Nov 11•10 min read

How Freeos Works Part 2: Maintaining Value

(This is a continuation of Part 1)

The Freeos Economic System is unlike other attempts to create price stability amongst cryptocurrencies.

Instead of attempting to be stable in terms of fiat dollar values, the Freeos Economic System incentivises the participants to steer the economy towards real-world purchasing power.

This is important and represents a key point of difference from other currencies.

- Unlike other government-issued fiat currencies that often devalue over time and slowly erode the purchasing power of a currency.

- Also, unlike other cryptocurrencies (stablecoins) that maintain fiat-based price stability — and end up suffering the same value erosion.

What is the advantage of achieving real-world purchasing power stability?

Part of the Freeos philosophy is that an ongoing income — which can stabilise towards real-world purchasing power — empowers a currency to be practically useful for the majority of people on this planet — and perhaps beyond.

Maybe UBI could be not only democratic, but also truly Universal…

The more people find Freeos to be useful, the more people will join.

The more people join, the more markets will start to use FREEOS tokens — which will then lead to more people joining, and so on.

Creating a virtuous circle that steadily maintains the value of the FREEOS token to reach a sustainable equilibrium.

This equilibrium is not reached through authority, magic, wishful thinking or overly-complex algorithms.

It is maintained through a Democratic Fiscal Policy that incentivises the participants to steer the economy towards stability and sustainability through Swiss-style direct democracy applied to a number of economic levers.

The Freeos Economic System leverages the often-touted “wisdom-of-the-crowd” dynamics that often can steer complex systems towards uncanny success.

The Democratic Fiscal Policy enables the participants with tools that are designed towards steering the economy wisely.

What kind of tools?

The tools are a number of key economic mechanisms — levers — that the participants vote on to help manage the price stability and maintain a price floor.

The primary mechanisms include:

