Oct 14•6 min read

Google’s Partnership With Coinbase

Web3 business is booming.

The recent news about Google partners with Coinbase is an example that the future of Web3 can progress.

https://twitter.com/BTCTN/status/1579993236361433159

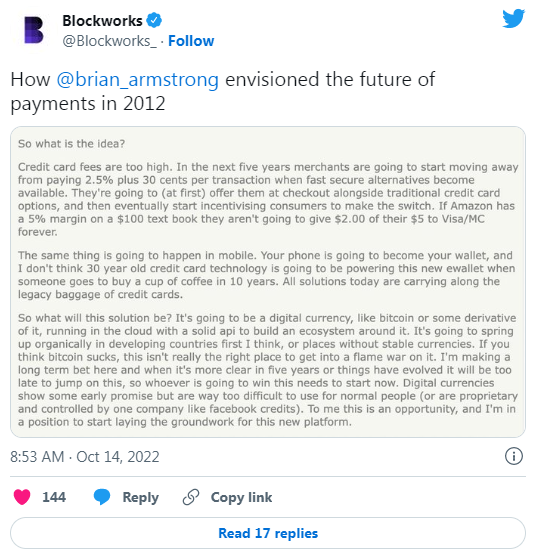

Coinbase CEO Brian Armstrong envisioned the payment system in 2012.

https://twitter.com/Blockworks_/status/1580949830536265729

If the transaction fee can be reduced to a fraction, cryptocurrencies are the way for payment systems.

I always support and believe the crypto payment system is the most route of the future.

The credit card business is the most profitable business in the banking system:

https://twitter.com/alexxubyte/status/1557758639946887170

Because credit card companies control the users' transaction data and mark up the price to end users, which then automatically collect fees from each transaction, but the service they provide is less frequent to the trade.

The difference makes a huge profit out of the "service fee" without needing to provide service as frequently as they would.

To make a cryptocurrency payment system work, you remove the middleman that provides "service" or replaces it with a cheaper method with a higher security protocol like blockchain.

We previously thought that blockchain transaction was cheaper than credit card payment system only because there were fewer users in the cryptosystem. But since 2021, we have experienced an overcrowded blockchain with higher fees that were not sustainable to become a replacement for the credit card system.

So let's explore what makes cryptosystem works.

What Is the Credit Card Payment System?

The e-commerce world has exploded in the last few years, and now many consumers have a digital payment option that’s second to none. In fact, online shoppers now make up more than a quarter of all Americans’ spending power. And thanks to digital disruption, they’re also more likely to seek out new ways to spend their money — including digital payment solutions. In this day and age, consumers are particularly interested in buying stuff they can trust with their financial data. Companies can offer that with a trust score that is based on a company’s track record and product safety. That trust score is sometimes known as a “credit” and it can give consumers a better chance of winning a purchase decision.

How It Works?

Here’s how the e-commerce industry could benefit from the new payment system. A cheaper and faster solution without a border restriction and is accessible to everywhere with any devices that users carry to. Since crypto is apolitical digital currency that using its blockchain as an unique channel to transact payments, it is an ideal candidate to provide alternative solution away to credit card payment system.

Why Are Card Payments Important?

Credit card companies will have to start getting ready for a new, digital payment landscape. In order to keep their business model intact, they’ll have to adapt to the emerging digital payment landscape. Payment card companies will have to live with the increasingly digital payment landscape and start to accept cryptocurrencies as payment channels. That could mean they’ll have to start including such payment channels in their app, as well as begin accepting payments in other alternative payment networks such as Bitcoin and Ethereum.

Ethical requirements for using crypto payments

While the concept of digital payment systems is new, the processes and requirements necessary to set up a modern payment system are quite strict. Credit card providers must follow strict rules on whom they can charge, how much they can charge, and when they can charge it. Credit card providers must keep records of every payment made, including the amount charged, the account number associated with the payment, and all payment confirmations. This includes all payment information, like payment amount, payment method, and payment recipient information. Opposite to credit card providers, crypto requires less invasive data to identify users before transacting payments.

However, regulations may change the privacy requirements, and payment systems may still need users data to grant their usage.

Step-by-step guide on how to use a crypto payment system

1) Identify your payments source. This will help you find out where and how your payments are coming from. For example, your payments could be coming from a credit card, an online service, a mobile app, or a service that’s only available in one language.

2) Set up a short business plan. Your short business plan should outline the nature and what value your business will add to the market. This will help you KPI ( KPIs ) your performance and show a clear path to market for your business.

3) Decide on a payment channel. The payment channel is the channel you’ll use for your payments. Depending on your payment channel, you may decide on a digital wallet, blockchain-based digital wallet, third-party cash deposit outlets, or other channels depending on your needs.

4) Set up payment policies. Payment policies are another important part of your business plan. These will help you define your payment policies, which will help you protect your customers.

Crypto Payment Risks

Crypto payment is irreversible. However, TradFi or Cefi such as Coinbase can resolve this issue.

However, crypto is still very expensive and slow processing payments that requires some knowledge of using such technology.

In the coming years, Web3 will bridge knowledge between users and companies to provide intermediate services that reduce costs on both sides.

Conclusion

It’s important for retailers to keep on top of the new payment landscape and their contractual obligations. That includes complying with the terms and conditions of credit cards, protecting customer data, and making sure there are adequate resources for customers who have new payment methods. That being said, it’s also important for businesses to make sure that they have the necessary manuals and procedures in place to handle new payments. That includes hiring employees dedicated to the new digital payments landscape, as well as compiling and aiming for a clear and concise manual.

Bottom line

The e-commerce world has been largely untouched by the digital payment landscape that has grown up with digital assets and digital payments. That means most businesses remain at a loss to accept new payments methods and know-how. To make matters worse, most credit card providers don’t yet recognize the new digital payment landscape, so there won’t be a standardized way to handle payments in the near future. Meanwhile, most payment channels — including credit cards, debit cards, etc. — are yet to get settled on. That leaves little room for innovation and growth within the e-commerce sector. In particular, as most e-commerce businesses remain at a loss to accept new payments, it’s important for them to get their manual right and make sure their payments are clear and consumer-friendly.