Sep 10•9 min read

Maker’s Future Belongs on Cosmos, Not Solana

You know the bear is bad when even Vitalik seems to have given up and started selling.

The Ethereum (ETH) cofounder sold about $580,000 of his holdings last week.

But there’s more to the story. For one thing, he didn’t sell ETH, mind you, but MKR, the governance token of MakerDAO.

The reason?

Because Maker cofounder Rune Christensen recently caused a stir in the crypto community.

We know that the folks at Maker have been toying with the idea of launching their own complementary chain to the one on Ethereum. In fact, it’s the last step in their master plan Endgame.

What no one expected, including yours truly, was what Maker’s first choice for a base layer would be. Instead of choosing an L2 on Ethereum, Rune proposed forking Solana (SOL) and using the forked chain as Maker’s backend infrastructure.

This latest provocative idea is par for the course for Rune. No one knows what Rune means. Or does. But it’s provocative, it gets the people going.(1)

Don’t get me wrong, I love Solana and welcome more projects exploring launching new chains there.

But the decision is a tad surprising, considering that there’s a whole ecosystem out there that might be a better fit (hint: it’s one we’ve discussed before).

In fact, Rune even said he also considered this network: Cosmos (ATOM).

The main reason he chose Solana instead is that, “Cosmos is not built around efficiency at its core...it would cost more to maintain and keep performant.”

Solana is built around the idea that hardware capacity improves exponentially, and blockchains should be designed to scale with hardware.(2)

As hardware’s performance scales, so does Solana. So, Solana is and likely will always be more efficient and better-performing than Cosmos.

However, Cosmos enjoys some other advantages when it comes to building AppChains that no other ecosystem enjoys.

The Case for Cosmos

Cosmos aims to be a network of connected blockchains. But creating a blockchain makes doing your taxes seem like a walk in the park.

This is why the folks working at Cosmos HQ have created a blueprint for launching a chain, composed of CometBFT (previously Tendermint), the Inter-Blockchain Communication protocol (IBC), and the Cosmos SDK.

CometBFT is the consensus algorithm through which nodes agree on the network. It might not be cutting-edge technology now, but it still is likely the most widely used consensus algorithm in crypto, even by some non-Cosmos chains like Binance Smart Chain. It is thus as battle-tested as they come.

And it can still be pushed to perform well. Sei, a Cosmos chain focused on trading, just launched with a speed of 20,000 transactions per second (TPS) and a time to finality (TTF) of 50 milliseconds. By comparison, Solana, one of the fastest chains out there, has a max TPS of 10,000 TPS and a TTF of 2.5 seconds.(3)

But the Cosmos SDK and IBC are arguably the most important features.

IBC is nothing short of revolutionary.

If you have ever ventured into L2s (like Arbitrum Optimism) from Ethereum, you’ll know you need to bridge assets from mainnet to the L2 in order to transact.

But bridges rely on centralized validators who must "honor" asset transfers. If compromised, these validators put funds at risk, as seen in the exploits of Wormhole, Nomad, and more.

Building safe bridges is extremely difficult. It is no wonder then that four of the top five hacks on the rekt leaderboard are related to bridges.

IBC does away with all of this. IBC messages are trustless – that is, there is no middleman that needs to be trusted for the thing to work. The IBC protocol itself handles the authentication of cross-chain messages.

What you get is a simple way of establishing communication channels between different blockchains.

Meanwhile, the Cosmos SDK makes it easy to quickly customize your own blockchain tailored to your app's needs. It has modules, each one handling a specific area (e.g., governance or IBC connectivity).

This means developers don't have to reinvent the wheel each time they want to launch a new chain. They can focus on their core application logic while the SDK handles the heavy lifting in the background.

So why would Maker need to build a new chain on Cosmos (or Solana) when Ethereum is still the most popular DeFi chain around?

Well, turns out that’s part of the problem.