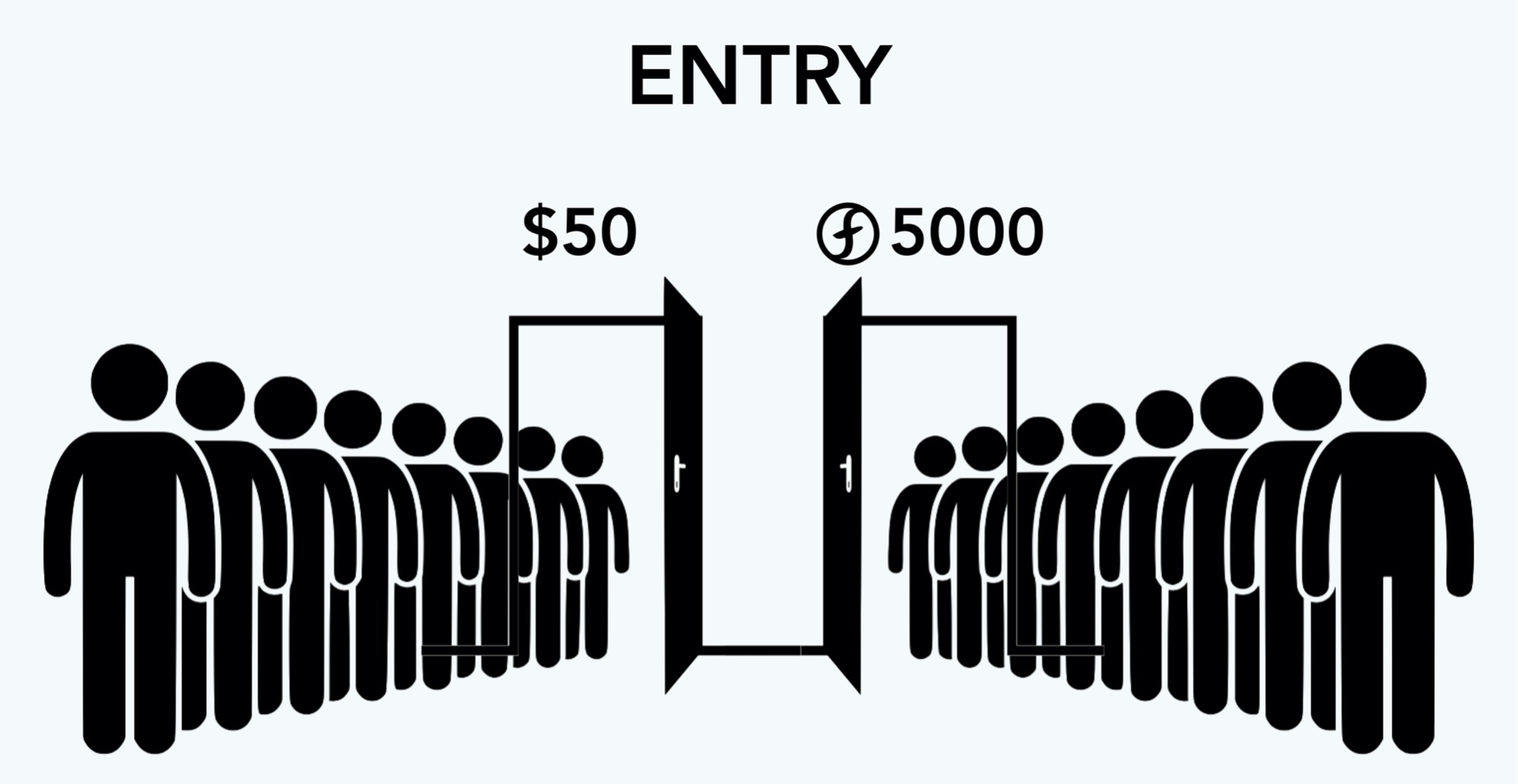

- Proof-of-Burn Access Fees

- Inflation Rate

- Use of the Reserve Pool

We will dive into the details of each of these systems below.

Burn Valuation Dynamics

The Proof-of-Burn Access Fee is a key mechanism that is designed to maintain a base value for the currency. It is so important to our system that we give it a fancy title: Burn Valuation Dynamics.

These mechanisms were inspired by a number of existing dynamics that take place in both the classic economy and the newer crypto economy. Each have been shown to help provide value to a currency.

Additionally, the governance of the access fees can create additional dynamics that loosely peg the price of Freeos to other cryptocurrencies and/or fiat currencies. This is an additional mechanic that helps maintain a floor to the FREEOS token’s value.

And finally, the governance of the Proof-of-Burn Access Fees can lead to decommissioning FREEOS tokens permanently from circulation. This lowers the supply of the FREEOS tokens—and this mechanism can often create a higher demand for a smaller amount of tokens which can keep the price from eroding, and inflation at bay.

All of these mechanisms are simply employed by voting for the price of the Proof-of-Burn Access Fees— within sensible ranges that ensure outsiders can still sustainably enter, and participants can easily save up a portion of their earnings for the next year’s Proof-of-Burn Access Fee.

