Aug 27•10 min read

The Solution to Cosmos’ Woes Is Hiding In Plain Sight

Stop me if you’ve heard this one before.

So, THORchain (RUNE) is a lending protocol that allows users to swap assets across blockchain networks. And it just launched a new lending primitive.

Here’s how it’s described by THORChain:

Opening new loans creates a deflationary effect on the $RUNE asset, whereas closing loans creates an inflationary effect on $RUNE.

If the value of $RUNE relative to $BTC is the same when the loan is opened and closed, there is no net inflationary effect on $RUNE (same amount burned as minted minus the swap fee). However, if the value of the collateral asset increases relative to $RUNE between the time the loan is opened and closed, there will be net inflation of $RUNE supply.

So, THORchain’s novel mechanism just increases and decreases the supply of the $RUNE token algorithmically.

Blimey, does anyone remember what happened last time we had such a mechanism?

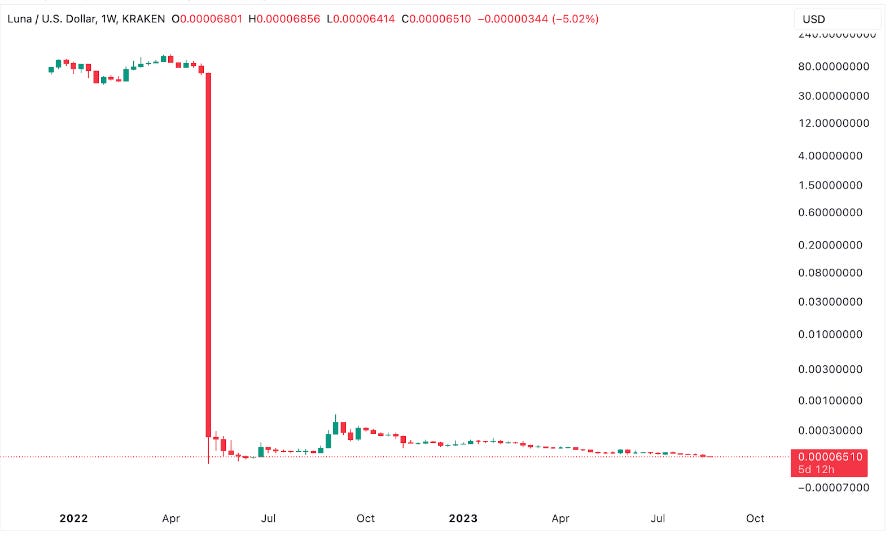

That’s right, our old friend LUNA!

Haven’t heard from her in a while. Let’s check on her, see what she’s up to.

Gnarly chart, isn’t it?

For those who don’t know, Terra was a blockchain project that aimed to create a stablecoin called UST. This stablecoin would maintain a 1:1 peg to the U.S. dollar through an algorithmic system involving LUNA, Terra's native token.

It was a roaring success.

Until it wasn't.

After UST reached a circulating supply of $18 billion, it promptly lost its peg, sending the whole Terra ecosystem down the gutter, and for a time, the broader crypto market with it.

LUNA’s market cap plummeted from $40 billion to virtually zero, and Bitcoin and Ethereum dropped over 30% each. As for UST, it is now trading at $0.0128.

But when the story of LUNA’s great ascent and even greater downfall gets told, a chapter is often overlooked.

You see, LUNA was built on Cosmos, an ecosystem of different blockchains all tied to the main Cosmos (ATOM) chain. It was built using the Cosmos SDK, it used Tendermint as its consensus algorithm, the whole shebang. It was also the most successful Cosmos chain out there. By far.