Heavy Is the Head

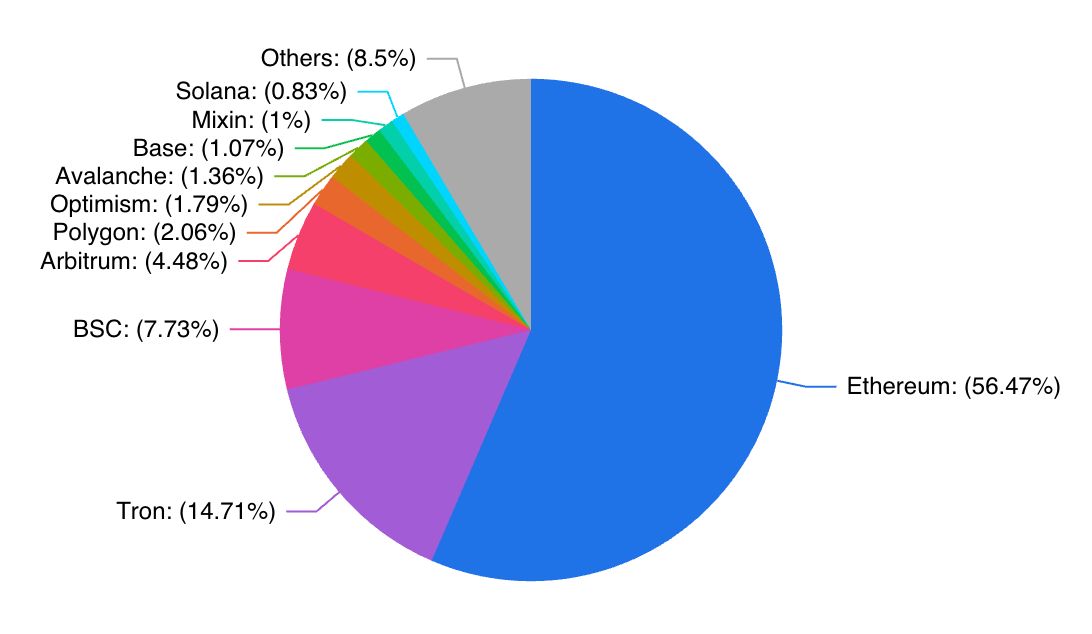

The data paints a clear picture: Ethereum is still the prom queen of crypto. Its DeFi ecosystem dominates the blockchain landscape in terms of value locked, stables, and overall ecosystem activity.

Over $21 billion in total value is locked on Ethereum – over $24 billion if all Ethereum L2s and rollups are counted. This dwarfs any other chain, including BSC ($5.5 billion), Polygon ($770 million), or Avalanche ($500 million).

DeFi TVL by chain. Source: DefiLlama

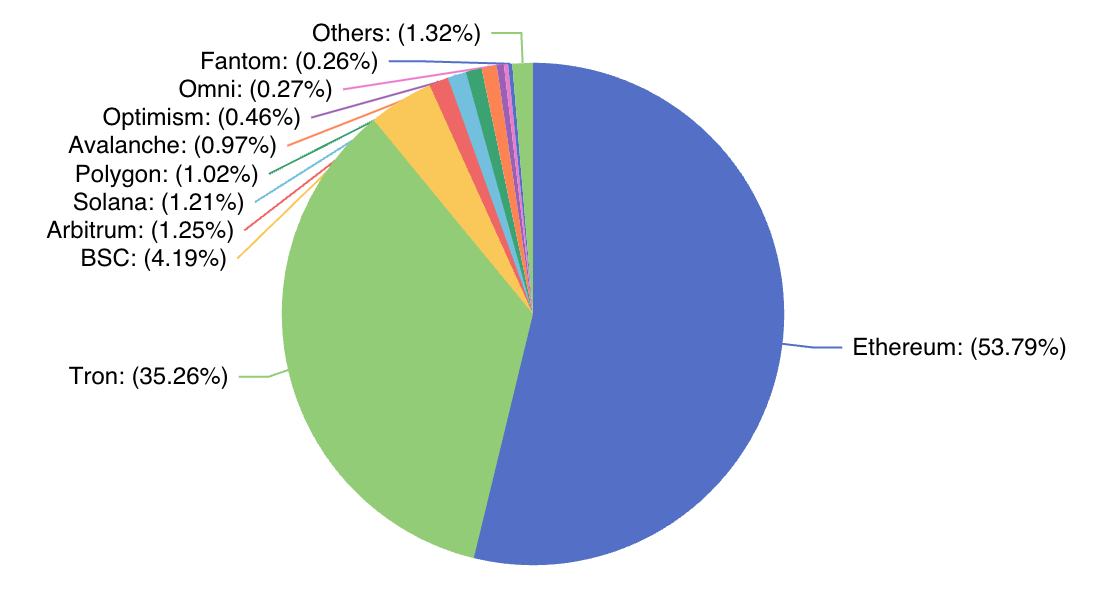

Plus, Ethereum dominates the stablecoin market with over $69 billion in settled stables, more than half of the total $130 billion stablecoin market cap. The only chain that comes close is Tron with $44 billion, 92% of which is just Tether (USDT).

