Dec 13•5 min read

Powell Prepares to Deliver a Check

My opponent stops sooner than I expect.

He catches me off guard, and now my skates are sliding out from under me…

We crash into the corner boards hard.

I take the brunt of the collision, as the other guy is a bit more graceful at impact. That’s because he was expecting me to play aggressively… as I had been all night.

So instead of letting me pin him to the boards again, he takes me out before I have a chance.

It’s a move that’s all about keeping me off his back. A wise one, too, as he gave himself a bit of room to play the puck whenever he has to defensively dig the puck out of his zone.

I still feel the aftereffects of this play in my ribs as I write… and while I hope it goes away before I take the ice again, I can’t help but think Mr. Jerome Powell will be looking to play the same move on the market today at the last FOMC meeting of the year.

Reason being is the market is getting aggressive on him again. And he may use today as a way to give himself some wiggle room to play monetary policy his way…

Aggressive Money

In May of this year, we began to know terminal rates were near, after they felt too far off for all of 2022.

JPMorgan even told its investors, “Policy is currently tight, and the Fed is most likely on pause,” in its FOMC assessment at the time.

The arrival of terminal rates gave the market what it wanted, despite what all the permabears had to say regarding Treasury liquidity issues (always remember who said the sky was falling for the last 1.5 years, as their tune hasn’t changed).

