Jun 29•7 min read

Whale-Watching Season Is Here…Is Alt Season Next?

Welcome to our new weekly issue we call, Filtered.

If you’ve been following Espresso regularly, you’ve likely noticed that we’re starting to ramp up our content on other platforms. So we thought we’d help our readers out by giving you some of the highlights.

You can consider this your weekly round-up of top insights from our analysts, filtered down to serve you better.

And if you’ve missed any of our content this week, whether it’s in essay, podcast, or video form, you can find links to it at the bottom.

Without further ado, let’s get into today’s Filtered.

The whales seem to be trying to tell us something...

The giant sea mammals are attacking boats more and more lately.

Last week, two sailing teams competing in a round-the-world race encountered a trio of whales near the Strait of Gibraltar that nudged and bit at their boat rudders. And last month, orcas actually sank a yacht near the same area.

Apparently, there are new incidents every day.

It’s got scientists baffled. Maybe the whales are finally fighting back against humans polluting the oceans and imprisoning their fellow brethren. Maybe they saw the new Avatar movie and got inspired. For now, it’s a mystery.

In crypto, we have a whale mystery of our own to ponder.

Crypto whales are wallets that hold more than 10,000 BTC (about $305 million at current prices). They’re often thought of as the “smart money” in crypto.

When they’re making moves, it’s important to pay attention – not just because they can move markets, but they often have knowledge the public lacks.

While we can’t know exactly who these traders are… thanks to the transparent nature of blockchains, we can see what they’re doing.

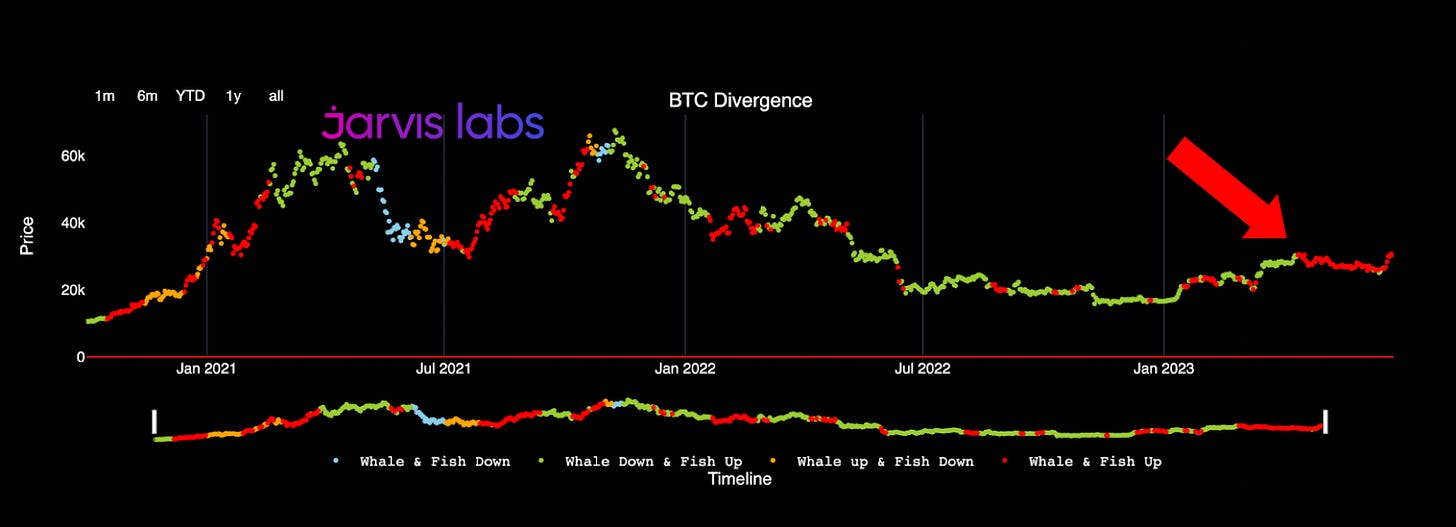

Here’s a chart showing exactly what I mean. It shows the buying of both whales and fish (smaller wallets with BTC), with various colors indicating buying and selling patterns.

