Nov 05•5 min read

This has to be changed

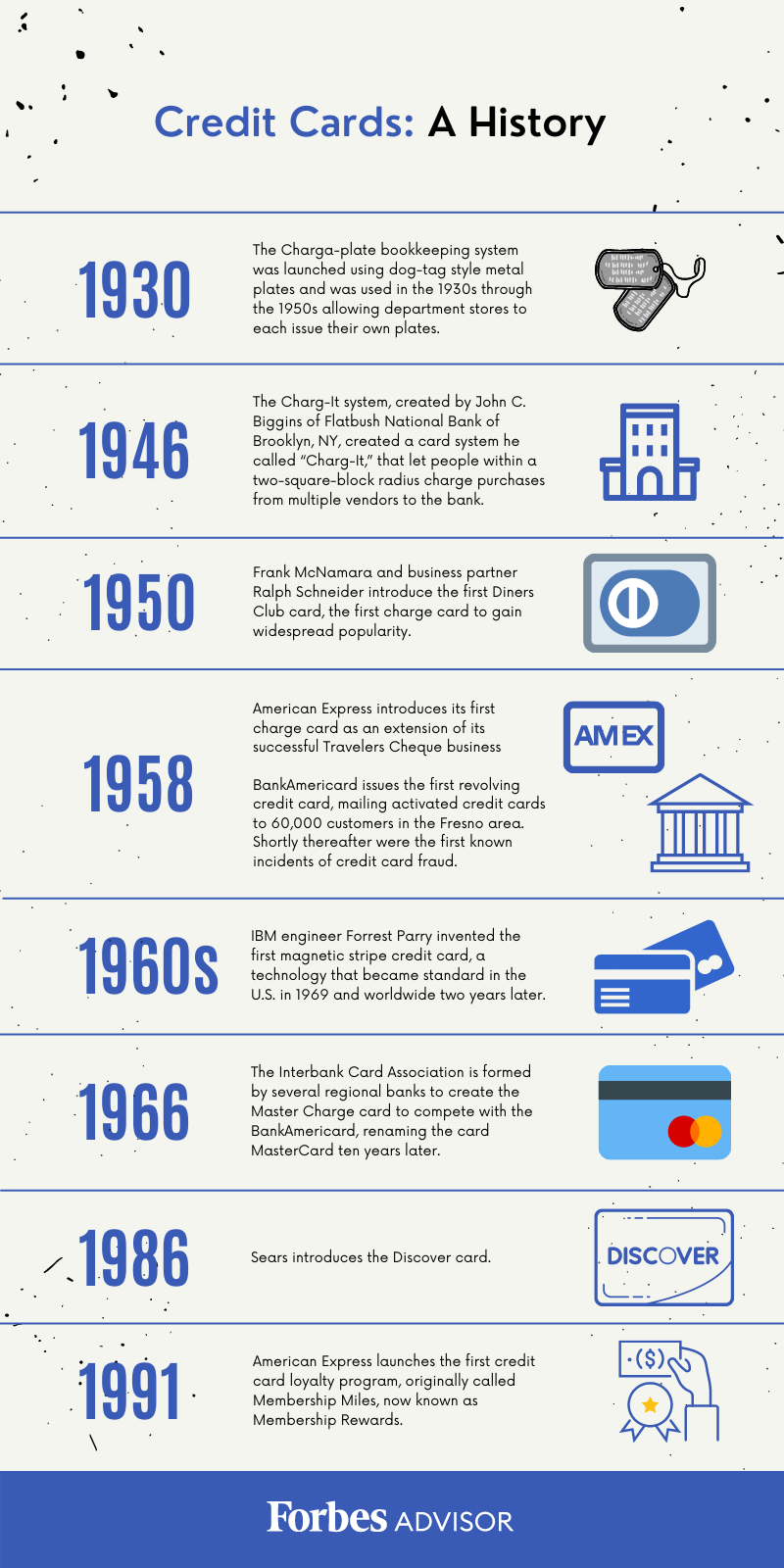

Electronic money transfer has a long history.

The first known electronic money transfer happened in 1871 through the Western Union under telegram technology.

Interestingly, it was charged 3% of transaction fees.

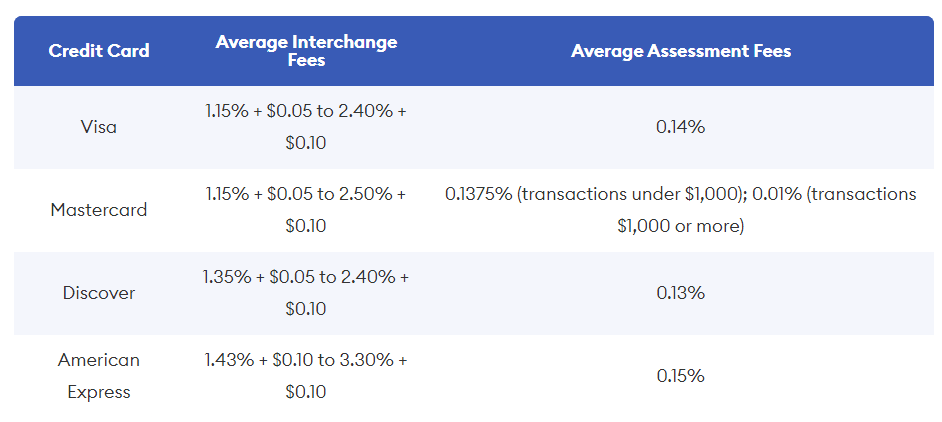

Fast forward around 151 years later, the credit card processing fee is around 1.5% to 3.5%!

https://www.forbes.com/advisor/business/credit-card-processing-fees/

And web2 innovation does not make any significant improvement!

