Jan 09•8 min read

The King is Dead, Long Live the King

Wake up, reader.

The Matrix has you.

That’s right, you can’t trust your own thoughts and perceptions.

Neither can I.

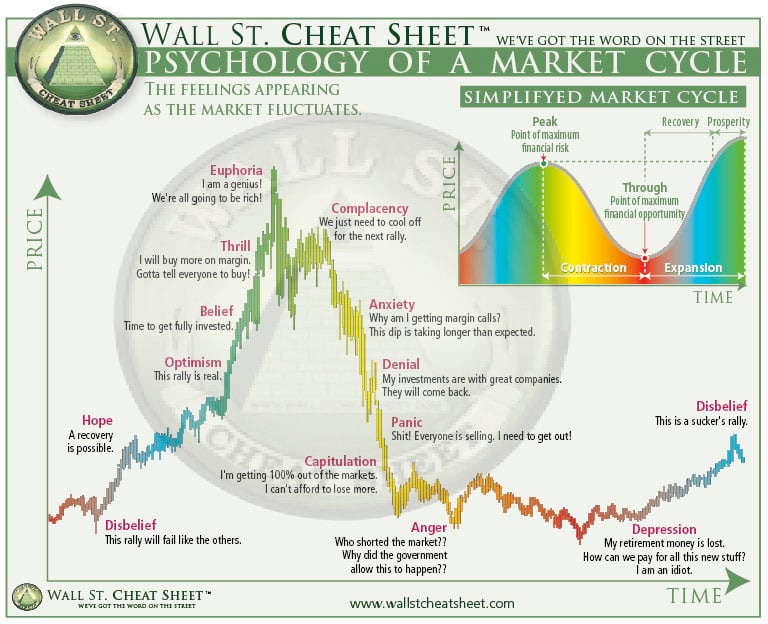

If we could, we wouldn’t see the same stories repeat themselves in the markets time and time again: irrational exuberance at highs, followed by extreme cynicism and depression at market lows.

Go back to spring 2021…

Crypto markets were experiencing peak levels of euphoria. Elon Musk was pumping Dogecoin on Saturday Night Live, Coinbase IPO’d, FTX was buying sports stadiums, and crypto’s market cap surged over $2 trillion. Life was good and getting better.

…or so we thought.

Since then, we’ve been put through the wringer, whether it’s macro events like Fed hikes, the invasion of Ukraine, or crypto-specific catastrophes like FTX.

Did anyone have all of the above on their 2022 bingo card? The short answer is no. The future is always impossible to predict with 100% accuracy.

But in times of peak euphoria or despair, we can avoid ruin by relying on data and becoming machine-like rather than succumbing to emotions and recency bias.

For instance, if you were focused on the U.S. Dollar Index (DXY) bottoming out in Spring 2021, instead of crypto mania, you could have sensed an increasing probability that trouble was coming in 2022 and acted early.

We’ve touched on this a few times before, most recently here, but the primary reason why the dollar is important is because it’s the global reserve asset, and as such, all other asset values are priced against it – crypto included.

This means that DXY’s movements can have profound implications on crypto prices in the near future. When DXY goes up, it’s risk-off. When it goes down, it’s risk-on.

In early 2021, you may remember the prevailing market narrative was that the dollar would never rise, because the Fed was “trapped” into keeping rates low. There was serious talk of them being unable to ever hike again.

The market would harshly debunk this falsehood throughout the past year. To borrow from Mark Twain, “rumors of the dollar's demise were greatly exaggerated.”

Last Friday, my colleague TD covered the fundamentals he believes will sustain the dollar’s dominance this year.

Today, I wanted to offer another perspective from the technical side. Although my outlook is different from his, here at Espresso we believe it’s important to show you what all the data is telling us, and let you draw your own conclusions from there.

The important thing is to rely on data, not on emotions and bias.

So with that in mind, today let’s review the charts and see the potent warning signal DXY is flashing which tells us that this time might not be so different after all.

To borrow from Mark Twain once again…

“It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so.”

Changing Tides

Before we get into the warning signal, let’s discuss a key indicator for identifying trend changes.

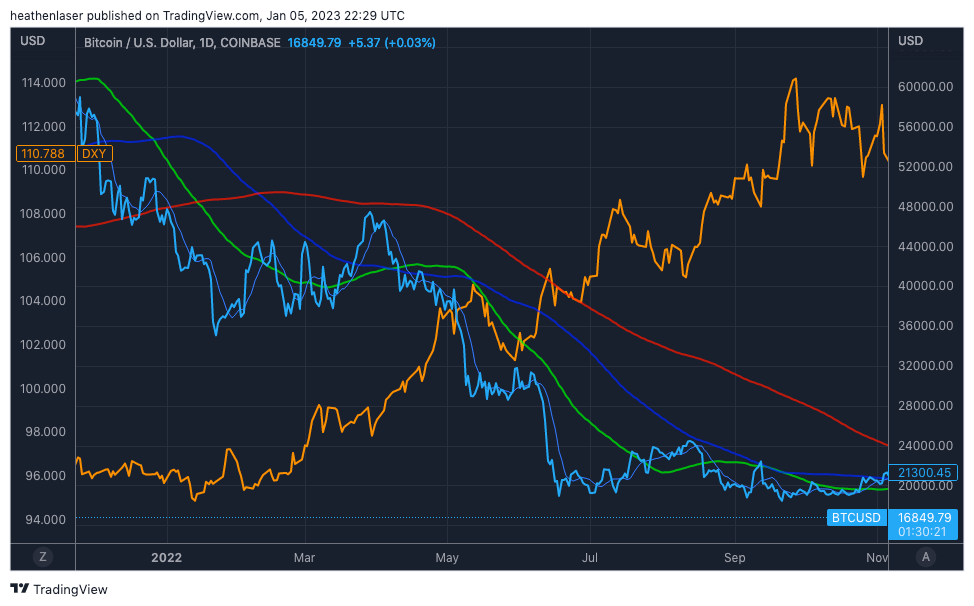

This chart below shows us DXY (light blue line) and its major moving averages (MAs).