Ongoing Fees = Price Floor

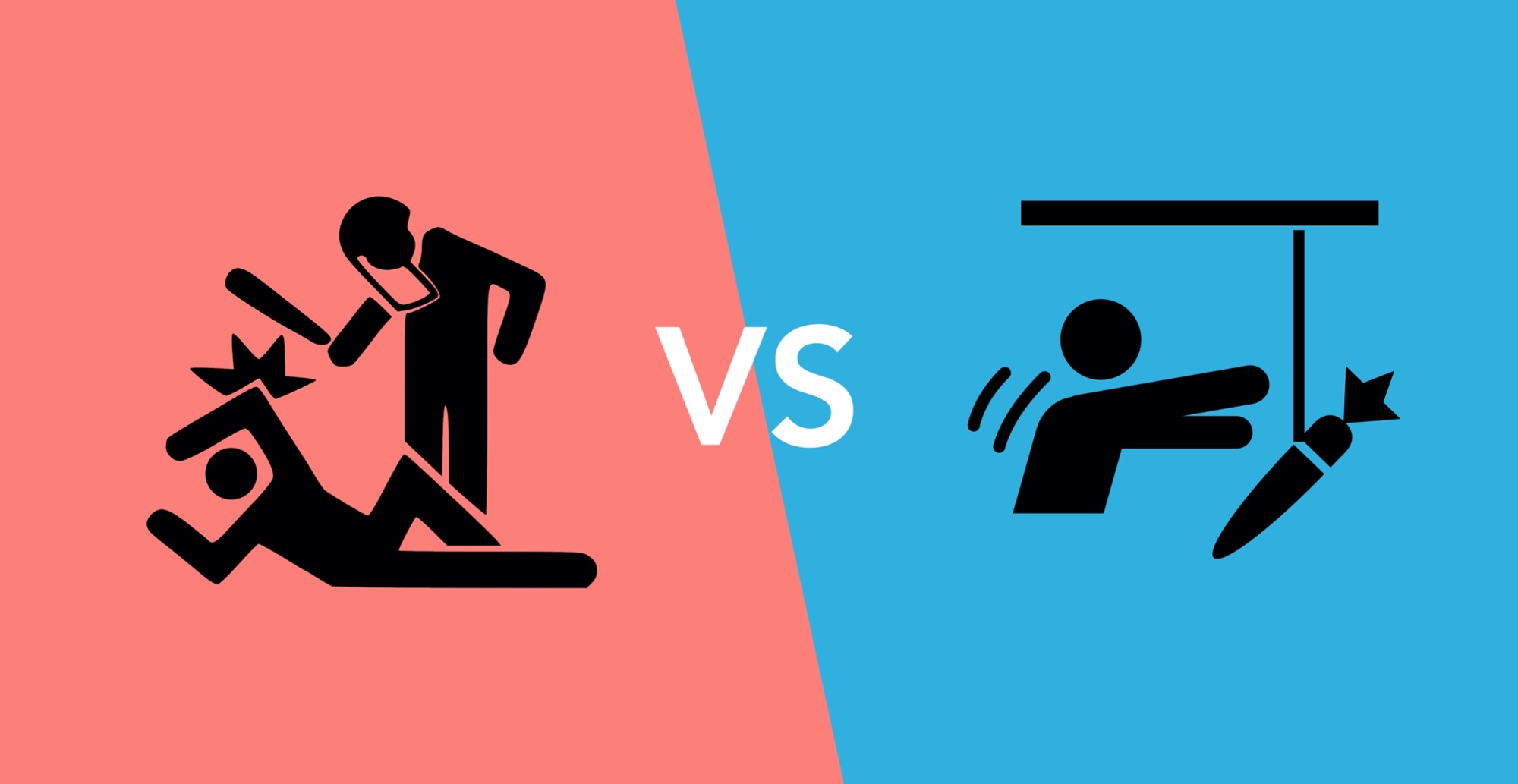

Floating fiat currencies have a special trick to help maintain their price floor. It is an unpleasant word that few like to hear or think about — taxes.

Taxes — in most national fiat currencies — is the authoritarian mechanism that helps an ever-inflating fiat currency provide a price floor. Individuals and (most) businesses pay a portion of their annual earnings to taxes.

Not paying taxes may earn fines and/or jail time for many individuals and owners of businesses. Not a pleasant prospect.

This authority-driven mechanism creates a consensual valuation of what these taxes are approximately worth — based on the percentage of combined labour of all individuals and businesses in an economy per year.

And this valuation of a portion of a year’s net labour/output ensures that ever-inflating floating fiat currencies have a type of price floor.

All other market activity provides layers of additional value well above the floor. Floating fiat currencies seldom ever go near the price floor as a result — especially if taxation is strongly maintained.

Now, Freeos is not an authority.

It cannot (and wishes not) to enforce a type of “taxation”.

So what special trick does the Freeos Economic System utilise to maintain a price floor?

The special trick is to provide a flipped version of a tax — a voluntary access fee.

Instead of forcing, the Freeos Economic System incentivises the payment of the access fee through the desire to earn an ongoing income.

Therefore, Freeos uses the proverbial carrot — not the stick.

Boo, stick. Yum, carrot.

Another carrot-style analogy comes from the world of cryptocurrencies.

Particularly the granddaddy of all crypto — Bitcoin.

Like Freeos, Bitcoin employs a carrot.

Bitcoin needs to be mined — solving difficult mathematical proofs — using computer hardware powered by electricity. Commonly called “Proof-of-Work”.

And Bitcoin miners often need to upgrade their equipment to better solve this increasingly-difficult mathematical proof and earn Bitcoin as a result.

The ongoing upgrading of equipment, and the electricity used creates similar dynamics as a type of access fee — just with Bitcoin, it is a bit more hands-on and tricky to juggle.

Regardless, the dynamics play out in a similar way. These ongoing costs of maintaining entry to the world of Bitcoin mining turns out to create a price floor.

Afterall, all Bitcoin miners pay roughly the same costs for equipment and electricity. Essentially, this consensual valuation represents time and effort — this corresponds to a minimum price floor that few Bitcoin miners are ever willing to sell below.

So this dynamic helps maintain the price floor of Bitcoin. All additional layers of value above the floor represent market forces, such as trading and holding the currency.