For our purposes, just focus on the red dots, which indicate whale buying – especially at the far-right of the chart.

On this week’s Alpha Bites podcast, our very own janitor, J.J., revealed he’s been keeping an eye on this chart since mid-April, when BTC topped around $30,500. According to him, that’s when this most recent spate of whale buying began (red arrow above).

What’s even odder is that this buying continued through May and June, even as bearish news like the SEC’s lawsuits came down.

And then...the BlackRock news hit.

Hmmmmmm.

Here’s J.J. with some more context:

And now we see even despite the ETF news, [the whales are] continuing to buy up. So what that would signal to me is that most likely expansion will happen, and we haven't reached the top of this rally yet. And quarter three [we] will probably go higher.

Given the amount of time that they've been accumulating, it's the longest since October of 2020 through February of 2021. So during that period, it was like a four- or five-month span, and they were just basically buying every single day….

And now, we're really seeing them ramp up the accumulation. That just says to me that there's bullishness, and we may not know what the catalyst will be. Just as we didn't know that the BlackRock catalyst was coming until it happened.

These wallet addresses tend to be smarter. That's why they have more money and [they’re] more in the know than us. So you're better off following the richest people in the market who have the most access to knowledge.

J.J.’s bullishness on BTC prompted another question: Does this mean alt season is almost upon us? Surprisingly, the team was divided on whether that was the case. You can listen to the full episode on YouTube here or on Apple or Spotify.

While an imminent alt season is questionable, there’s still plenty of focus on Ethereum (ETH). Especially regarding the state of its yield.

And that gave me an excuse to get back to my safe place, and talk about the Ethereum yield curve in this week’s Blend.

Yields are currently just under 4%...but if alt season does arrive, does that mean they go up or down? The answer’s not as simple as you think. Here’s a snippet of what I wrote on Wednesday:

If you lock up Ethereum via Lido’s staking solution, the 7-day yield is around 3.9%. Not the worst.

Well, what do you think will happen if economic activity picks up in the land of Ethereum? Will those rates go higher?

Likely. But what if 100,000 more validators come online to stake their ETH? With rewards from the Ethereum network getting spread across even more validators, will the increase in activity really result in more yield per staked ETH?

Then there’s a question of the timing between how much activity rises and the amount of validators coming online. If activity rises on day 360, but several thousand validators have been added [before the rise], will you really benefit in terms of yield earned for the year? Not really.

All of these questions give us what will become one of the more exciting niches of the Ethereum market for macro economists like myself…

You can read more of my argument here...and don’t miss the other bits on another financial giant getting into crypto…as well as how blockchain games are about to take a huge leap forward.

Meanwhile, if you’re buying into the hopium of alt season and looking to diversify, our token design analyst Kodi might have a suggestion…

He did a deep dive on an L1 that most people have forgotten about, Cardano. And that’s despite the fact it outperformed both BTC and ETH… At least on the way up.

I don’t think we could ask for a more contentious topic than that.

According to Kodi, the project hasn’t been idle during this bear:

Decentralized exchange (DEX) volumes for Cardano increased from around $60-$90 million in the months prior to almost $250 million in May. According to DefiLlama, the May weekly volumes of its leading DEX, Minswap, were 5-10 times those of prior weeks. Heck, Cardano even had its own memecoin season.

But this had long been in the making. Cardano’s total value locked (TVL) had been rising steadily since the start of the year, after peaking in April 2022. Cardano’s TVL in USD terms is now over 50% of what it was at the peak, despite ADA's price being a fifth of what it was back then...

TVL in ADA terms has tripled since the bottom at the turn of the year and is over 50% higher than at the peak in April 2021.

You can read more in his essay, “Reports of Cardano’s Death Have Been Greatly Exaggerated.”

And as always, you can find links to all the content we published this week below – along with our Tweet of the Week.

That’s all from me this week. We’ll see you again on Monday. Enjoy the weekend.

Your Pulse on Crypto,

Ben Lilly

Espresso

Alpha Bites

Tweet of the Week

In an ode to this week’s Blend: