Feb 23•3 min read

Consumer Price Inflation Supercycle Fingerprint

Do we live in a world which is fundamentally:

disinflationary for consumers;

inflationary for consumers;

or neither?

Spoiler Alert Conclusion: At the beginning of 2021, then, on a global scale, we are consumer inflation-neutral, with mild regional characteristics.

The supply and demand disruptions of 2020 mean that this year's data will be deafeningly noisy, so a simple tracking of monthly CPIs is quite as likely to deceive as to inform in 2021. My previous piece tried to lay out what inflation 'normality' would look like in 2021 in the world's major economies, together with the degree of tolerances within which we should be wary of believing we have the answer to the inflation/disinflation question. The more fundamental question of whether as consumers we live in a fundamentally inflationary or disinflationary world was not really addressed.

By contrast, this piece attempts to answer it by looking at the changes in the relative prices of capital goods and consumer goods. The idea is this: if capital goods are correctly (rationally) priced, then changes in their price will incorporate a present-day value on their ability to generate revenue from their output. If it is generally accepted that we live in a persistently inflationary world, this means that, necessarily, the price of capital goods will rise faster than the price of the consumer goods they produce, (since the current price of the capital good will be discounting back to the present day, those anticipated revenues). By contrast, when we live in a fundamentally disinflationary world, the price of capital goods will fall faster than the anticipated fall in the consumer goods they produce.

This sort of pricing dynamic of capital goods relative to consumer goods (or the capital goods/consumer goods terms of trade) is the very bedrock of business cycles. But we should expect the same dynamics to show up in longer-term global consumer inflation supercycles too.

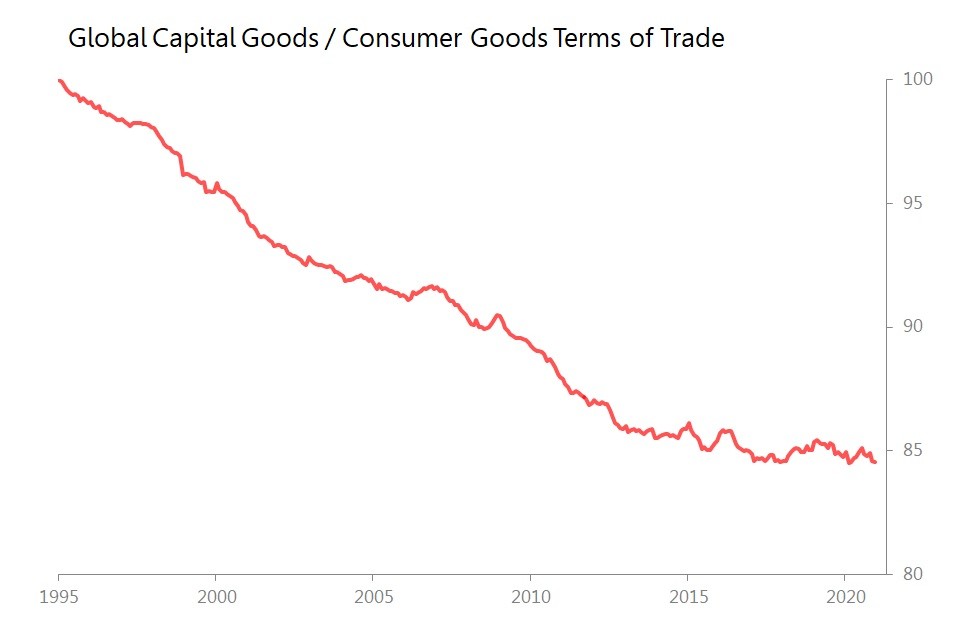

The global capital goods/consumer goods terms of trade chart below is generated using PPI data for capital goods and consumer goods from the US, Eurozone and Japan, with weightings established by 5yr average US$ nominal GDPs.

It shows the clearly disinflationary era for consumers which was established in the early 1990s (initially by Japan), and which ran uninterrupted throughout the next 20 years. By around 2012/13, however, the force of the global disinflationary impulse had moderated very considerably. Since the beginning of 2017, that disinflationary force had run its course. However, it has not (yet) been replaced by an inflationary impulse. Since then, the relative pricing of capital goods to consumer goods tells us the world has been essentially inflation-neutral.

At the beginning of 2021, then, on a global scale, we are inflation-neutral.

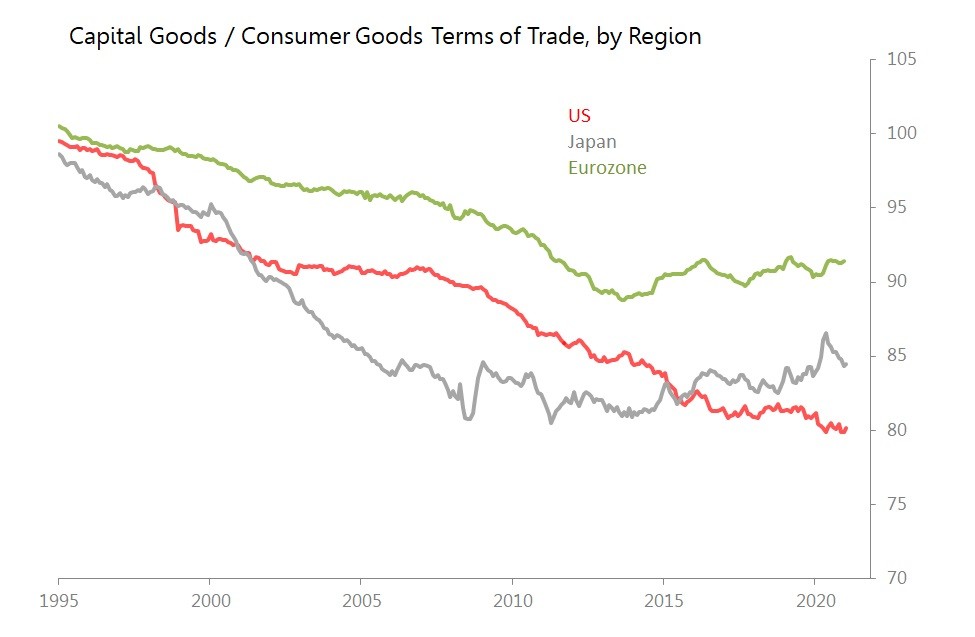

Within that neutrality, however, the three regions show slightly different results:

The US continues to show a very mild disinflationary trend;

Since around 2015, Japan has managed to develop a very mild inflationary trend;

Since around 2015 , the Eurozone has shown something close to inflation-neutrality.