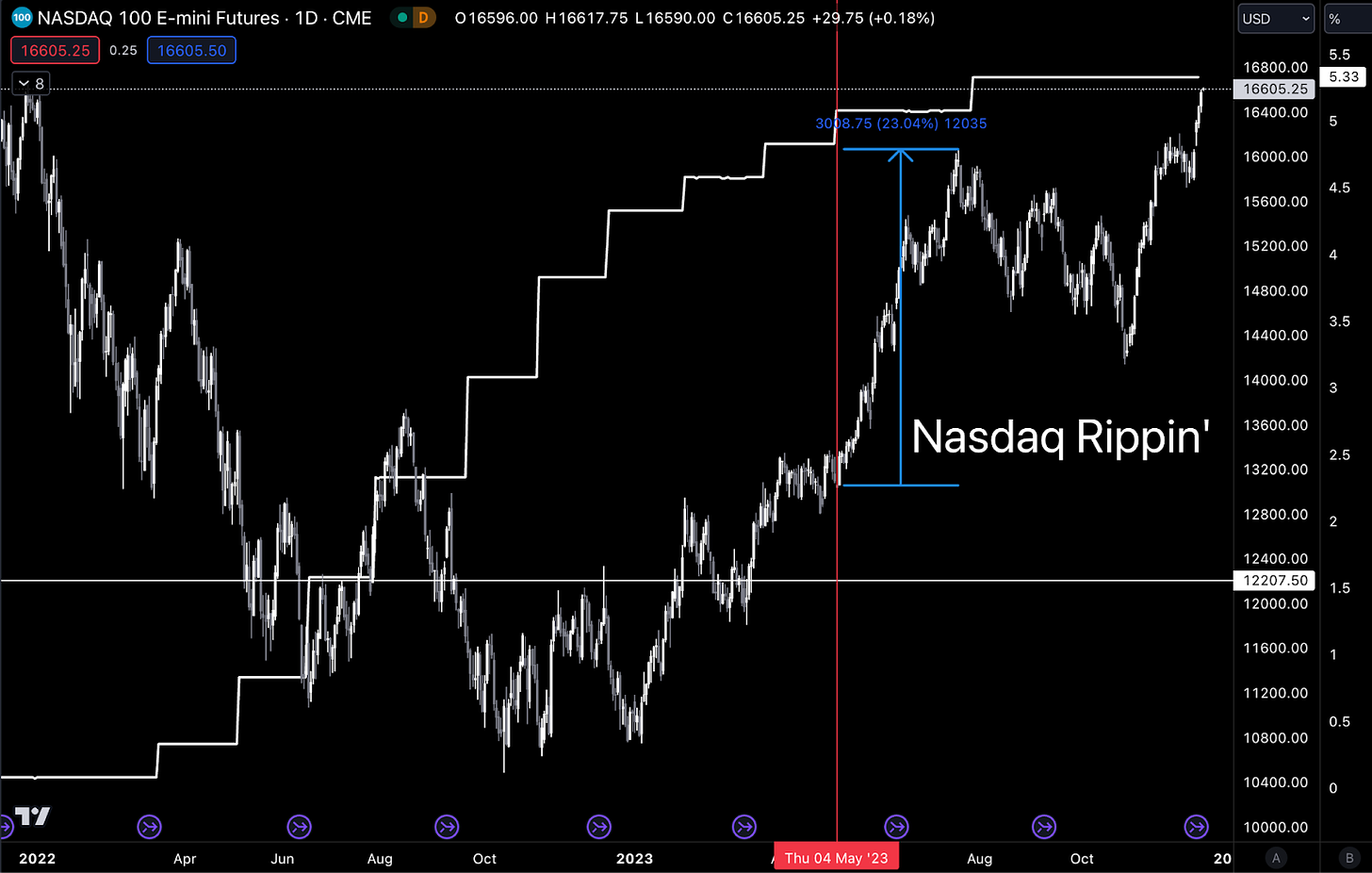

We can see the second-to-last rate hike was where the market caught fire. The Nasdaq rose 23% in the two months that followed.

We then see the Fed hiked one more time after that. The market didn’t like it a whole heck of a lot, and many thought Jerome went one step too far.

Today, we see the market is still ripping without pause.

