May 10•7 min read

Bitcoin Has an Unlikely Ally in Its Fight Against the Dollar

Two men enter, one man leaves.

This is the one and only rule of Thunderdome.

Which is of course a reference to the gladiator arena from George Miller's 1985 classic Mad Max Beyond Thunderdome starring Mel Gibson.

In case you’re not a movie geek like me and haven’t seen it, Mad Max’s Thunderdome resides in a post-apocalyptic city named Bartertown.

Thunderdome is the place where all disputes are settled, with the caveat that there can be no peaceful resolution – only a violent fight to the death will suffice.

Two men enter, one man leaves.

A true zero-sum game, and one I’ve been increasingly reminded of while watching the tension rise between the U.S. Dollar Index (DXY) and Bitcoin (BTC).

As Ben alluded to earlier this week, we are in “The Calm Before The Storm,” as volatility has been muted for the past month while both assets have traded in well-defined ranges.

A calmness that won’t last much longer.

The volatility we experienced yesterday will only continue to increase as these two assets begin duking it out in a fight to expand out of their current ranges. This Thunderdome moment will deal one a decisive Q2 victory and the other a crushing defeat, which will likely dictate directional momentum for the rest of 2023.

To get a better idea of what to look out for as this rumble gets underway, today let’s review the technicals and see what to expect once the battle axes start flying…and how gold could be a deciding factor in how this match plays out…

The King’s Crucible

As we’ve mentioned before, any decline in the dollar is good for Bitcoin (and vice versa).

But despite all the headlines in recent weeks regarding global de-dollarization, DXY’s technical structure hasn’t changed all that much since my last dollar update following March’s banking crisis.

As we see below, DXY (blue line) managed to test and hold above the crucial line of support we outlined at 100.80 on April 15.

Not coincidentally, BTC (orange line) reached its year-to-date high on the exact same day the dollar retested its yearly low.

In the weeks since, both BTC and DXY have been consolidating in tightly compressed ranges, creating the market tension I alluded to earlier…sooner or later, this month-long structure will break and both assets will enter into price discovery – one to the upside, the other to the downside.

One notable thing about DXY in particular is that since it peaked during March’s banking crisis, it has been totally unable to sustain any technical momentum.

As a result, it has now registered six lower highs since March’s peak of 105.90, a strong confirmation that it is indeed stuck in a downtrend.

This price action is narrowing the possible outcomes in the near future, which leads me to believe the start of our DXY vs. BTC Thunderdome brawl is about to begin.

Should the dollar’s yearly low fail to hold upon retest, and should that failure send DXY crashing below 100 without relief, I believe that would create an ideal set-up for BTC to make a series of higher highs this summer.

Reason being is that the present is beginning to look an awful lot like the past, with a slight twist…

Is This DXY’s LUNA Moment?

If you recall this time last year, just after LUNA and UST’s death spiral, Bitcoin appeared to be oddly resilient as it held above $30,000 for a month or so following the collapse.

This gave many the misguided impression that it was fulfilling its safe-haven narrative while altcoins burned to the ground.

As we now know, this was not the case.

In the chart below, you can see BTC spent much of last spring consolidating above its yearly lows, but mostly below its major moving averages (MAs). This price action created a “head and shoulders” chart pattern, which led to a full-on collapse after LUNA’s death spiral caused CeFi exchanges like Celsius and BlockFi to go under.

Now what’s interesting is that the fractal above showing BTC’s spring 2022 market structure is eerily similar to DXY’s current market structure.

As we’ll see on this next chart, DXY is now showing the same, ominous “head and shoulders” pattern below resistance that BTC showed last spring.

Now could this just be a random coincidence? Of course. Technical analysis is not the end-all, be-all. But it is a reliably useful tool for risk management nonetheless.

And while I definitely don’t expect a similar 60% drop from DXY anytime soon, I would be extremely cautious of holding any long dollar positions unhedged at present.

After all, given what we’ve experienced this year from geopolitical issues, to domestic bank failures and the debt ceiling debate, there is no shortage of potential catalysts that could spur a sudden sell-off in the near future.

So what would save the dollar from doom and spoil Bitcoin’s hope for new highs this summer?

For me, it would start with DXY first making a move above the May high at 102.53 and then reconquering its 50-day MA (green line above, 102.60) and 100-day MA (blue line, 103.04).

If it does that in the face of such overwhelmingly negative sentiment, it would be the ultimate sign of strength for the dollar, and a clear signal for the market to go “risk-off.”

