Jan 15•11 min read

Musical Chairs

(Jerome Powell discussing the yield curve with the Board of Governors & staffers by Jarvis Labs)

Congratulations on earning a bachelor’s degree in monetary economics.

Last year, you learned about consumer price indexes (CPI), core inflation, the repo market, treasury curves, QT/QE, and the definition of a recession.

You even spent most of the year wondering whether the man running the money-printing machine – Federal Reserve Chairman Jerome Powell, or JPow for short – looked uncomfortable because he didn’t like the data, he was lying about something, or he ate a burrito for lunch.

But the biggest lesson learned through all of this macro nonsense was…

The FED giveth or the FED taketh away.

I’m referring to market liquidity. And in 2022, the FED taketh away.

Meaning every move, word, or announcement from the FED was like a reality TV show you turned on to see whether money would flow into the markets.

And it taught you a lot.

Now, it’s time to use your newfound knowledge of macro to change the world.

It’s a tall order. But the good news here is that you can apply your knowledge to crypto. I’m not referring to the FED’s actions causing crypto to go up or down. I’m talking instead about something our team at Jarvis Labs discusses daily when it comes to token fundamentals.

With Ethereum’s Shanghai upgrade fast approaching, we thought it would be timely to hit on some of these fundamental points as the event nears. And while doing so, explain why ETH looks to be the main play to start 2023.

As we learned from watching the FED this past year, things often come down to supply and demand. Let’s look through those two lenses to help us gain a better understanding of what’s on deck for Ethereum.

Supply Lens

Back in September, we wrote about The Merge, the event where Ethereum went from Proof-of-Work to Proof-of-Stake, in “Merge Like Joe Cool.”

That piece also touched on how the Merge led to Ethereum drastically reducing its supply and the implications of that change.

The main takeaway can be summed up in this passage:

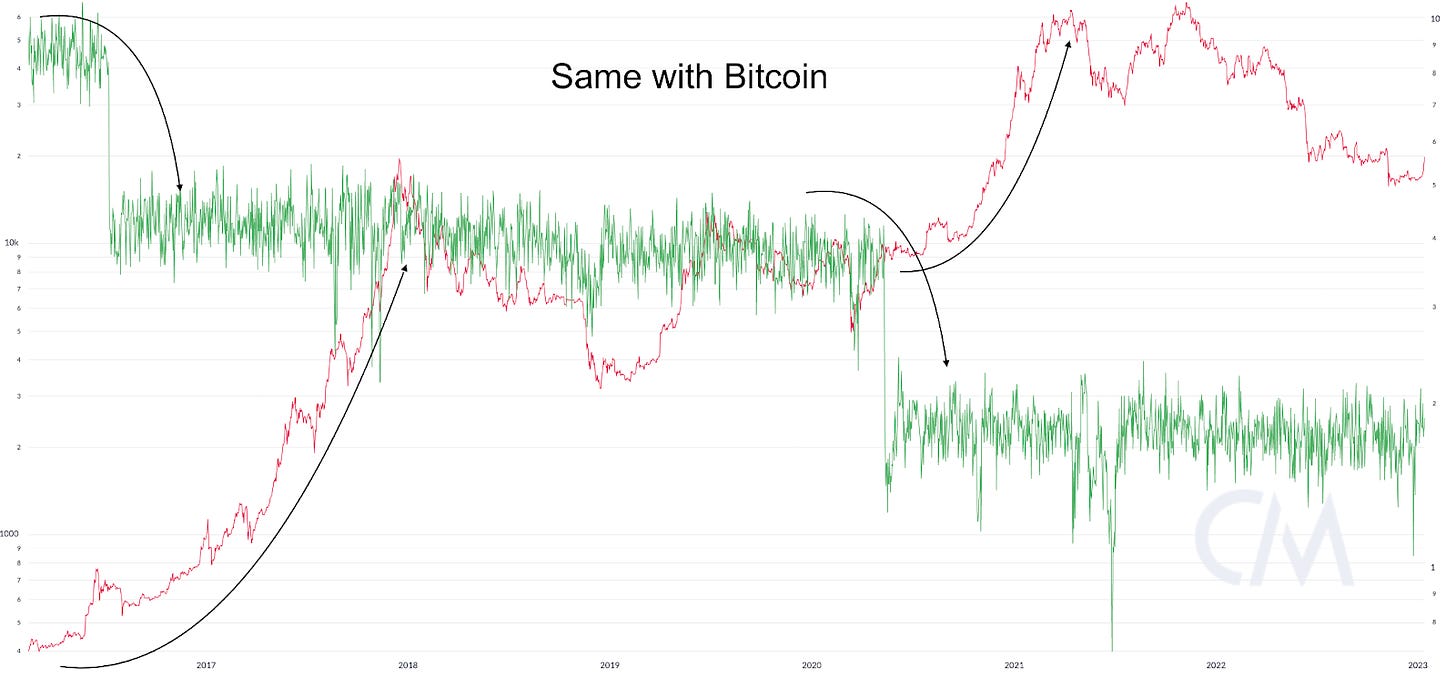

“We’ve witnessed this with Bitcoin several times now where its emissions rate gets cut in half every four years. Much of its cyclical behavior can be attributed to this. The difference being is the net liquidity is not as drastic as what we see unfolding here with Ethereum.

But what I want you all to take away here is that this supply dynamic takes a bit of time.”

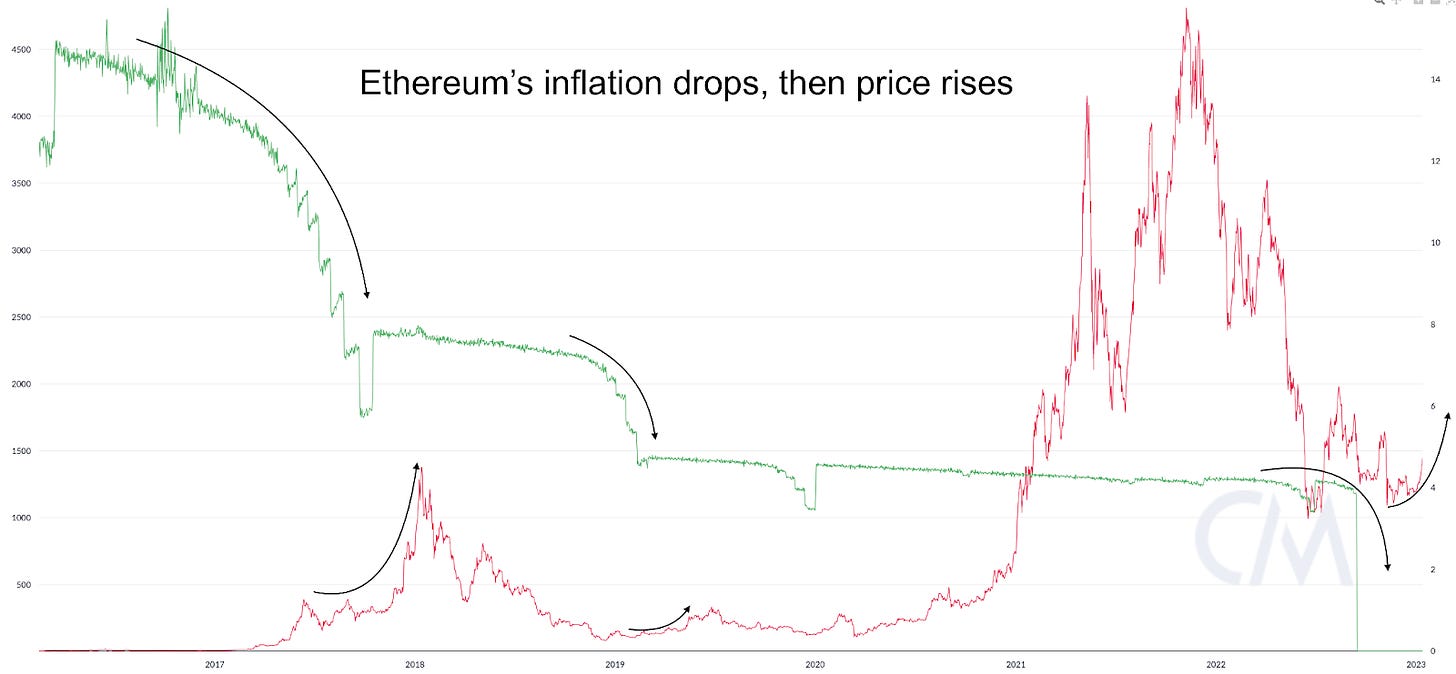

What that passage hits on is something that can be seen in these two charts below. The green line in both charts is inflation. The red line is price. The first chart is Ethereum while the second chart is Bitcoin.