This cements Ethereum as the clear settlement layer for crypto assets.

Stablecoin circulation by chain. Source: DefiLlama

But all this activity brings problems. Challenges like congestion, gas fees, and scalability limitations hamper the Ethereum user experience as more apps get added to the chain.

In order to fit as many apps as possible on a single chain and keep it functional, we’d need to scale it through roll-ups, bridges, state channels, etc. And this is no easy feat, as we are seeing on Ethereum.

That's where Cosmos comes in.

Cosmos was built around the AppChain thesis. At its core lies the question: Instead of trying to fit all apps into a single blockchain, why not build each application as its own chain?

Cosmos believes that applications should form a myriad of chains, each designed specifically to host that application, and all chains should be connected by a shared communication standard.

Letting Cosmos handle the boring and hard bits (logic handling, security, governance) can enable you to offer truly great product experiences on Ethereum.

A project can leverage Ethereum's network effects and higher capitalization while using Cosmos for backend logic, interoperability with other IBC chains, faster transactions, etc.

This is a combination that we are likely to see more of in the future. A Cosmos chain as the “coprocessor” of Ethereum, activating dormant liquidity on Ethereum, reducing costs, and automating transactions.

And there’s a project out there that has already realized Rune’s vision of launching a product on Ethereum while keeping the backend on a separate chain.

The Best of Both Worlds

Sommelier Finance is a protocol built on the Cosmos blockchain that aims to expand the capabilities of Ethereum-based decentralized finance.

With Ethereum gas fees being more expensive than a bottle of Dom Pérignon, Sommelier looks to uncork opportunities for small-time investors.

The project currently offers two main services – yield farming and algorithmic trading strategies. For the user, it’s as simple as choosing one of them, locking money in the vault, and watching as your dear crypto holdings grow little by little.

