: The Island of Poyais (1821-1837)

Gregor MacGregor fabricated a fictional island with abundant resources and paradise land for Scottish settlers to occupy. With fake banknotes, fake newspapers, fake guide books, and fake songs to lure hundreds of people to sail across the ocean to migrate to an unknown island, only one-third survived the adventure.

19th century - The largest speculative bubble: The Railway Mania (1840s)

With the new technology booming at the time, the Bank of England cut rates and caused the stock to be purchased with only a 10% deposit. The railway king George Hudson ran a Ponzi scheme that paid dividends out of company capital without realizing the debts.

20th century - The Great Depression: Black Thursday (1929-1941)

It was a series of financial crises that happened over a period of time stretch of 12 years. It went from a stock market crash in 1929 to a regional banking crisis in 1930 along with an international financial crash through 1933. Then the commercial banking system collapsed and recession in 1937. Then World War II broke out in 1939.

20th century - The Precious Metal Bubble: The Gold and Silver Bubble (1976–1980)

The US Federal Reserve removed gold as their reserve currency triggering the precious metal mispricing and inflating the price.

20th century - The Currency Bubble: The Dollar Index Bubble (1983-1985)

The dollar index was sharply dropped due to precious metal bubbles. Then it deflated with the high value of the dollar which caused the US to enter into stagnation.

20th century - The Asian First Financial Crisis: Japanese asset price bubble (1986–1991)

High dollar value dragged Japan into recession and entered into the Lost Decade.

20th century - The Asian Second Financial Crisis: 1997 Asian financial crisis (1997)

Many Asian countries printed too much money inducing the crisis along with geopolitical changes that Hong Kong returned back to China. The result was that Hong Kong bought every stock possible to prevent the stock market from crashing and eventually they prevented the crisis.

20th century - The First Tech Crisis: The dot-com bubble (1995–2000)

Tech companies’ valuation was out of control until it tanked and triggered the recession.

21st century - The First Global Housing Crisis: United States housing bubble (2002–2006)

Easy money with infinity mortgages that would never be paid off triggered the mortgage-backed securities crisis and brought down the entire world economy.

21st century - The First Pandemic Crisis: COVID-19 Induced Recession (2020–Ongoing)

The global pandemic forced the economy to shut down and disrupted current operations. The government started printing more money (second barrrr) to support the economy which created ripple effects down into the years to come.

The speculative asset was introduced without third-party oversight. A new type of asset class was born. It is too speculative to know what will happen in the future.

All previous bubble has a pattern of central authority or a person claiming how much the asset is worth until it was not. The last bubble operated under decentralized circumstances.

History of FOMO

FOMO is to join everything as much as possible to gain the possibility of success. From the economic bubble in the past, the economy eventually recovered and hit another high. The only question is how to select the one that can recover.

Pandemic of FOMO

However, people tried FOMO wrong as a pandemic spread out. Instead of preventing FOMO, we should turn FOMO into an opportunity to learn something new. Rather than focusing on fear, you have to learn a way to make decisions that chooses what you want and misses out on the rest.

How to Cure FOMO in Crypto

Here are 3 rules you may want to try out:

1. 30% fun

2. 10 years return goal

3. Missing out Next 10 years

30% fun means you only put down your 30% of the cost in speculative assets. Whether it is crypto or NFTs. If you cannot afford it, then forget about it. If you can afford it, only spend up to 30% of your total spending power. Or others may say to keep 70% of your expenses or your cash flow.

10 years return goal means the potential earning from such purchase will be worth 10 years of that money you are missing opportunities to invest in others. If you dare to take a risk on speculative crypto or NFTs that you will not bother to sell for profits within 10 years, you may go ahead to do so.

Missing out on the Next 10 years means that you bear to spend those money and miss opportunities down the road the next 10 years. If you hold one NFT and believe that NFT can beat the rest of the NFT within the next 10 years, you will go ahead to own it. Otherwise, forget about owning it.

Crypto Castle

There is the world’s first Bitcoin addiction clinic in Scotland’s Castle Craig. Of course, I am not suggesting seeking a profession to cure your FOMO. The cryptocurrency addiction clinic existed with many demands in the line. You could addicted to hoarding crypto or NFTs to the extreme and got an addiction similar to drugs or alcohol or gambling.

In Conclusion

FOMO is not that bad. However, to prevent it from becoming a problem, you should be mindful and learn how to give up and accept missing out.

Resource

https://www.bostonmagazine.com/news/2014/07/29/fomo-history/

https://www.gsb.stanford.edu/insights/brief-history-financial-bubbles

https://www.investopedia.com/terms/d/dutch_tulip_bulb_market_bubble.asp

https://www.historic-uk.com/HistoryUK/HistoryofEngland/South-Sea-Bubble/

https://www.britannica.com/event/Mississippi-Bubble

https://www.focus-economics.com/blog/railway-mania-the-largest-speculative-bubble-you-never-heard-of

https://www.federalreservehistory.org/essays/great-depression

https://en.wikipedia.org/wiki/Economic_bubble

https://en.wikipedia.org/wiki/Japanese_asset_price_bubble

https://en.wikipedia.org/wiki/1997_Asian_financial_crisis

https://en.wikipedia.org/wiki/Dot-com_bubble

https://en.wikipedia.org/wiki/United_States_housing_bubble

https://en.wikipedia.org/wiki/COVID-19_recession

https://en.wikipedia.org/wiki/Cryptocurrency_bubble

https://hbr.org/podcast/2019/12/season-3-finale-how-fomo-was-created

https://thehustle.co/04012022-codie-sanchez/

https://funcheaporfree.com/the-70-percent-rule/

https://decrypt.co/81654/inside-crypto-castle-the-worlds-first-bitcoin-addiction-clinic