Jan 28•9 min read

The Liquid Staking Wars Are Just Getting Started

Ah, how I love the smell of green candles in the morning.

After more than a year of DownOnlyTM, courtesy of the Fed, we’re finally getting a pump in the coins.

And, as you’ve probably noticed, some of the best-performing tokens like Lido (LDO) and Rocket Pool (RPL) are related to Liquid Staking Derivatives (LSD).

What are LSDs anyway? And does this narrative have legs?

Well, LSDs are a way for Ethereum (ETH) stakers to have their cake and eat it, too.

You are probably aware that now that Ethereum is a Proof-of-Stake (PoS) chain, you can stake your ETH for a comfy, stable yield of around 4–6%. Sad thing is, staked tokens cannot be used anywhere.

I know, I know, there’s a myriad of opportunities for an enterprising degen like you to make money in crypto, and yet you are supposed to settle for a single-digit APY? Bit boring, don’t you think? Un-American even.

But fret not, degens! LSDs allow you to stake your ETH in a smart contract and receive a tokenized derivative of this staked ETH in return. Armed with this derivative, you can head back to the wildlands of DeFi to degen away and make Su Zhu proud.

Now, is the LSD narrative gonna stay with us for a while?

Our view is that it will.

That’s because despite Ethereum’s dominance, staking ETH is still viewed as risky, as users are currently unable to withdraw their staked tokens.

Do you know what a typical staking ratio is for PoS chains? Between 40–70%, according toStaking Rewards.

Ethereum’s staking ratio? A meagre 13%.

As Ben pointed out in “Musical Chairs,” this number will likely increase after the upcoming Shanghai upgrade scheduled for March, which will allow users to withdraw their staked ETH. That will de-risk ETH staking, and as more tokens are staked, that will drive demand for LSDs.

In April 2021, LSDs started to gain momentum over other staking solutions. By the time Ethereum successfully switched from PoW to PoS (the Merge) in September 2022, they were cemented at the top of the food chain.

ETH staking by category. Source: Adapted from Write2Earn

Now that I (hopefully) have convinced you that LSDs are a narrative that won’t go away, let’s get down to business, and examine some of the most popular liquid staking solutions.

The Contenders

That’s right, this is crypto after all. LSD solutions are dApps, and you can always count on dApps to issue shares governance tokens to further decentralization, empower the community and all that jazz.

This gives us a chance to bet directly on LSDs’ growth and hype.

The leading LSD protocols according to DefiLlama are the following:

Top Ethereum LSD protocols by TVL. Source: Adapted from DefiLlama

Since we’re only focusing on protocols with governance tokens, we’ll leave out Coinbase. And while Stakewise has enjoyed some early success, its adoption has stalled, so we’re leaving it out of our discussion today.

So we think the three protocols that are best positioned to benefit from the LSD narrative are Lido, RocketPool, and Frax.

While there’s plenty to discuss regarding each one’s unique ETH derivatives, for today we’ll focus on their protocol’s tokens.

Lido (LDO)

The king at the top of the LSD mountain is Lido. A whopping 30% of all staked ETH and over 70% of all ETH in LSD protocols sits at Lido.

Lido is set up as a Decentralized Autonomous Organisation (DAO), and LDO is the “membership card” of the DAO.

The holders of LDO get to vote on some aspects relating to the functioning of Lido, such as the fees the DAO should get or what node operators and oracles Lido uses. The DAO also accumulates profits from fees that will be distributed towards research and development, liquidity incentives, etc.

However, LDO doesn’t accrue any value to token holders. Therefore, it’s more of a speculative bet on the success of LSDs and Lido continuing its dominance.

Not that there’s anything wrong with that. Sometimes, tokens relying only on narratives are the best bets.

Arguably the best-performing sector of the 2021 bull market was dog tokens. And Uniswap’s UNI, which is structured in a similar way to LDO, was one of the best-performing DeFi tokens. Until the crypto market matures, memes and narratives are king. Best we don’t forget that.

If, however, you want to get a share of the profits from the dApp you hold the token of, you’ll have to look somewhere else.

To Frax, for instance.

Frax (FXS)