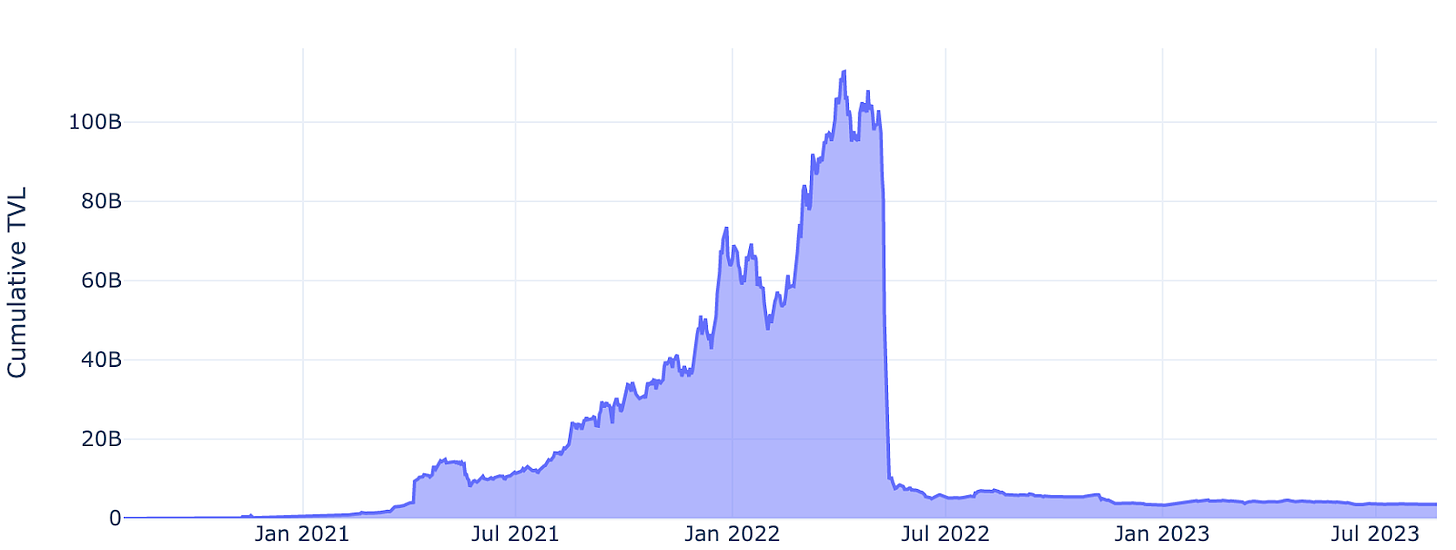

So it’s no surprise that the cumulative TVL of the Cosmos ecosystem looks like this today:

Cosmos TVL. Source: DefiLlama

Guess when the LUNA collapse happened.

Cosmos projects that relied on or were building on LUNA died. It also didn’t help that a lot of Cosmos projects relied on UST too as their main stable.

Liquidity in the ecosystem dropped precipitously. Osmosis (OSMO), the leading DEX project in Cosmos, was one of them. Its TVL plunged from a peak of $1.7 billion in April 2022 before the collapse to just $150 million by June 2022 – a 91% decrease.

By contrast, Uniswap and Curve “only” shed 30% and 55% in TVL, respectively, over the same period.

So yeah, the LUNA debacle was bad for everyone in crypto, but it was particularly bad for Cosmos. And it has not recovered since.

In the words of Zaki Manian, a prominent figure in the Cosmos ecosystem:

Cosmos has, [...] maybe a year at most, to kind of find a way to create something unique and distinctive, something that differentiates itself and makes it feel like some coherent thing that's separate from Ethereum or separate from the rest of the blockchain space.

What is that something that can bring Cosmos back from the brink of death?

It ain’t gonna be algorithmic stables or their cousins, I’ll tell you that much.

But we have an idea.

What Did Liquid Staking Ever Do for Us?

