May 18•4 min read

Coldwater Slow Model Update - Japan 1Q21

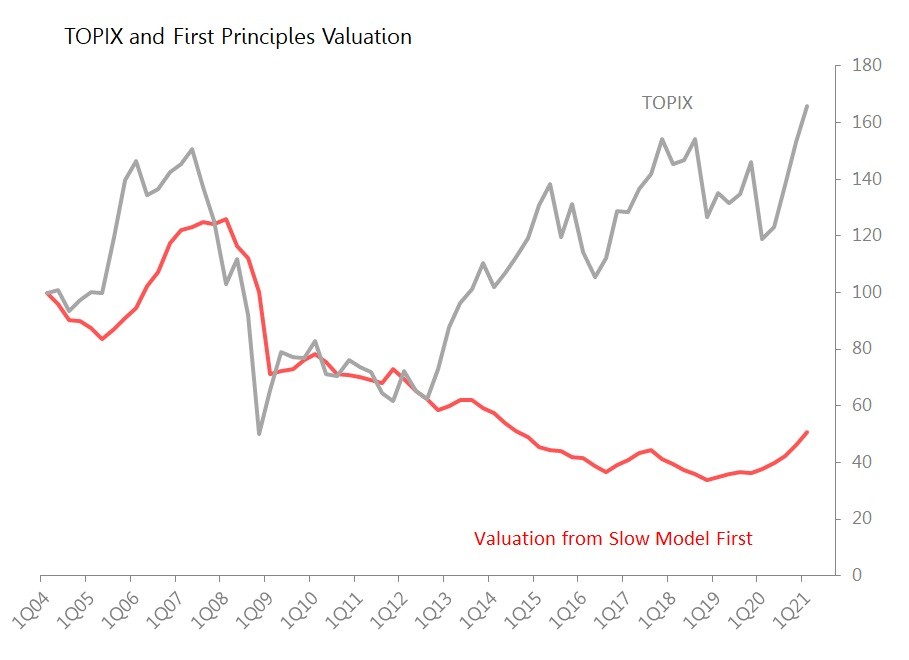

The publication of Japan's 1Q GDP accounts allows us to update the Coldwater Slow Model valuations for TOPIX. One conclusion is inescapable: for TOPIX, this is as good as it gets. Downward pressure on TOPIX valuations can be expected throughout 2021, starting now.

The Coldwater Slow Model valuation depends on two metrics:

First, calculation of Kalecki profits;

Second, calculation of multiple based on a) long-term nominal GDP growth and b) the volatility of that growth.

(For a fuller explanation, see 'Stockmarket Index Valuation from First Principles')

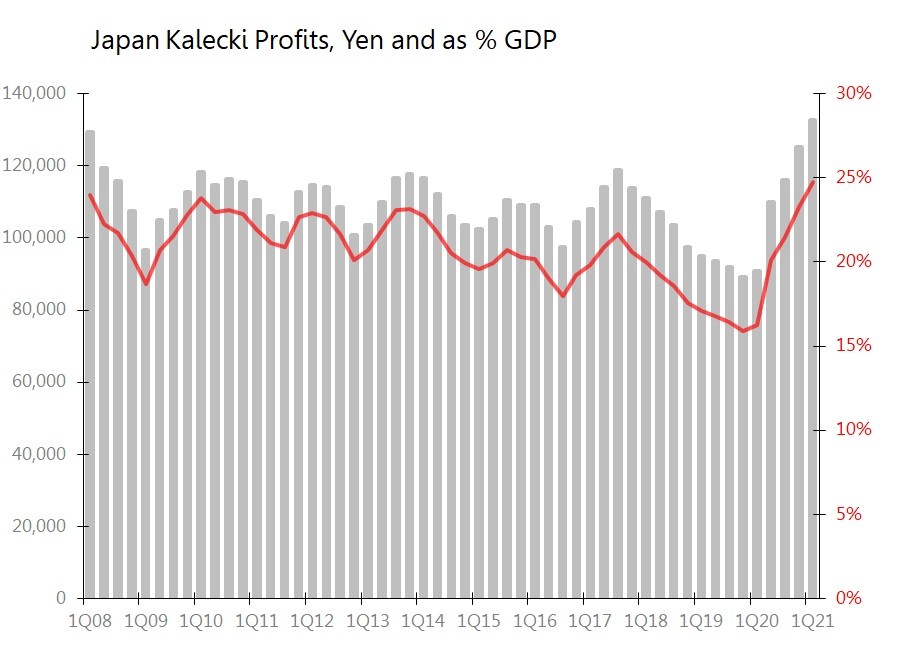

1Q's national accounts allows us to calculate that in the 12m to March, Kalecki profits rose 46.2% yoy to Yn132.6tr, equivalent to 24.8% of GDP (compared with a 2011-2019 average of 20.2% of GDP). The 1.9% yoy fall in nominal GDP cut the 10yr average nominal GDP growth to just 0.6%, with a 10yr standard deviation of 2.5%. This left the applicable profits multiple unchanged from 4Q20 at 32.5x.