Indirect Price Pegging

Another mechanism for FREEOS tokens to have a price floor value is through allowing other cryptocurrencies to be used to pay for the access fees.

Each cryptocurrency’s access fee can be voted on individually. This allows the price to correspond to the FREEOS access fee and therefore provides an additional metric to determine the value of FREEOS.

By setting the access fees in various currencies, Freeos participants can create a price correlation that values entry to this economic system — and therefore the income earned as well.

Inflation Rate

The participants can vote on the weekly inflation rate — within a built-in upper cap to help ensure that there is no over-inflation.

This rate is a percentage of a total supply that is — in turn — defined by all active participants. We call this the Conditionally Limited Supply.

Each week this percentage is sliced off from the Conditionally Limited Supply and then divided up by all active participants per week.

More about how this Conditional Limited Supply works in PART 3.

Reserve Pool

Since the Freeos Economic System can accept other cryptocurrencies as payment for the Proof-of-Burn Access Fee, there is an opportunity to use these cryptocurrencies to grow a Reserve Pool.

And what is this growing Reserve Pool used for?

To provide another mechanism for the participants to vote on to maintain the value of the FREEOS token.

This works by allowing the participants to vote on a percentage of the Reserve Pool to be sold, and for existing cryptocurrency traders to take advantage of our Arbitrage Trading Opportunities.

FREEOS tokens can be used to buy the discounted assets in the Reserve, thus democratically initiating critical arbitrage incentives for traders to purchase FREEOS when sharp dips in the market occur.

This arbitrage is an opportunity to take advantage of price differences in another market.

The tokens in the Reserve Pool will have a number of discount tiers (first come, first serve). The first traders that buy up these tokens will have the largest percentage of a discount compared to the standard market rate.

The traders can then go and purchase these assortment of cryptocurrencies and resell them on traditional exchanges and make a profit.

What is the catch?

The catch is that the only way to purchase these many cryptocurrencies is to buy them using FREEOS tokens. This creates a market demand for FREEOS, and can cause traders to purchase FREEOS to access this arbitrage opportunity.

This is a type of dynamic often used by some nations to hold the value of their currency. Holding reserves of foreign currencies to be used to purchase their own currency off the open market.

Instead of putting this in the hands of a nation’s central bank, Freeos puts this mechanism in the hands of the people that participate in this economic system.

Traders can can find profit from the Arbitrage Trading Opportunities. Traders can also potentially park their other trades in FREEOS when they want to exit their trades and hold value that is not tied to fiat currencies.

These aspects help keep the FREEOS token to be useful in current market conditions.

Arbitrage Trading Opportunities help ensures that the important role of traders is factored into the Freeos dynamics — despite a lack of volatility that represents most traders’ bread and butter.

Burn, FREEOS, Burn

What’s an economy without the means to manage inflationary forces?