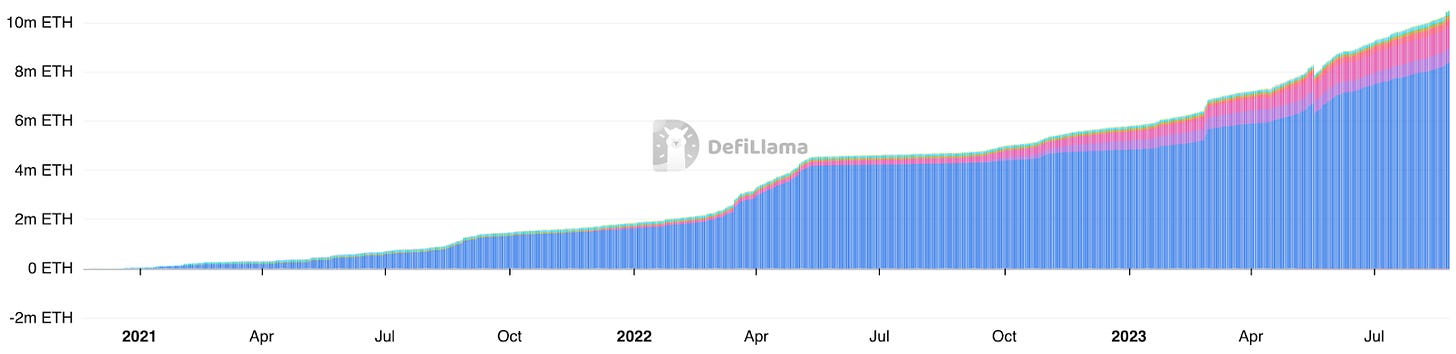

This is Ethereum’s TVL, in terms of ETH, over the past two years.

Ethereum TVL. Source: DefiLlama

This is Ethereum’s TVL over the past years if we subtract liquid staking derivatives (LSDs).

Ethereum TVL minus LSDs. Source: DefiLlama

Quite the difference.

Mind you, the last chart does take into account LSDfi projects, in which you can deposit liquid staking tokens like Lido’s stETH. If we were to subtract those, we’d be looking at an even lower TVL of 12.5 million ETH.

So, Ethereum’s TVL, in terms of dollars, declined through the bear market in 2022 as expected. But it also would have seen a sharp decline in ETH terms through 2023 – if not for liquid staking coming to the rescue.

Let's dive into some crazy stats. Of the entire 26 million ETH staked out there, liquid staking protocols hold 11 million ETH. That's nearly 42% of the total staked ETH and a whole 10% of the total supply of ETH. Not bad for a sector that was in diapers not even 6 months ago.

ETH supply in liquid staking protocols by protocol. Source: DefiLlama

Plus, same as how fresh kicks can energize a tired outfit, LSD has brought much-needed energy and innovation to DeFi.

There’s around $1 billion sitting in as many as 25 LSDfi protocols, none of which existed at the start of the year. And many more protocols are going to be launched in the coming months. Not too shabby.

This is the kind of liquidity that Cosmos sorely needs if it wants to survive. And the ecosystem is set up for LSDs to become an even bigger phenomenon there than on Ethereum.

A New Hope for the Cosmos

The Cosmos network embodies the App Chain vision: Every application is its own Proof-of-Stake (PoS) blockchain, and all of them are interconnected.

But the problem is, this means nearly all value in Cosmos is locked in chains staking their native tokens to secure the network.

Contrast this with Ethereum, where only ETH is staked. That frees up a plethora of tokens from DeFi tokens to stables to NFTs to be used across the Ethereum ecosystem.

LSDs can unlock this dormant value on Cosmos. By allowing stakers to mint derivative tokens representing their staked assets, liquidity can start to flow freely again.

And because staking is so core to Cosmos, the adoption of LSD platforms could be extremely rapid and widespread.

Staking is relatively new to Ethereum, which didn’t even enable withdrawals until the Shapella upgrade this past April.

By contrast, all Cosmos chains were Proof-of-Stake from the get-go.

