Sep 02•12 min read

The Debt Dollar Melt-Up

You’ve probably never heard of George Warren before.

He was an agricultural economist who had a couple notable accomplishments in his life: He wrote a book on dairy farming, devised a way to get chickens to lay more eggs, and later, altered the entire course of monetary history.

You see, Warren acted as an adviser to President Franklin Delano Roosevelt in the early 1930s. And in 1933 during the Great Depression, he was the one who convinced Roosevelt to take the United States off the gold standard.

And that move has since created very polarizing takes.

On the one side, many believe the reason the U.S. got out of the Great Depression was this act.

On the other, many view it as the end of sound money.

Both are right. It’s all about perspective. Your framing of that moment in history depends on whether you wrote the rules or you just read the rules.

Now, this moment in history changed how we viewed money. Before, we based our money on commodities that don’t spoil, like gold.

But with this change, money became a nation’s currency. And factors like whether it was easy to transport and whether it could convert value into non-perishable form became irrelevant.

Instead, the foundation for a system built on trust began.

And here we are, about to see it happen again.

The International Monetary Fund (IMF) recently dropped their GDP forecasts for advanced economies. Academics gave lectures to central bankers at Jackson Hole on problems in the economy with no easy solutions. And anybody following finance understands a recession is more of an inevitability than a threat.

All of these issues point to the fact that productivity is dropping, debts are growing, and something needs to give.

That something is what I’ll get into today, and show why the global financial system is about to see the biggest U.S. dollar melt-up in history.

The Fed’s Lead Foot Put Us in a Bind

In the past few years, the Federal Reserve has acted like a toddler driving a car.

2022 started off with Jerome Powell smashing the gas pedal without hesitation. Rates rose without a sense of danger ahead. It felt reckless.

And with his hands on the wheel of the economy, he went on to crash into the first thing he saw: Silicon Valley Bank (SVB).

As a result of rates rising so fast, the bank couldn’t manage its balance sheets. The reckless driving caught it off guard. And when SVB went bust in March, instead of a parent coming in to fix the situation, regulators rolled out the caution tape like it was a crime scene.

With such an emergency response, Mr. Powell himself acted without even slowing down.

His action was BTFP, the Bank Term Funding Program.

The program allowed banks, similar to Silicon Valley Bank, to use certain collateral (i.e., Treasuries) for borrowing. Meaning if a customer wants to withdraw $10,000 that the bank doesn’t have, the bank can send the Fed $10,000 worth of Treasuries and get their needed dollars.

All of this is at 1:1 or par value. There’s no pennies on the dollar, even though the bank is in a tight position. Nor is there a fee.

Confidence was restored in the banking system. It was the crisis that wasn’t.

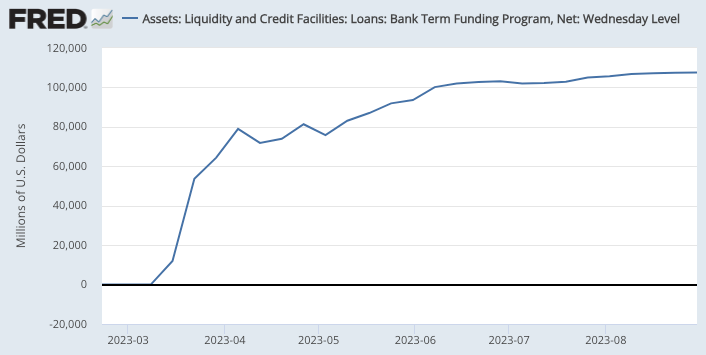

The program continues to this day. Loans from the Fed sit at $107 billion, although they’ve plateaued over the last month.

This facility stemmed off a major shockwave in the Treasury market. If the Fed hadn’t stepped in, banks would have unloaded their balance sheets in mass to avoid insolvency. This program kept dollars in various bonds, such as Treasuries, and avoided volatility.