As you’ll see, when inflation takes a nosedive, we see price shoot higher after some months. It is a dynamic that takes a bit of time to unfold.

The way we can think of this is that the quantity available in the market is slowly getting eaten away. It’s like musical chairs…When the music stops, players don’t rush to sit in a chair because there are plenty available. Then as the players realize there are fewer and fewer chairs, you see a frenzy begin.

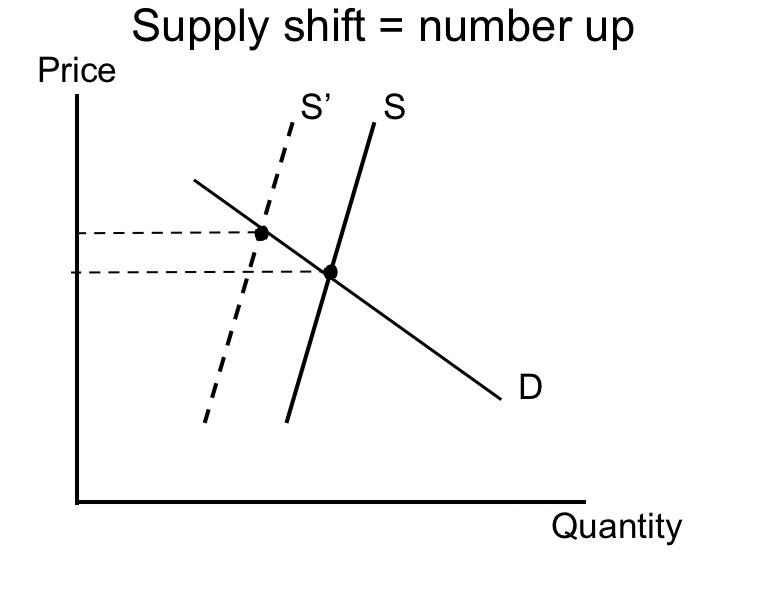

In the chart below, we can see how your professor would have framed it on their chalkboard. With the drop in supply, the supply curve shifts from S → S’. Assuming nothing else changes, price goes up.

That’s what we see in those two previous charts for Ethereum and Bitcoin… Supply shifts, then the market goes on to find a new price level.

The change in inflation creates powerful price dynamics.

Which is what we see on steroids right now as the net creation of new ETH is pretty much zero. And this does not even take into account the 2.5 million ETH staked to the network in 2022 Q4 alone… making this supply shift even more drastic than what the market thinks since staked ETH is less liquid.

When we break it down to just supply, we start to think that maybe this price thing really is that simple.

But remember, we have two lenses here.

Demand Lens

Do you recall what happened when Powell raised rates?

Pools of money became eager to earn all that newfound yield. The more Powell cranked the rates, the more appetizing yields became.

In turn, the U.S. dollar index as measured by the DXY rose nearly 30% in about 16 months. It is one of the index’s biggest moves in two decades.

The demand for the dollar is a lesson we can use for what is fast approaching for ETH because of the Shanghai upgrade, currently set for March.

When Shanghai goes live, the tokens currently staked to the Ethereum network can become unstaked.

Most tend to view this event as a reason for price to tank. I would not be surprised if a sell-off occurs based on technicals, especially if the price action is very strong in the weeks leading up to Shanghai.

But I’ll share three reasons here why a price dump on fundamentals is unlikely and why ETH stakers are unlikely to dump their tokens post-Shanghai...

First, if there was such a rush to unstake, then the various ETH liquid staking derivatives (LSDs), which represent staked ETH, would be trading at a severe discount.

One derivative we can look at is Lido’s stETH. Over the last week, stETH’s price on Uniswap v3 has been swappable with ETH 1:1. This is up over the last few months where stETH traded at a discount, meaning demand for stETH is rising.