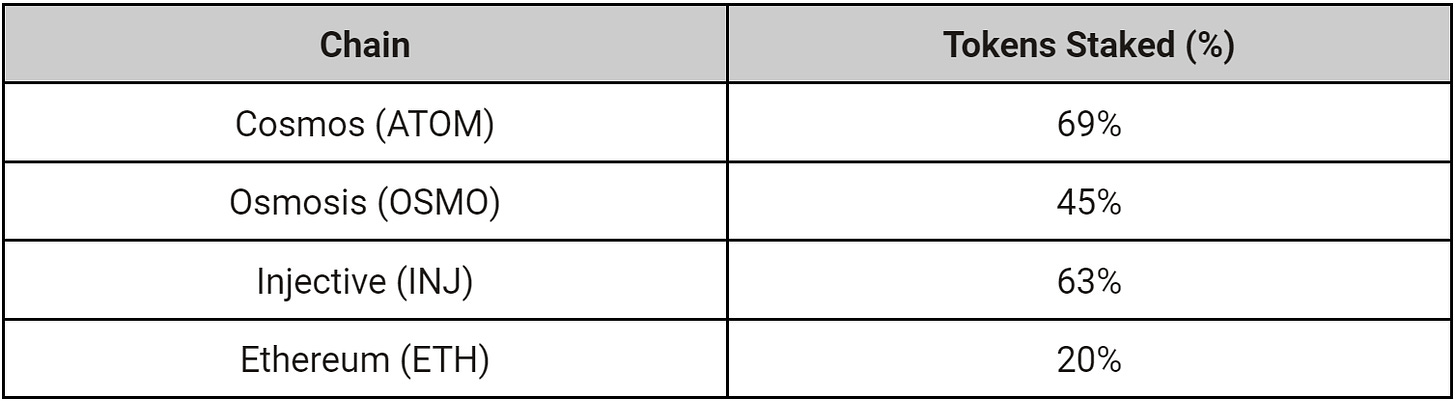

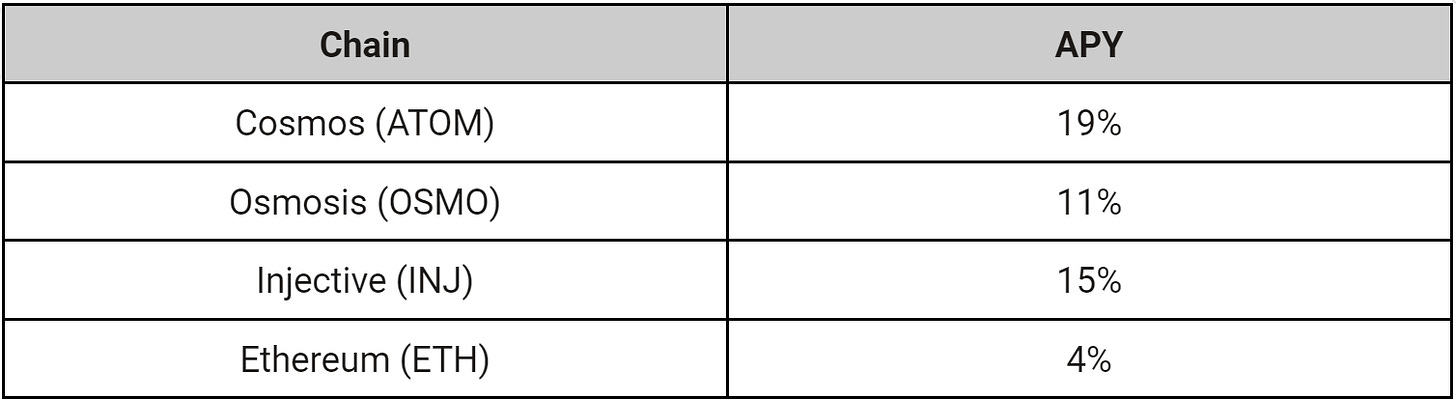

This translates to much higher staking percentages in Cosmos chains.

But remember, the path to liquid staking in Ethereum is a two-step process: first, ETH gets staked, and then a portion of it trickles into LSDs.

Cosmos can bypass this initial phase, as a substantial volume of tokens is already staked.

The demand for staking is built-in already.

LSDs may even incentivize more users to stake, now that their tokens need not be locked anymore. Why not gain an extra yield on your tokens, if you can continue using them across the ecosystem?

And what yields. ATOM and OSMO have staking APYs of 19% and 11%, respectively. Ethereum has an APY of around 4%, and it’s rapidly decreasing as the number of validators grows.