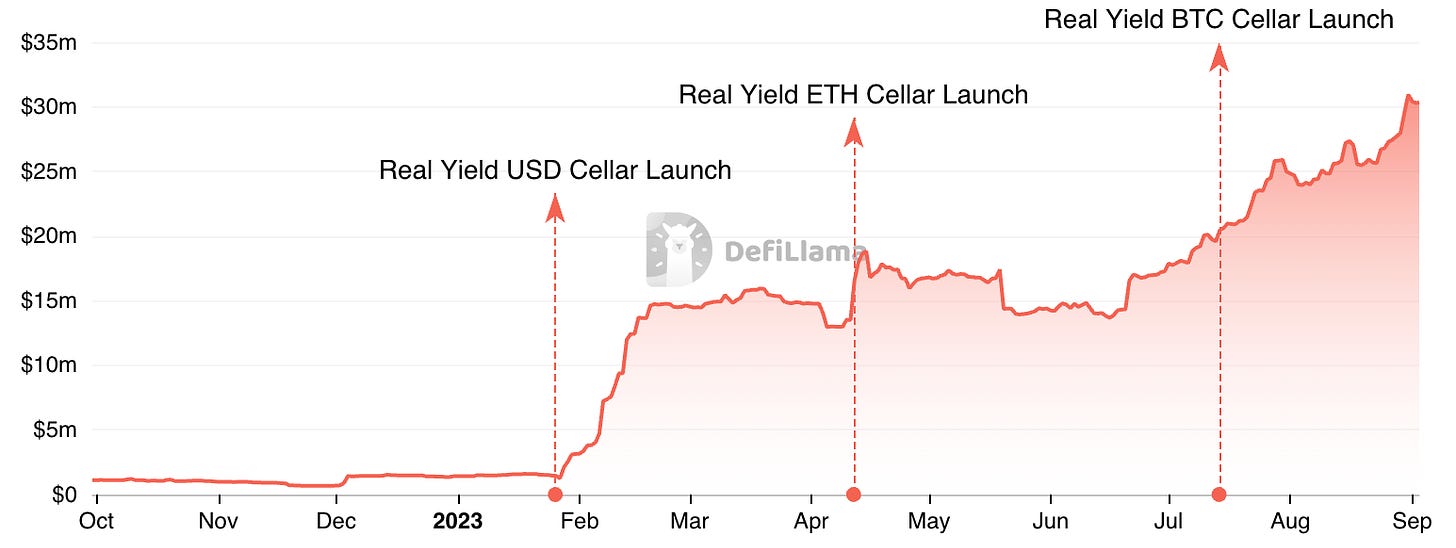

Sommelier Finance TVL. Source: DefiLlama

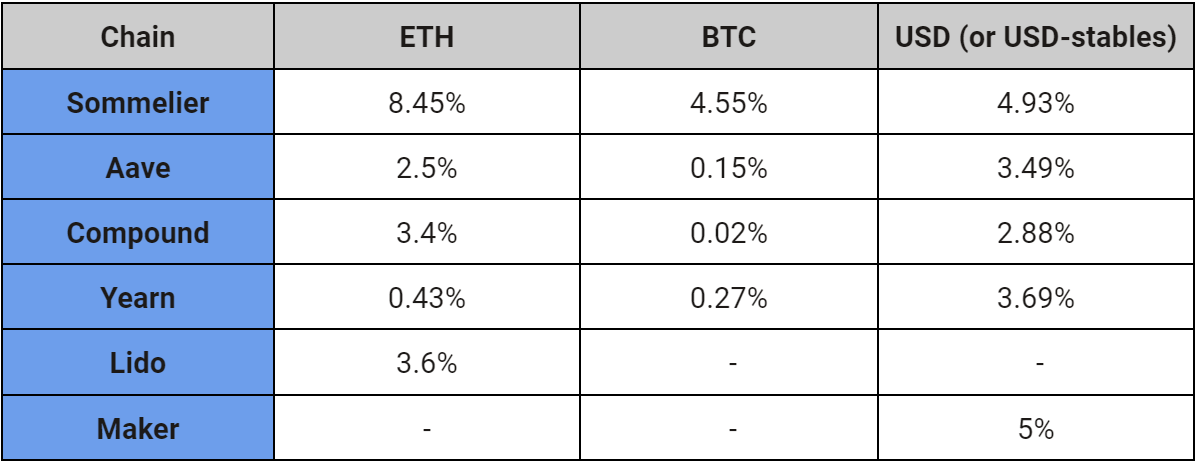

The algorithmic trading vaults saw some inflows at the beginning, but it wasn’t until the main yield vaults arrived that total value locked (TVL) exploded. And it is no wonder. Here’s how Sommelier’s “Real Yield strategies compare with the blue-chip DeFi protocols:(4)

Aside from Maker, Sommelier’s yields for ETH, BTC, and stables beat any of the blue-chip protocols hands-down. And even Maker’s 5% yield for DAI is only a temporary measure to attract TVL and will be reduced to 3.19% in the coming weeks.

The only way to find higher yields is to get into riskier, more exotic yield strategies, like selling calls, or providing liquidity (which risks impermanent loss.)

It is no wonder then that Sommelier’s yield vaults drive most of its TVL, with over $30 million locked in them compared to the $200,000 in the algorithmic trading vaults.

So what’s Sommelier’s secret sauce?

One advantage is that its strategies are run off-chain, which enables resource-intensive algorithms to run while preserving their privacy.

But I’d argue that its edge lies in being able to harness the strengths of both Ethereum and Cosmos.

The Cosmos backend provides a sovereign foundation handling governance, security, and cross-chain communication. This keeps fees low by reducing Ethereum mainnet transactions. Meanwhile, the user-facing front end takes advantage of Ethereum's vibrant ecosystem.

If more developers realize the synergies between these networks, we may see an influx of innovative, new Cosmos-based applications that use Ethereum as their window to users. This, together with bringing liquid staking to the network as we explored in our last piece, may prove to be the way to rekindle the fire of the Cosmos community.

Just as liquid staking can inject much-needed liquidity into Cosmos, so too can Ethereum-Cosmos hybrid products catalyze fresh energy and progress for this ecosystem.

Keep it fun,

Kodi

(1)Couldn’t help myself. Gotta give credit to Will for this one.

(2)Frankly, this is above my paygrade, but if you are interested in hearing more about it, here’s an interview with Anatoly Yakovenko that explores this in depth.

(3)For a deeper exploration of TPS, TTF, and what they tell us about how performant a chain is, do check out our piece on Cardano.

(4)Some of these protocols offer multiple pools with different yields; they also offer different pools for different stables (USDT, USDC, etc). For all of them, the pool with the highest yield was considered. Also, token incentives have been subtracted, and only the base yield for each pool is presented.