Part of this is because of what we see in the chart below…

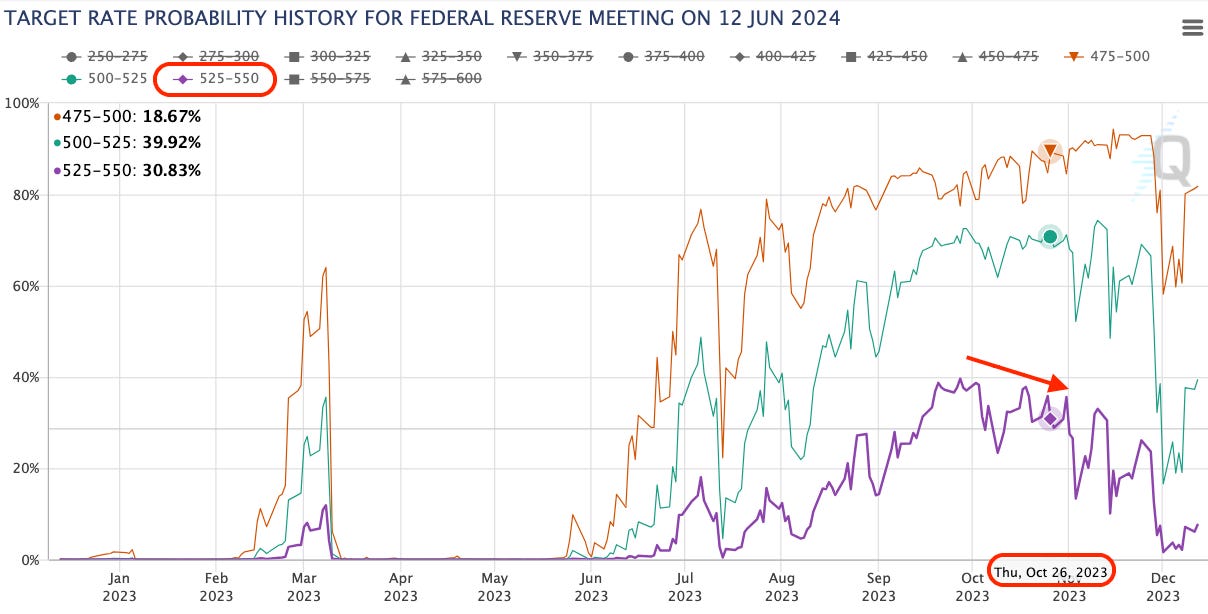

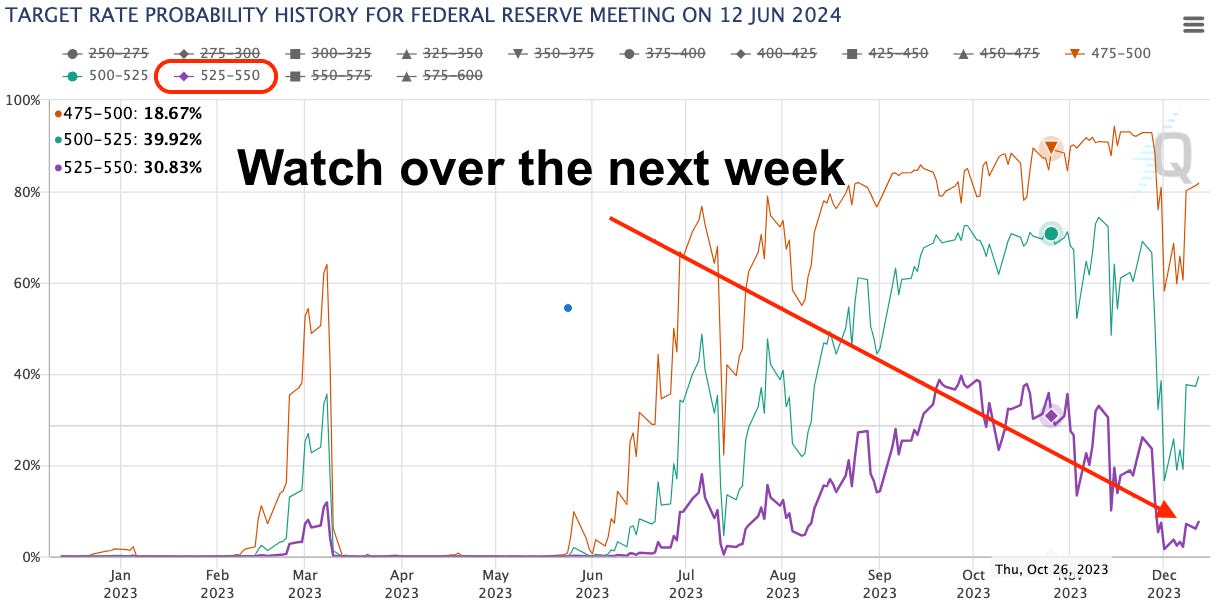

The market is beginning to expect rate cuts. In the chart below, we have expectations over time for rates coming out of the June 2024 meeting. We can see in the run-up to October 26 – when the market began its most recent rip higher – rate cuts were starting to get priced in.

The purple line is what rates are now. And with the line trending down, that indicates less probability that June 2024 rates will be as high as current rates…

If anything, the highest probability on that date was 25 basis points (bps) lower.

Below is the Nasdaq with the October 26 date as the red vertical line. The market has risen 17% since then.

The market is playing aggressively. And just like we saw this year in July with Jerome making what the market felt like was one hike too many, I’d expect the Fed to give the market another “check” to give itself a little breathing room.

Which is to say, watch the purple line in the days that follow here, as I’d expect this to trend up.

And just because Powell might not deliver a subtle dose of hawkishness in the press conference, that doesn’t mean he can’t do it in the hours or days that follow.

If we don’t hear him shoot down the possibility of rate cuts, I wouldn’t be surprised to hear other board members leak this sentiment to the media in the days that follow…

It would be them trying to signal the market to settle down.