This massive liquidity influx can greatly expand DeFi potential across Cosmos chains. DEX projects like Osmosis could see exponential growth in TVL and volumes. Other sectors such as lending or stablecoins would also benefit greatly from higher liquidity.

Moreover, Cosmos' cross-chain nature is ideal for LSD products. The Inter-Blockchain Communication (IBC) protocol connecting Cosmos chains allows for new LSD products that seamlessly interact across multiple networks.

LSD vaults could optimize yield farming across networks using IBC, for example. Or liquid staked assets could fuel lending markets and margin trading across the ecosystem via IBC transfers.

The composability of LSDs across Cosmos chains could quickly outpace innovation on Ethereum thanks to IBC. It may yet be the secret recipe that allows Cosmos to unlock staking's true disruptive potential.

I know what you are thinking.

If liquid staking presents such a great opportunity for the Cosmos ecosystem, how come it has not taken off yet?

Well, the main reason is that no efficient and proven liquid staking solution was there in the ecosystem. But that may be changing.

The Knight in Shining Armor

It’s not like liquid staking hasn’t been tried in Cosmos before.

pStake Finance, the native LSD solution from the Cosmos chain Persistence, has been live since February 2022. Quicksilver launched back in May 2023. But with TVLs of around $3 million and $2 million, respectively, they have failed to catch fire.

Enter Stride (STRD).

Stride is another Cosmos chain that offers liquid staking. But, unlike its predecessors, it is finding traction.

Stride TVL. Source: DefiLlama

Its TVL quickly grew to just over $30 million since its launch in late 2022 until it peaked in June 2023, when the pace of adoption slowed down and the price of many tokens on Cosmos started decreasing. In native token terms, however, it hasn’t decreased.

Its LSD tokens (stATOM and stOSMO) have also found traction in Cosmos DeFi, with two of its pools (ATOM/stATOM and OSMO/stOSMO) being the second and sixth pools in Osmosis by TVL.

Osmosis liquidity pools by TVL. Source: Osmosis

Indeed, Stride's stATOM/ATOM pool has amassed a TVL of $16 million – dwarfing Quicksilver's qATOM/ATOM pool that sits at just $1 million. pStake’s is even lower, at $500,000.

An even starker difference emerges when comparing stOSMO and qOSMO pools. Stride's stOSMO/OSMO dominates with $3 million TVL, while Quicksilver's qOSMO/OSMO limps along below $100,000 – less than 3% of its Stride counterpart. pStake does not even have an OSMO pool, as the only liquid staking token it offers in Cosmos is ATOM.

We’re not trying to bash Quicksilver or pStake here. But it’s clear that with its innovations, Stride is finally opening plenty of eyes as to the potential of LSDs on Cosmos.