If this changes as we get closer to the upgrade, then maybe it hints at people trying to front run the line to unstake their ETH tokens. But for now, it seems anything but that.

The second reason is that only so many ETH can be unlocked each day, around 43,200 according to Ethereum.org. With over 16 million ETH staked to date, this means it would take more than a year for all the ETH to become unstaked.

That’s a long time. Meaning Shanghai is not going to be the proverbial dam-breaking event causing all the staked ETH to flood into the market overnight as Crypto Twitter might have you believe at the moment.

Even if half of all locked ETH gets unlocked, ETH’s total supply of non-staked tokens would rise from about 106 million to 114 million ETH, It’s only a 7.5% uptick on token liquidity. The only way this becomes significant is if Ethereum activity is less than what we see today. But as you’ll see in a moment, I don’t see that happening.

Nor do I expect to see a trend in unstaking...

Only 13% of ETH is staked. If you look at other networks, this number has room to climb. Polkadot is about 45%, Polygon is nearly 40%, Solana near 70%, and Cardano at 72%. While I don’t see ETH matching those figures anytime soon, due to the token having more use cases, I do believe this number will rise in 2023.

In fact, just in the last week, some of the top protocols that offer LSDs have seen nearly a million ETH flood onto their platforms.

The market’s demand to get that yield is rising.

But here’s the main reason why a fundamentals-based sell-off is unlikely…and why demand will rise even higher.