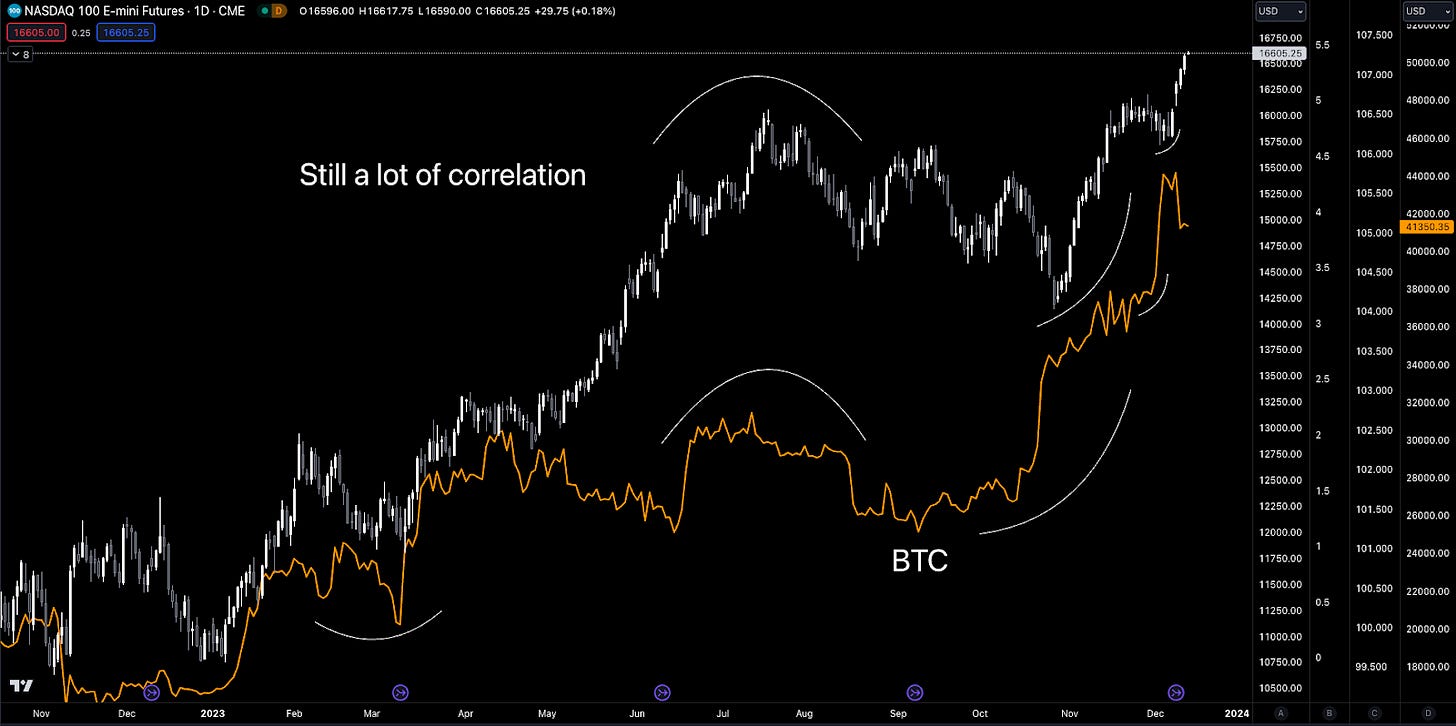

And while this is all great to know if you’re trading the Nasdaq, does crypto even care? Or is Bitcoin acting like a honey badger…

Nasdaq vs. Crypto

Turns out, it does. Dang.

What’s interesting here is that Bitcoin is actually front-running some of TradFi’s moves for the most part.

But what it also says is that the selloff we saw to start the week might be more about what’s to come. Which I find hard to believe, because liquidity in crypto has been – as the trade desk said the other day on the recent Pablo selloff – ocean-deep.

Translation: The market was well-positioned to absorb Pablo’s selloff over the weekend.