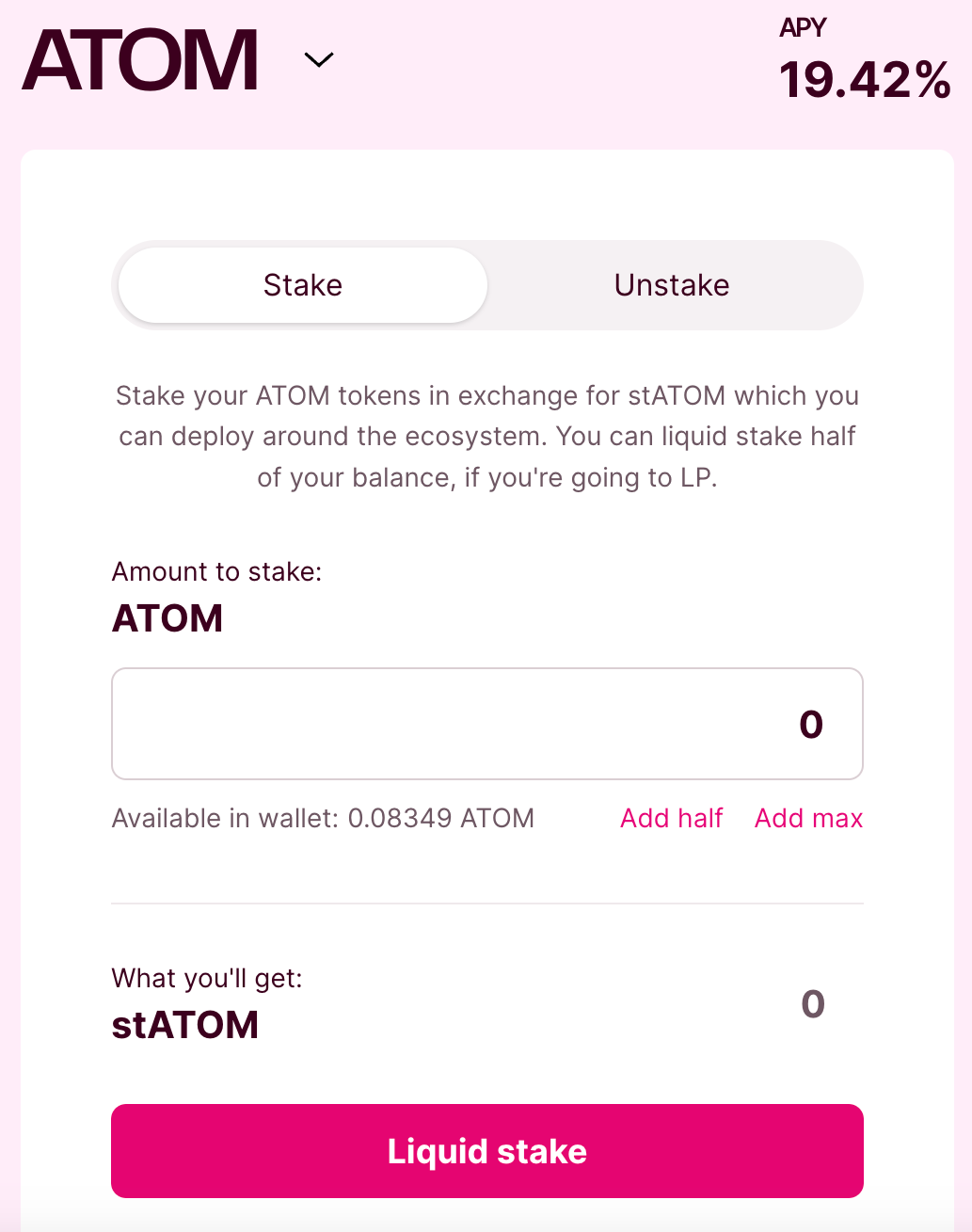

Part of the reason is it’s very easy to use. Staking requires just a couple of clicks, and Stride's interface is as clean as it gets.

Good UX is something we often overlook in crypto.

Stride even selects validators for you when staking, so that you don’t have to go through the tedious process of choosing one yourself.

Plus, Stride recently joined Cosmos’ Interchain Security (ICS) to further protect its network. ICS lets validators from a provider chain like the Cosmos Hub secure consumer chains, like Stride, by using ATOM.

So Stride now uses Cosmos Hub validators instead of its own.

The main benefit is a massive increase in the amount of value backing Stride’s security – from around $25 million in staked STRD tokens to $1.8 billion secured by ATOM stakers. This makes it much more financially difficult for an individual or group to attack the network. Enabling ICS also further aligns Stride and Cosmos.

The Next Frontier for LSDs

Our bet is that liquid staking can, if not be transformed by coming to Cosmos, at least it could rekindle the fire in the hearts of its users. And it would bring much-needed attention and liquidity to the ecosystem.

LSD growth on Ethereum this year has been staggering. But because of the way the network is set up, it’s possible that that represents only a fraction of the opportunities that LSDs offer. IBC connectivity may yet allow Cosmos to unlock LSDs’ disruptive potential beyond other ecosystems.

Our bet is also that Stride will be the dominant LSD solution in Cosmos, given its impressive growth and integral usage of interchain security.

The road ahead remains challenging given the damage inflicted by LUNA's collapse. But if anyone can pull a phoenix-like resurgence, it’s the Cosmonauts.

Keep it fun,

Kodi