Should that come to pass, it would be time to protect the crypto gains we’ve made this year and run for cover, as the odds of a March crash redux would dramatically increase.

As it relates to Bitcoin in particular, DXY rising above its 50-day and 100-day MAs would almost certainly send BTC crashing into another retest of its 200-day MA (red line below), which currently rests at $22,220.

Needless to say, if price were to fall back below the 200-day MA, things could turn quite ugly indeed for the remainder of 2023.

But don’t be overwhelmed by those anxieties just yet, as there is a strong macro signal among the noise which is telling us not to expect such a dollar revival anytime soon…

Who Run Bartertown?

Gold run Bartertown.

Just like Master Blaster from Mad Max.

No matter how much it pains central bankers and fiat enthusiasts to admit this, there is no asset more in control of market behavior than the shiny rock.

The size of gold’s global market (~$13.5 trillion), and its reliability over centuries as a hedge against fiat failure, make it the purest litmus test we have for measuring DXY’s relative strength and weakness.

All moves from crypto and risk assets are ultimately downstream of the trend that gold sets.

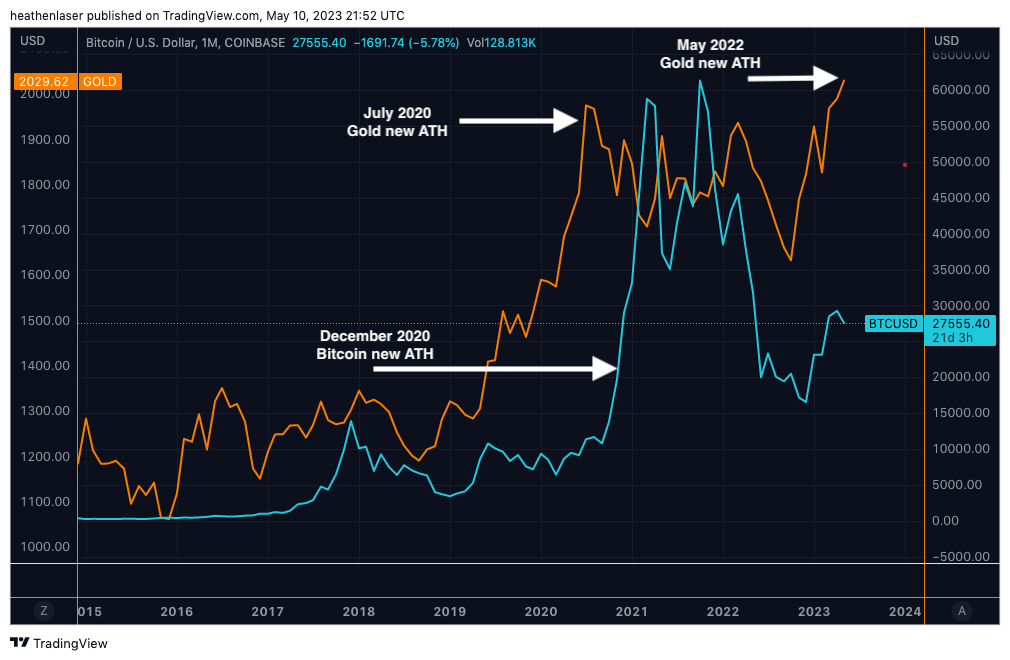

For example, an often forgotten detail of 2020–2021’s bull run was that BTC’s breakout to all-time highs lagged gold’s all-time high breakout by about five months.

As we see below, gold (orange line) registered all-time highs in July 2020, but it wasn’t until December that same year that Bitcoin (blue line) followed suit.

As that chart shows: what’s good for gold is good for Bitcoin, albeit on a lag.

This is relevant at present, because just last week, gold made an all-time high when it soared to nearly $2,100 per ounce.

Historically, gold macro breakouts have been a good forecaster of trouble ahead for DXY as well, as we saw a similar breakout take place in 2007 just before the Global Financial Crisis sent DXY to the 70 range.

Gold’s breakout in 2020 also front-ran DXY’s collapse to sub-90 levels by about four months.

BTC and DXY lagging behind gold is something to keep an eye on and be mindful of into the end of May. Should gold continue expanding to new highs, it will be setting up BTC and crypto at large for a bull run into the second half of 2023.

But should gold falter and reverse below its $2,000 breakout, Bitcoin, Ethereum, PepeCoin, and all the rest won’t be far behind.

That’ll be all for me today. Until next time, I’ll leave you with this clip of legendary fund manager Stanley Druckenmiller explaining why his family office is currently long gold, short DXY…enjoy!

Your friend,