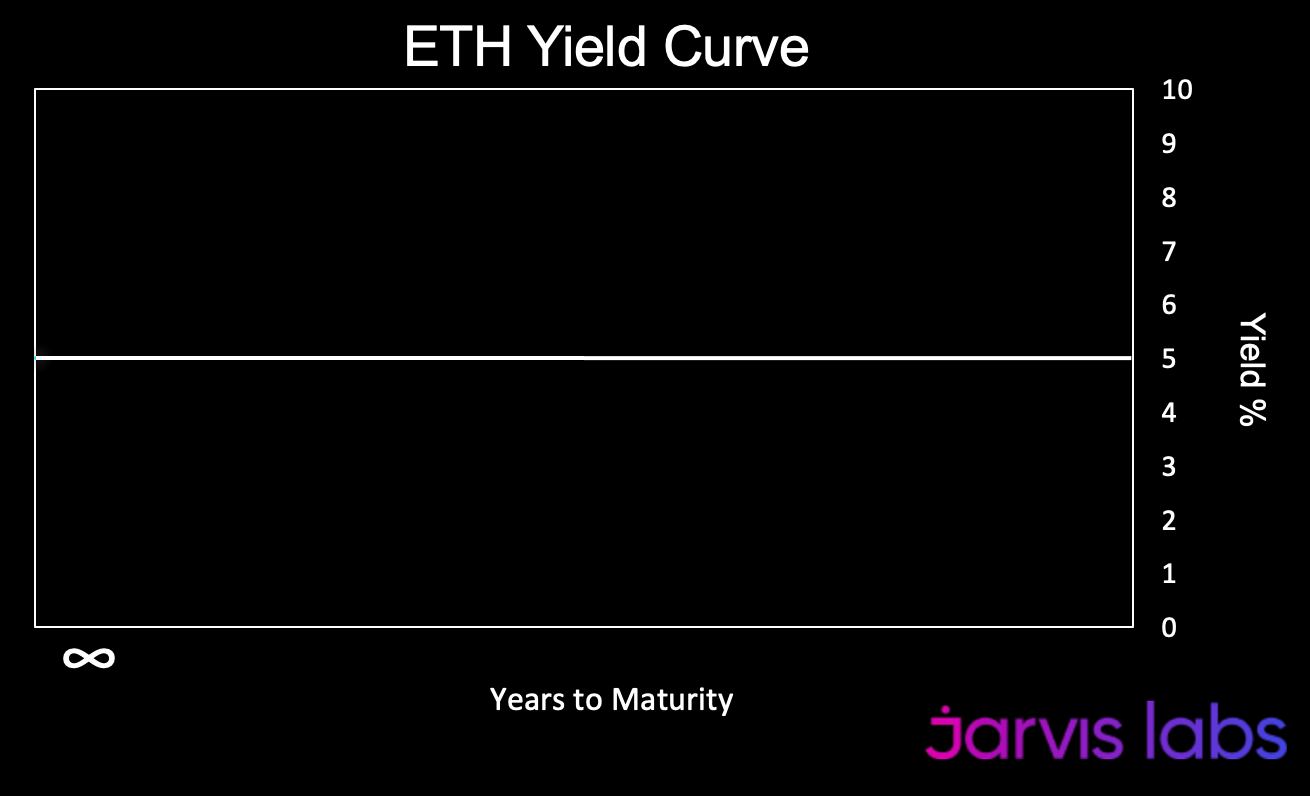

I’m anticipating the emergence of ETH’s yield curve. Well… At least a more sophisticated one than its yield curve today.

You see, because Shanghai introduces the ability to unstake tokens, that opens up a whole new world of possibilities related to ETH’s yield. To help explain the significance of this event, let’s lean on some macro.

Yields are juicy right now for U.S. Treasurys. You can get nearly 5% on some short-term T bills. Meaning you can “stake” your dollars to the U.S. government for several months and earn a yield. At maturity, you receive your dollars back.

You already know this from your macro 101 course.

But does this not sound like ETH as well now? You bond your ETH to the network, earn a yield, and at some date in the future, you unbond your ETH.

Interesting parallel, but let’s take it a step further.

Lido as a protocol has almost 5 million stETH. Hypothetically, users holding stETH can get in line to unstake their tokens. This gives their stETH a maturity date.

Where this gets fun is if a holder thinks it’s likely the yield on their staked ETH might fall from now until when their tokens are unlocked. As a result, they might try to lock in the current yield before it falls.

The combination of tokens with varying maturities and a secondary market on the network’s yield…

Marks the beginning of ETH’s yield curve.

This opens up a new arena for financial activities to begin. This in itself is enough to spark a new wave of demand for the ETH token.

I don’t know about you, but I am geeking out at the chance to start seeing how the market tries to offer loans on ETH while unloading some of the loan’s risk.

Say you use ETH as collateral on a one-year loan at a certain rate. The protocol then takes your collateral and locks it up somewhere else for one year to earn its own yield. This yield offsets the risk to the protocol that originates the loan… And now the protocol makes a nice spread assuming there’s no systemic wave of defaults.

If the user decides to pay back the loan earlier, no problem. The lender can go ahead and unload their bond in the market to then make the ETH available to the borrower again.

It is this type of innovation that can spark a new era in DeFi. It reminds me of the food token craze in 2020, when protocols attracted large sums of liquidity by issuing free food-themes tokens to users who deposited funds with them.

I wouldn’t be surprised to see protocols like Frax trying to compensate you for your ETH… And then other protocols trying to bootstrap ETH to their protocol with new forms of Yams and Pickles…

Whether we see new Yams or Pickles, we can be sure that new types of financial engineering can create new demand on ETH. One that will be fun to watch for the actual solutions as well as the price.

The Feedback Loop

Financial innovation and experimentation are sure to be in the air for 2023.

For those of us that were around in 2020, do you remember how much fun you had trying new protocols out?

Well, turns out a lot of Ethereum users enjoyed it as well. Transaction activity doubled around this time. You can see it in the chart below.

I bring this up because we should not forget EIP-1559. This Ethereum Improvement Proposal (EIP) means when transaction activity rises, so does the burn rate.

Our analyst and token design specialist, Kodi, wrote about the significance of this three months ago in “Welcome to Deflation City.” He said it didn’t take much of a spike in transaction activity for Ethereum’s inflation rate to go negative.

It also alluded to how significant this burn rate can become if activity returned in full force to Ethereum.

This possible new financial experimentation wave can be this exact force. And in turn, it would plunge inflation rates into the negatives.

This translates into a more drastic shift of the supply curve than what one would expect.

Falling supply of ETH, rising demand to stake ETH, and rising activity on the network… It is enough to create a powerful positive feedback loop.

Or put more simply…

If a group of people were playing musical chairs… This would be a scenario where additional chairs are being taken away before the music stops.

This should be a fun one to watch. And while we wait for this feedback loop to unfold, be sure to follow along on the day-to-day technicals on the @Jarvis_Labs_LLC Twitter account.

Stay tuned.

Your Pulse on Crypto,

Ben Lilly