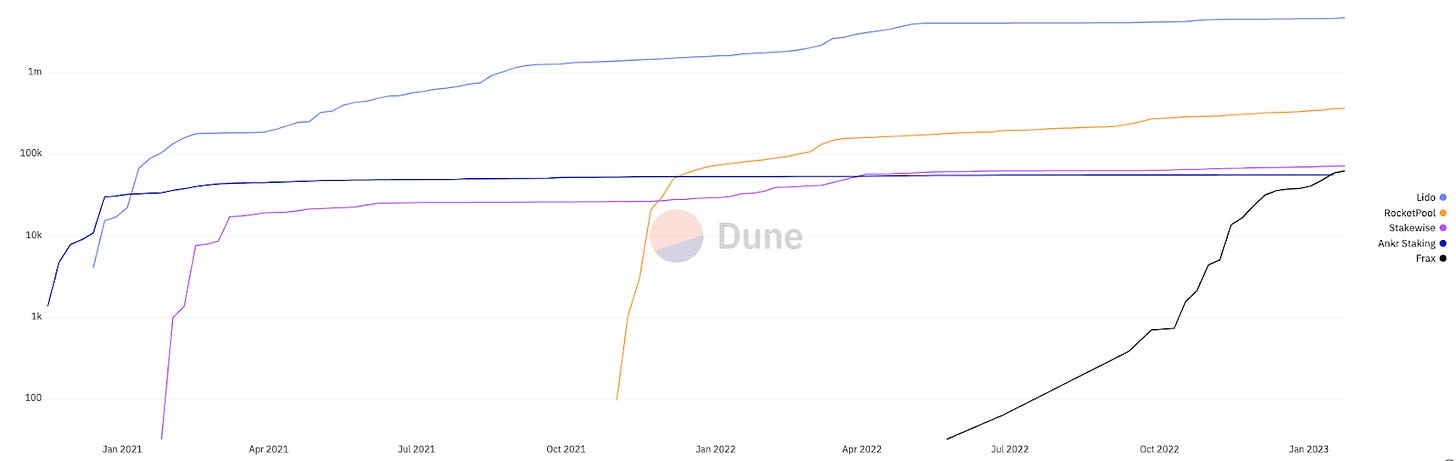

Frax is the new kid on the block, at least when it comes to LSDs. And its growth has been staggering, becoming the fifth-most popular LSD solution by ETH staked in only three months. This is even more impressive considering we are in the midst of a bear market.

Staked ETH per LSD protocol. Source: Adapted from Dune Analytics

A big reason for Frax’s rapid success in LSDs is that it has already implemented a string of DeFi products, including a stablecoin, a lending market, a decentralized exchange, etc. Plus, it’s used its influence on Curve to juice the ETH yields for its users.

So, how does Frax’s governance token, FXS, factor in?

Frax implemented a veToken model with FXS, similar to that of Curve.

Frax tokenholders can lock their FXS in exchange for veFXS; the longer they stake it for, the more veFXS they get. The more veFXS you have, the higher your yield boosts, voting power and share of profits.

At the time of writing, the current APR if you lock your FXS for four years is 1.58%. Not great, but better than nothing. And entirely profit-based and sustainable, which is quite rare in crypto.

The farming boosts are nice but are mostly related to other verticals within Frax, as is the success of Frax and FXS itself.

LSDs are but one of their products, and (for now) not their core product. So, FXS is not a pure bet on the success of LSDs, and even worse, since Frax’s products are intertwined, should one fail, others could fail, too.

This brings us to the token whose performance is a protocol which is probably more directly related to success in the LSD space.

Rocket Pool (RPL)

Launched in November 2021, Rocket Pool marketed itself as the LSD solution of the masses, standing against the VC-backed Lido. Whether this characterisation holds, the reality is that Rocket Pool managed to gain a significant market share of over 5%.

We won’t get into the minutiae of Rocket Pool’s staking mechanism. This we will leave for another day.

What is important to us right now is:

Rocket Pool node operators are rewarded both in ETH (from staking yield) and RPL (from Rocket Pool inflation)

Node operators must post collateral together with their ETH. This collateral acts as insurance, in case the node operator is slashed.

Guess what that collateral is denominated in?

That’s right, RPL. And the more RPL you post as collateral, the higher RPL rewards you get.

To deter RPL whales from getting the majority of inflation, there is a cap on the collateral you can post equal to 150% of the value of ETH a user has staked. But there is also a minimum collateral of 10% that you must put up in order to receive any RPL rewards.

These act as soft upper and lower bounds on RPL price relative to ETH.

If RPL increases too much in value, node operators will take collateral out of their vaults as they are not being rewarded past the 150% cap. There’s not much for them to do with RPL at that point other than sell it.

However, if RPL decreases too much in price, node operators will need to buy and post more RPL as collateral to keep getting RPL rewards.

In effect, this model stimulates demand for RPL based on ETH staking activity, tying the token’s success to the success of its staking solution.

Place Your Bets

So which LSD governance token offers the most potential?

If you want to play it safe, the answer is easy: LDO.

Lido is way ahead of the pack in the LSD space. Even more importantly, it has won over the narrative.

The first protocol that comes to mind when thinking of LSDs is Lido. It’s also most people’s first choice when staking ETH. And Lido’s stETH is synonymous with staked ETH.

Yeah yeah, the token does not accrue any value.

So what?

If DOGE can graze $1, useless governance tokens can and will make you fortunes.

If you want to play it a bit riskier, FXS is the token you should be eyeing.

Not for value accrual, mind you. Low single-digit APY in exchange for locking up my tokens for four years? I think not. Thank you and good day, sir.

No, FXS is a great bet right now because of its staggering growth.

However, betting on Frax means betting on all its DeFi arms, and their success is not guaranteed in the slightest. Hence, a riskier but possibly much more lucrative bet.

Lastly, we come to the ugly duckling.

Rocket Pool has achieved a great degree of success. However, RPL is just not an attractive bet right now. Rocket Pool is miles away from catching up to Lido, and it is just not growing that much anymore.

If that changes, we would change our view.

Overall, what’s clear is that the success of a protocol and its token are not as intertwined as one might think. Successful protocols can be bad investments. The reverse is also true, although much rarer.

In any case, the LSD wars are heating up and teams across DeFi are coming up with more innovative solutions. We expect that Shanghai will only stir things up even more when it makes ETH staking even more attractive.

Keep it fun,

Kodi