MAs are a simple way to pierce through narratives and see market structure through an emotionless lens. They allow us to easily identify key levels of price support and resistance, so we can recognize directional trends.

When price is above its MAs, assets are in a bull trend, and when price is below its MAs, they’re in a bear trend. Intertwined MAs signal a trend change in progress.

As we can see, the dollar is now a long way removed from its best days of 2022.

From October through December, its parabolic trend of 2022 collapsed, ending with it closing the year below all major MAs.

But perhaps it “just needs to cool off for the next rally.”

The last time the dollar was below all major MAs was in Spring 2021, when crypto markets were in their full glory.

And while this breakdown alone isn’t enough to confirm anything as it relates to BTC and ETH, if we dig deeper, there’s another pattern forming right before our eyes that could have huge implications.

Crucifying the King

A “death cross” describes the phenomenon of an asset's 50-day MA (green line below) dropping below its 200-day MA (red line).

This happens when assets have fully exhausted their uptrend. Think of it as the final nail in every bull market’s coffin.

For reference, Bitcoin (BTC, light blue line) experienced a “death cross” in early January 2022 when prices were near $45,000.

In the months that followed, it fell by over 75% and spent the entirety of 2022 helplessly trapped below its 200-day MA.

If we overlay the dollar (DXY, orange line below) on that same chart, we see as Bitcoin momentum faded, the dollar’s bull run was just beginning.

DXY climbed from 94.50 in January 2022 to a September 2022 peak of 114.50.

Due to this high inverse correlation, we might be about to see the reverse play out in 2023.

DXY’s 50-day MA has already fallen below its 100-day MA, which signals exhaustion. And as we see below, “King Dollar” is now days away from its first death cross since 2020.

Below, we see the two most recent examples of DXY death crosses, and their effects on BTC and Ethereum (ETH).

Both preceded massive dollar depreciation cycles and crypto bull markets.

The first came in mid-2017. The dollar death-crossed (green line) while BTC was trading at roughly $3,000 and ETH near $185.

About six months later, BTC (orange line, first chart) was trading over $19,500 and ETH (orange line, second chart) close to $1,400.

Then in June 2020, the dollar death-crossed once again, and you likely remember what happened next…

Bitcoin went from the $8,000 range to over $65,000 within a year.

Once animal spirits were reawakened, ETH kicked off DeFi summer, which led it to parabolic all-time highs in 2021.

So based on the above, if I told you BTC and ETH were also on the cusp of technically changing their macro trends…

Would you believe me, or take me for yet another fool strung out on hopium?

I can hear the skeptics already…

“FTX fallout is just getting started.”

“Sub-$10,000 BTC has to happen.”

“Michael Saylor must be liquidated.”

“Crypto will never survive an economic recession.”

Etc., etc.…There’s that recency bias again.

Maybe those things will come to pass, maybe not.

But if we observe the technicals rather than listening to stories, we see both BTC and ETH are inching ever closer to rising above their MAs and beginning a new trend.

Not unlike DXY in the second half of 2021, after everybody left it for dead.

Beach Balls Underwater

This chart below shows BTC versus its 50-, 100-, and 200-day MAs.

On January 4, both BTC and ETH reconquered their 50-day MAs. A meaningful first step in creating a new trend if it holds.

From here, BTC would only need to break its 100-day MA ($18,039) followed by its 200-day MA ($19,633) in order to fully reverse its technical trend for the first time since September 2021.

ETH’s hurdles are even closer in sight, with the last major MA sitting at just ~$1,388.

These low MAs for both BTC and ETH are a reflection of how long prices have been suppressed.

The idea of a “beach ball held underwater” comes to mind while looking at these charts. Once that ball has nothing holding it back, it will rocket to the surface.

Crypto markets have gone without a meaningful rally since August, a trend which seems likely to break in a big way soon should DXY’s implosion continue in the weeks and months to come.

And if we pair these charts up with other indicators such as the MVRV breaking above its 200-day MA and CME futures still trading in deep backwardation, the stage will be set for a strong disbelief rally in early 2023.

The caveat here being a surprise DXY rebound back to the highs, or further forced selling of crypto that would quickly spoil any hopes for a crypto revival. As we know, there is no shortage of looming events which could cause this.

But in markets there can be no outsized rewards without accompanying risk. It’s just a matter of acting on high-probability set-ups when they appear and always having a clear exit strategy in the event of invalidation.

That’s the name of the game when attempting to catch a new trend early.

What do you guys think?

Comment below, or message me on Twitter @JLabsJanitor.

Your friend,

JJ