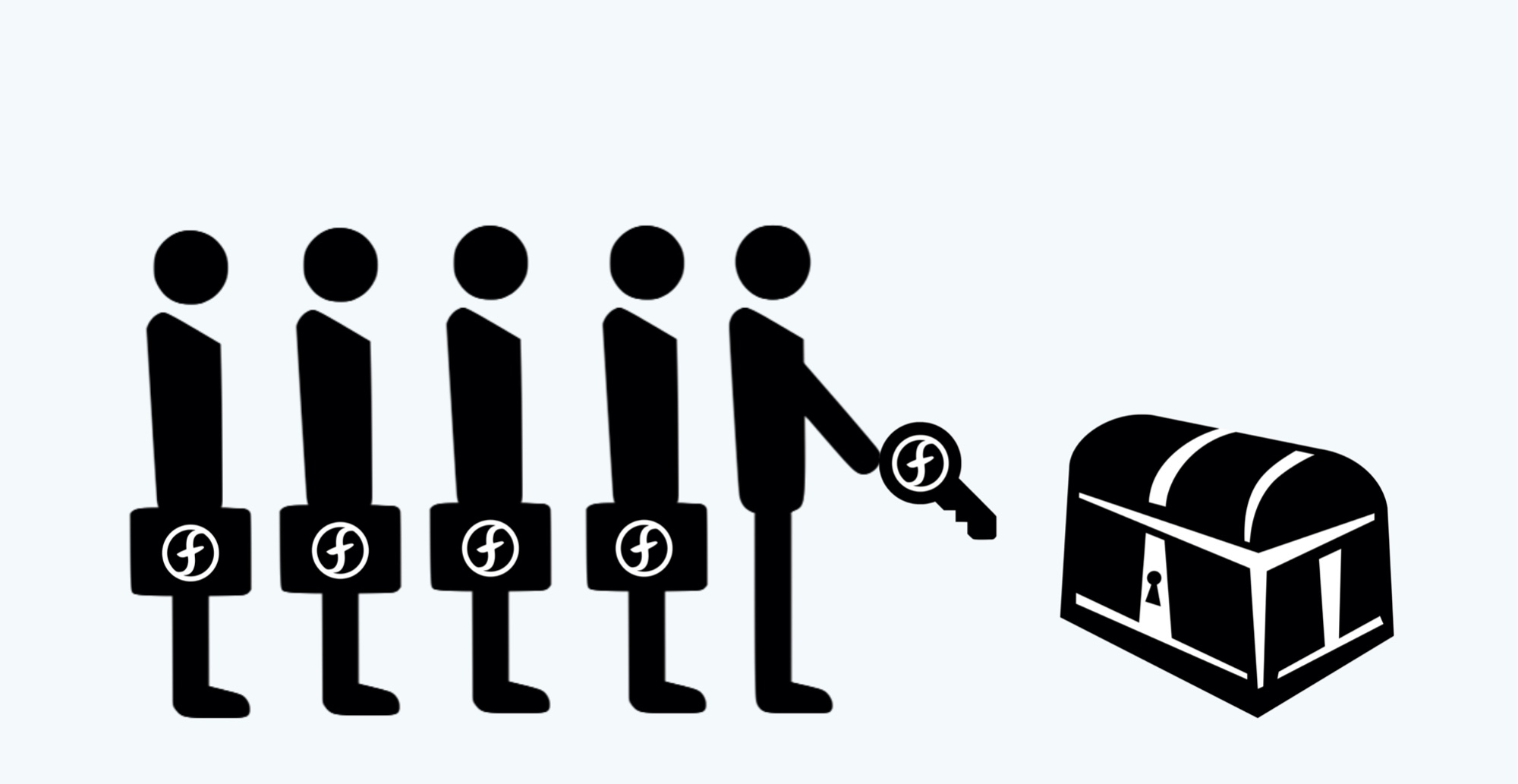

It is our opinion that decommissioning tokens from circulation is a key mechanism to help maintain value and we provide a number of mechanisms to decommission — or burn — FREEOS tokens periodically.

Firstly, any FREEOS tokens used in the Arbitrage Trading Opportunities to purchase discounted tokens from the Reserve Pool, are burned. And where did these other tokens come from originally? From the Proof-of-Burn Access Fee. Even though the Reserve Pool slows down the process, FREEOS tokens are ultimately burned.

Additionally, FREEOS tokens used to directly pay the Proof-of-Burn Access Fee are destroyed. Never to be seen again.

Destroying these FREEOS also mints a special non-fungible token (NFT) that we call a Voucher used to onboard new users and build up local markets that use FREEOS consistently.

More about how these Vouchers work in Part 3.

Since these FREEOS are taken out of circulation, the supply is diminished, and the value of the FREEOS token can be maintained if sufficient demand to pay for the Proof-of-Burn Access Fee to earn an income exists — to counter the inflationary forces.

Conclusion

This concludes Part 2 where we covered the many ways Freeos has governance systems that are intended to maintain a price that is stable.

The participants of Freeos can use these mechanics to respond to a variety of economic conditions as illustrated below:

Small drop in FREEOS price on the open market?

- Lower the inflation rate

- Increase the access fee for other cryptocurrencies to correspond to the FREEOS access fee and encourage FREEOS access fee spending + burning.

Large drop in FREEOS price on the open market? Total market going down?

- Lower inflation rate

- Increase access fee for stablecoin cryptocurrencies (these have a more stable peg to correspond to FREEOS

- Vote for a percentage of the Reserve Pool to be sold for FREEOS — which also burns this FREEOS and takes it out of circulation.

FREEOS price is healthy, and demand to enter FREEOS is high?

- Increased inflation rate

- Increase FREEOS access fees to match demand

- Slightly lower the price for non-FREEOS access fees to use a healthy economy to build up the Reserve Pool.

Curious to find out more?

Check out the links below to additional articles that dive deeper into the mechanisms that make Freeos work.

Part 3 dives deeper into some of the interesting supporting mechanisms that help the system sustainably grow and respond to the real world.

And if you'd like to ask questions directly, Join our Discord Channel.