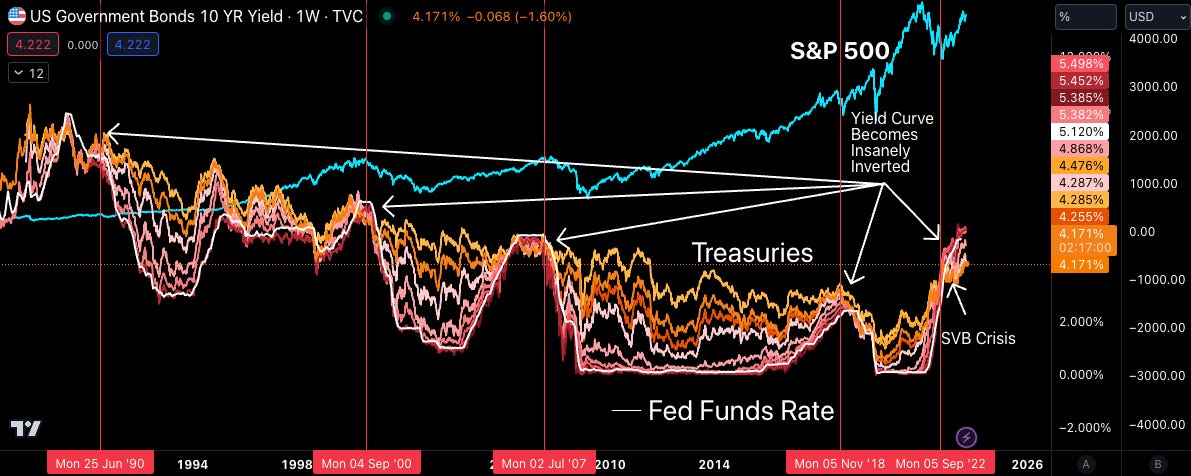

Here’s a chart that highlights the issue… Near the end of 2022, after Powell spent multiple quarters inflicting pain through raising rates, the curve gave the signal it always does by becoming insanely inverted. Shortly after, SVB failed and yields started to become volatile.

This was the moment where rates typically get slashed to zero, markets collapse, and more quantitative easing (QE) happens.

You can see in the chart below how the market and rates have responded each time yields got insanely jacked up.

Only this time, markets didn’t collapse, rates didn’t go to zero, and QE was not really there…

BTFP changed the game.

Which means we need to realize the Fed knows what it’s doing. And yes, we will likely see another crisis similar in scale to SVB again.

And what I’ll show you next is where that crisis is likely to originate from, as well as the likely response. Then later, the endgame where 1933 happens again.

It’s Chronic

The lending from BTFP has flatlined. So it appears any impending crisis has been averted.

But the issue is much deeper than simply meeting withdrawal requests. It’s a chronic one. In fact, another symptom of how pervasive things are is beginning to show.

To get to this symptom, we need to understand two things. The first is the Fed’s pressure release valve.

The central bank needs to keep rates elevated to get inflation under control. At least, that’s what they tell us. Whether that’s true or not, what we do know is that demand for Treasuries goes up as yields get more attractive.

Which means more money locked up in time deposits. This is a way to help combat inflation, not so much because of restrictively high borrowing rates, but because there’s less liquid money sloshing around the economy.

Reducing the liquid money supply reduces price levels, with all things equal. It’s the old P = MV/Q. Raising rates helps reduce M (money supply) and V (velocity).

What also happens is less money exists in the market. So to raise rates means to suck liquidity out of the system, especially Treasury markets. Hello, SVB issue.

To help combat this, the Fed created a pressure release valve before rates began to rise. It was the first step of its plan. This facility, the reverse repo (RRP) market, brings needed liquidity to the market when necessary.

Below, we can see that the funds in the repo market (white line) are negatively correlated with the S&P 500 (blue line). Basically, when the valve is opened up to drain the RRP, the market recovers. This relationship is so strong that it has almost a 100% negative correlation.

The main period of time where this correlation was not near -1 was after the BTFP began. That’s because BTFP was a different type of liquidity, so RRP didn’t need to be used. Needless to say, all this liquidity has been boosting asset prices since rates began to rise.

So that’s the first thing to note about the market: the Fed is keeping things afloat through liquidity.

The second is the amount of new Treasuries hitting the market is rising. And the economy can’t allow demand to slow… Otherwise, the symptom triggers the end result of chronic disease: death.

OK, with that background of a pressure relief valve helping keep liquidity flowing and Treasury issuance rising, let’s get to the upcoming concern. The one that suggests Jerome is now short on runway to accomplish his soft landing.

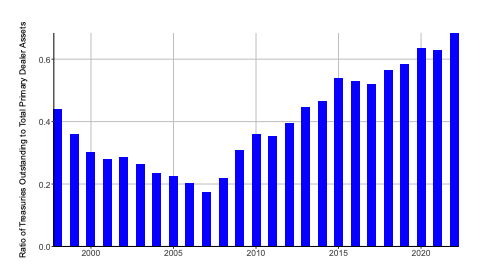

Last month, Darrell Duffie from Stanford presented a paper titled “Resilience redux in the U.S. Treasury market” to central bankers at Jackson Hole.

In the paper, he shared a chart showcasing the newest symptom. One of pain, emanating from the primary dealers of U.S. Treasuries, aka banks.

As the bars go higher in the chart below, the amount of Treasuries relative to the assets held by the dealer is rising.