Kalecki Profits - Covid's Weird Mix About to Reverse

As we've seen elsewhere (US, UK, Germany), the government's fiscal response to the pandemic is absolutely central to the rise in Kalecki profits in the 12m to March, and has distorted Japan's source of profits profile in an extraordinary way. The expansion of the fiscal deficit left it responsible for 63.2% of Kalecki profits in the 12m to March, up from 19.1% in calendar 2019. It was also responsible for the entire rise in profits: the fiscal deficit blew out Yn61.58tr yoy in the 12m to March, whilst net investment fell Yn8.7tr, net household dissaving fell Yn12.5tr and net exports fell Yn1.5tr.

The threat to valuations in the short and medium term is therefore very obvious: if the fiscal deficit merely stops growing in the coming 12m, the prospects for continued Kalecki profits growth are muted. If and when the extraordinary fiscal deficits of the pandemic are reduced back to 'normal' levels, the entire structure of Kalecki profits will be undermined, and the ability to sustain pandemic-level profits will depend on reversing the long-term decline in household dissaving, reversing the slowdown in investment spending (private capital spending down 5.3% yoy in 1Q, and down 10.3% on a 12ma), and rebuilding a significant trade surplus.

The prospects of these three recovering in a way which out-strips the likely winding back of the fiscal deficit seems to me remote. That change in the yoy growth of the 12m fiscal deficit certainly begins this quarter, and will see deficit's contribution to Kalecki profits decline dramatically. Since it is the deficit which is propping up profits, we will almost certainly also see a dramatic decline in profits.

The decline in Kalecki profits from 2Q21 will also mean a decline in the valuation of TOPIX.

Slow Model Valuation Mirrored by TOPIX

Since 2015, quarterly changes calculated using the Slow Model valuations for Japan have largely been mirrored by actual changes in TOPIX. Since the beginning of 2015, the accumulated divergence between the valuations calculated by the Slow Model and TOPIX's actual performance is TOPIX outperformance of 14%. This track record was extended in 1Q21, with the Slow Model valuation suggesting a rise of 6.1% qoq was justified, and TOPIX rose 8.3%.

However, the history of TOPIX roughly conforming to changes in Slow Model valuations does not run in the long-term because of a serious and sustained jump in TOPIX between 2012 and 2015 which has never been justified either by improved profits or raised multiples. This has left TOPIX in a state of sustained and rather dramatic over-valuation.

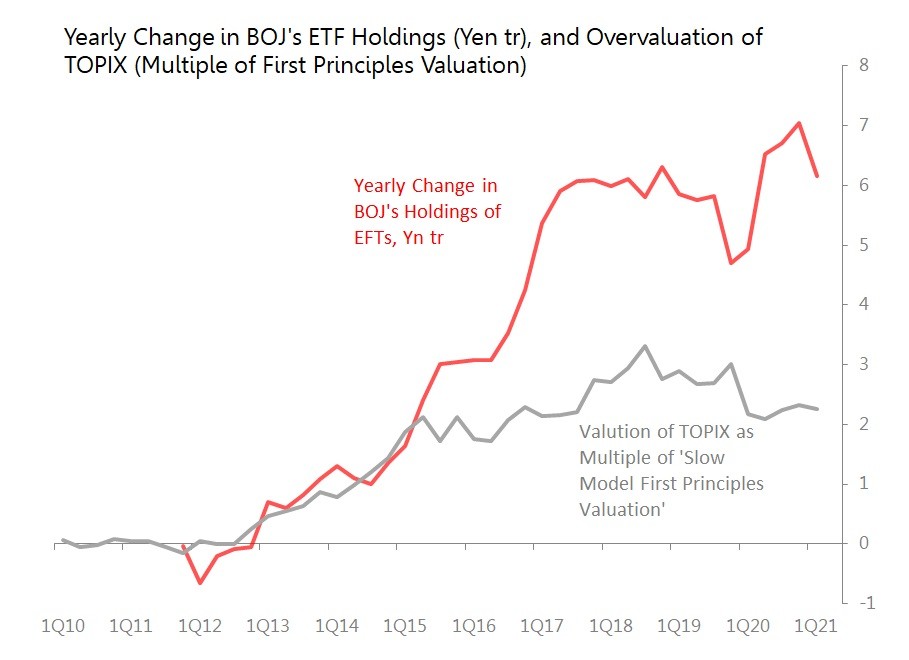

Bank of Japan and TOPIX Overvaluation

The eruption of this sustained over-valuation occurred at the same time as Bank of Japan began to widen its 'quantitative and qualitative' monetary easing by buying ETFs in the Japanese stockmarket. At the beginning of 2012, Bank of Japan held Yn0.85tr in ETFs, but by the end of 2015 this had risen to Yn6.90tr, and the central bank's holdings have been rising ever since. By the end of March 2021 BOJ held Yn35.88tr in Japanese ETFs, and this was up to Yn36.06tr by mid-May.

My belief is:

that Bank of Japan ETF buying has been and is responsible for the sustained over-valuation of TOPIX;

that TOPIX is hostage to continued BOJ ETF buying, and

that in the near term, the extent of overvaluation is likely to fluctuated with changes in the yearly buying program.

During the 12m to March 2021, the pace of ETF buying slackened slightly (to Yn 6.16tr, from Yn7.05tr in the 12m to December 2020), and the degree of TOPIX overvaluation declined to 226.5% (from 232% in Dec 2020).