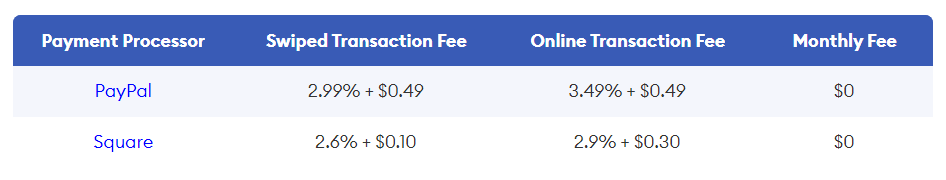

Transaction through online payment services range between 2.5% to 3.5%!

https://www.forbes.com/advisor/business/credit-card-processing-fees/

That makes you wonder why it costs so much even after technological innovation.

https://www.forbes.com/advisor/credit-cards/history-of-credit-cards/

What makes the transaction so costly? And should technology bring down the cost at all?

Crypto fee is fractional of payment processing since there are less intermittency to charge fees from.

For example, Bitcoin has an average transaction per $100 is about $1.45 but Dogecoin is about 0.0025DDoge, which is insignificant.

While there are many ways to save money by using a credit card, the process of applying for one can cost you thousands. It’s important to understand how much it will cost you to use your credit card, so that you can make the best decision for your specific needs. A credit card costs money to create, manage, and use. It doesn’t provide access to special features or services that no other credit card offers. These are all paid for with the account holder’s personal cash balance. The cost of creating and maintaining a credit card is astronomical, so far beyond the reach of most people who want to use a credit card. Thankfully, there are ways around this preventative measure and get the most from your credit card. Read on for more info on how you can cut down on costs by using a credit card.

What is a Credit Card Fee?

A credit card fee is a fee charged when a cardholder uses a credit card. You can charge a fee to your credit card when you go to add a new cardholder or when you make a cash-out or cash-in. You can charge a fee to your credit card when you’re applying for a credit card.

How Much Does a Credit Card Cost?

The cost of a credit card often depends on your credit score, the type of card (debit or credit), and the amount you’ll be spending. Debit cards charge a higher fee, generally 2% of the amount you’re charged per day. Credit cards charge a higher fee, usually 3% of the amount you’re charged per day.

Why Is a Credit Card Fee High?

Credit cards charge a high fee for every payment you make. Some credit cards even charge a late fee when you make a payment that’s more than 30 days past due. Because credit cards charge a high fee for every payment, you have to be extremely careful about how much you’re spending. It’s important to shop around to get the best rates on credit cards. ## How to Avoid Credit Card Fee Purchasing A major credit card issuer has an annual fee, so you have to be careful about how much you’re spending. It’s important to shop around to get the best rates on credit cards. Before you spend a single penny on a credit card, make sure you understand the annual fee. You’re likely to spend more on a credit card than you have in your account, so it’s important to make a plan for how you’re going to get that money back. If you’re really tight on cash, it’s possible to borrow money from an online lending website and get your money back. The loan comes with a provision that your lender won’t let you borrow more than the amount you agreed to pay.

How to Get the Most Out of Your Credit Card

Once you know how much credit card you’ll be using, look into how you can cut down on costs. Here are a few tips to help you save money: Shop around. It’s important to shop around to get the best rates on credit cards. You want to make sure you’re getting the best rates on different cards and making the best decision for your specific needs. Limit your travel. You don’t want to go through months without hearing from a credit card company that you need to make a payment. It’s important to plan ahead and make sure you don’t pay more than you should. Limit your online purchases. Any online purchases you make should be done so online. It’s important to be able to check your account online when you need to make a payment.

Crypto transaction fee is low

With blockchain technology to eliminate the middleman, payment processing is purely peer-to-peer. The transaction fee solely depends on computational power. With Proof of Stake consensus, it can further reduce transactions through all participant's contributions, which can further reduce the processing fee.

In conclusion

Credit cards are a lot more than you might expect. They cost money to create and manage, charge you a fee when you use them, and ultimately, you have no access to special features and services that no other credit card offers. This is why credit cards are so expensive. When it comes down to it, it’s all about money. And in today’s environment, where financial services are more competitive and access is more difficult, it’s important to know how to cut down on costs by using a credit card. That said, there are ways around this preventative measure and get the most from your credit card. Whether you use a cash-out or cash-in, consider how much you’re going to be spending each month, and make sure you’re making the best decision for your specific needs.

Thinking it too late to buy Bitcoin? How about earning Bitcoin through daily spinning? Try Fold App here and start your Bitcoin earning journey with a free $2 to start!

Photo by Linus Nylund on Unsplash