It’s the liquidity issue showing up again.

Dealers need some more of that premium-grade liquidity.

If these bars continue to rise, it means dealers are running low on cash. And in a world where more Treasuries are being issued, this is a problem that can’t be ignored.

Jerome will need these dealers to free up capital. If that happens, there will be massive buckets of liquidity that can be injected into the market.

The question is, how does he free it up?

The solution sits in a program that was already rolled out. The BTFP. In that program, banks can use Treasuries as collateral. Meaning they are an asset that can be exchanged one-for-one with dollars.

Right now, dealers don’t really have the same flexibility. Treasuries aren’t dollars. They are an asset that has risk. Which is why they need to hold more dollars on their balance sheet. If Treasuries were more like dollars, then those dollars on the balance sheet could be used for something else.

Which is why more people are about to be asking the question, “Why does the most pristine form of collateral have risk attached to it?” You treat it like dollars, you pacify this symptom. And Jerome gets more runway.

It’s the likely response to the next crisis that likely won’t be a crisis for very long, thanks to more plunging power in Jerome’s arsenal to clear up the market’s plumbing.

But there’s another recommendation that Mr. Duffie dropped within the paper. And it’s this piece that gives us a hint as to the next steps to the “Debt Dollar.”

You’re Already Using the Next Version of FedNow

Let me introduce you to a proof-of-concept version of the new dollar: USDC.

The token is essentially dollars and trades like dollars. In all actuality, it’s tokenized dollars… Right?

No. It’s basically government Treasuries. Debt. Same goes for USDT. Debt. Yet, we all are happy to hold it like dollars and use it to pay salaries and play in DeFi while earning less yield.

Nearly the entire amount of tokenized dollars on the Ethereum network is really just debt being traded around. And these traders are crypto natives who are wary of FedNow, U.S. monetary policy, and the debt bubble. The most skeptical crowd is already subscribed.

The proof-of-concept of what FedNow will become exists. You are using it. BTFP already gave way to Treasuries being seen as risk-free. With another quick accounting adjustment, tokenized debt dollars will flow through the 24/7/365 settlement network with ease.

This will give the Treasury market endless pools of liquidity. All dollars turning into debt dollars.

The runway became so long that it’s possible to do a “soft” landing by crashing without landing gear.

But wait… There’s more.

In Duffie’s paper, he discussed decentralizing the Treasury market. It’s currently centralized, and primary dealers are the permissioned entities. They dictate the market.

But Duffie is saying if we remove the primary dealers and allow anybody to trade via a limit order book, there will be even more liquidity… And more demand… And more resilience.

Literal music to a central banker’s ears.

Greater accessibility creates more demand. More demand means more liquidity. This is what the Fed wants to unlock. Just give it the excuse to tap its self-appointed powers.

It’s also how the Treasury can soon keep issuing barrels of debt without a worry.

Endless Liquidity

This is really made possible because the U.S. dollar is the reserve currency. It has a great yield right now earning 4%–5.5%. It’s also used for more than 80% of foreign settlements.

No other currency comes close. It’s a luxury, one that the Fed is poised to take advantage of through this magical wave of the hand to change accounting rules.

Debt will be currency.

And when debt dollars roll out, we will see unprecedented demand for them by decentralizing the Treasury market. It’ll be the greatest thing to hit the street. And I wouldn’t be surprised to see DXY go above 120 a year after this agenda gets implemented.

It’ll go down in history as a pivotal moment for money. Much like 1933 took us off the gold standard, this will put us on a debt standard.

Our addiction to debt will only become greater. Markets will see the U.S. dollar’s strength like never before.

But that’s just when the endgame will come in. The one where settlements no longer need to bypass through dollars.

If this last concept is new to you, have a read of this past issue. In it, I break down how several pieces of technology being worked on at the global level will create less demand for dollars.

Since this new foreign settlement technology still needs a few years before rolling out, we can expect the dollar melt-up to have plenty of time to take place. Followed by the onset of the end of the U.S. dollar’s reserve status.

Until then, let’s watch the Fed rewrite the rulebooks during the next crisis that wasn’t.

Your Pulse on Crypto,

Ben Lilly

P.S. As for timing, it’s all path-dependent on when legacy markets crash. Retail debt conercens and commercial real estate are becoming dangerous as our resident analyst TD highlighted.

And we don’t even have visibility into some areas of the market, like Buy Now, Pay Later balance sheets.

However, timing for such an event seems likely for 2024. This would look similar to 2020, when markets crashed, Bitcoin pumped higher, and then crypto came to a halt as DXY ripped higher for 17 months. Which places the beginning of the dollar’s end in late 2025 or 2026. Meaning we have time to enjoy this coming rally.