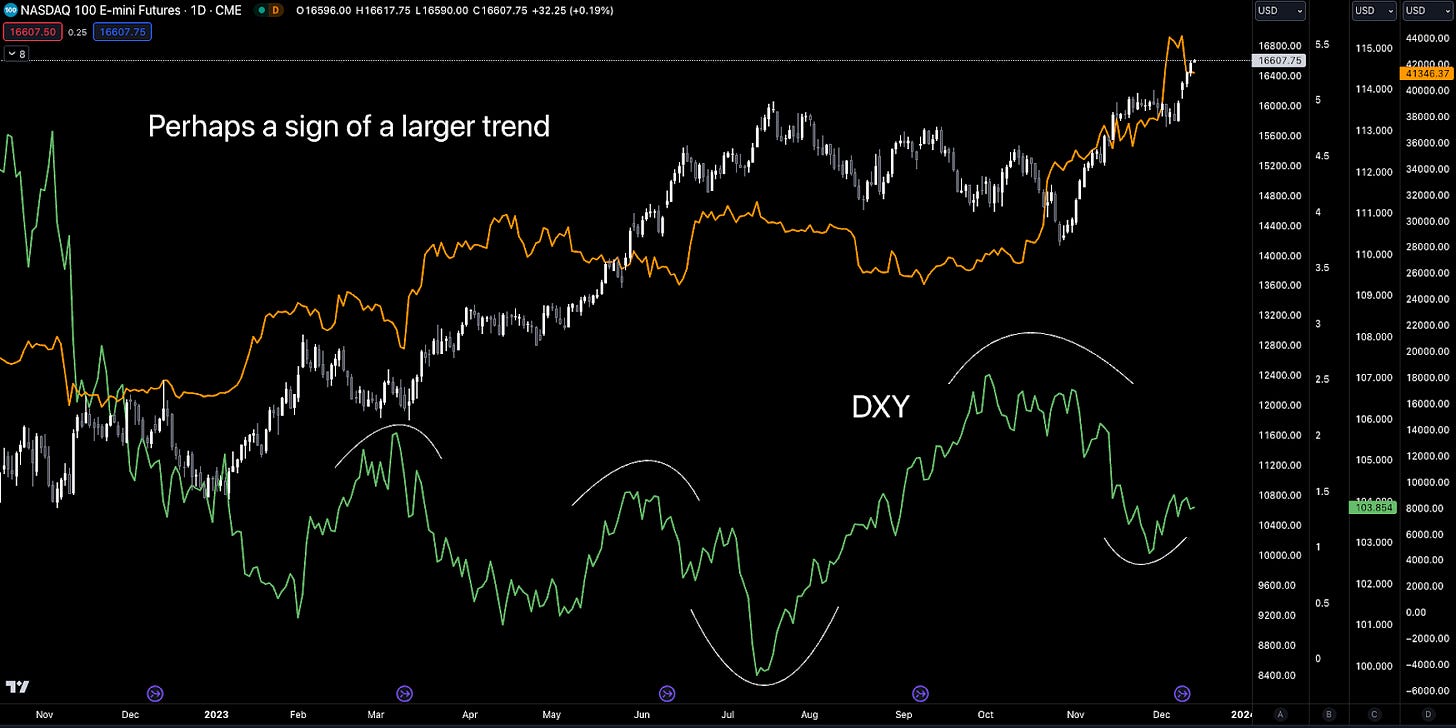

But what we know is that some of this entity’s activity is correlated with the U.S. Dollar Index (DXY) or its reversal. And if we pull up DXY and add it to the chart above, we can see what might be happening here…

The U.S. dollar might be building up strength here. And in the chart above, we can see Bitcoin and the Nasdaq have been responding to DXY’s reversals… DXY reverses up, the other two markets pivot down.

And if the Fed signals to the market that we should not expect rate cuts like the market is currently predicting, it means the rest of 2023 will have a headwind.

If that happens, I wouldn’t expect it to last too far into 2024… Mostly because I don’t think the market will believe Jerome for too long here.

If anything, we are still lining up for a strong post-halving run.

Your Pulse on Crypto,

Ben Lilly